The Tokenomics of U2U Network is not merely about the mechanisms for token allocation and usage; it also reflects a long-term development strategy and sustainable profit opportunities for investors. This article will analyze in detail the opportunities and challenges that investors may encounter when participating in the Tokenomics ecosystem of U2U Network.

U2U Network and What You Need to Know

U2U Network is not just a blockchain ecosystem but also a decentralized financial platform that allows users to engage in services such as staking, farming, and lending without intermediaries. The use of advanced blockchain technology enables U2U Network to maintain high security and good scalability, thereby creating a sustainable investment environment for investors.

One of the highlights of U2U Network is its ability to integrate blockchain solutions into traditional financial services. This enhances user access to blockchain technology while promoting the growth of the decentralized finance market. With this potential, U2U Network aims to build a strong community and a fair financial platform for everyone, especially investors seeking new opportunities in the DeFi space.

The Tokenomics model of U2U Network not only helps maintain stability for the U2U token but also creates opportunities for investors to participate in diverse financial services, thereby increasing chances for profit and long-term asset growth. However, as with any blockchain model, there are also challenging factors that investors need to carefully consider before making decisions.

The Tokenomics of U2U Network plays an important role in establishing stability for the platform and attracting investor participation. The U2U token is not only a medium of exchange but also a tool that allows investors to receive rewards from activities within the ecosystem, such as staking, farming, and participating in governance decisions through the DAO (Decentralized Autonomous Organization) model.

Unique Factors of Tokenomics of U2U Network

The Tokenomics of U2U Network plays an important role in establishing stability for the platform and attracting investor participation. The U2U token is not only a medium of exchange but also a tool that allows investors to receive rewards from activities within the ecosystem, such as staking, farming, and participating in governance decisions through the DAO (Decentralized Autonomous Organization) model.

The Tokenomics of U2U Network is unlike any existing token model on the market, as it not only relies on fundamental allocation factors but also creates mechanisms for incentives and long-term value stability. Below are some unique factors in U2U Network’s Tokenomics:

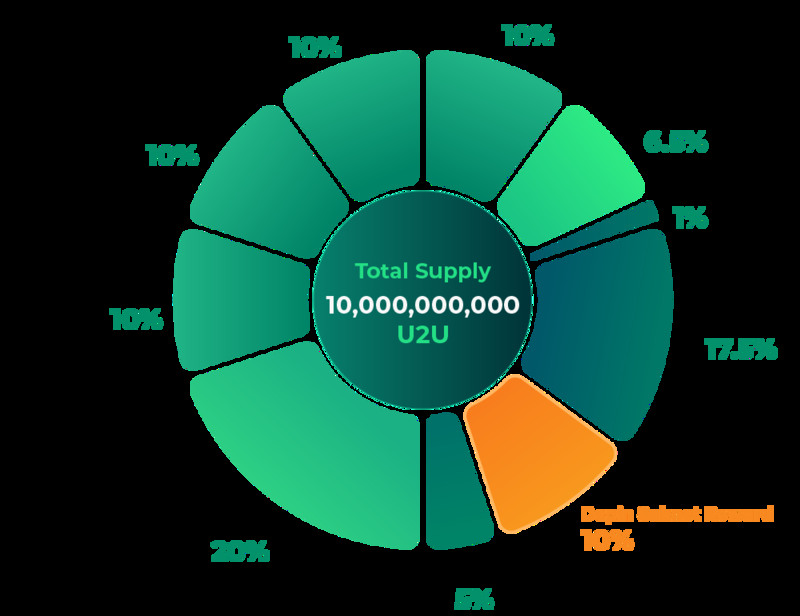

U2U Network has a very reasonable token allocation strategy that helps maintain liquidity and value for the U2U token within the ecosystem. A large portion of tokens is allocated to long-term investors, community members, and activities that encourage user participation in the ecosystem. This ensures that investors can reap benefits from holding tokens and engaging with the platform’s services.

The Tokenomics of U2U Network includes mechanisms that incentivize users through staking and yield farming programs. Investors can earn profits from staking U2U tokens while also participating in important project decisions through the DAO system. This not only helps maintain stability in token value but also encourages users to engage in governance and development processes.

U2U Network provides decentralized financial (DeFi) services such as lending, borrowing, and trading with high liquidity. This gives investors numerous opportunities to participate in attractive financial products and increase their asset value through flexible investment activities.

The Tokenomics of U2U Network creates opportunities for users to participate in important governance decisions for the project. This allows the community to have a voice in developing the ecosystem while maintaining transparency in financial activities. The DAO model empowers the community, ensuring that project decisions benefit not just a small group but the entire ecosystem.

Opportunities for Investors with U2U Network’s Tokenomics

The Tokenomics of U2U Network opens up many attractive opportunities for investors. Below are some notable opportunities that investors can leverage:

- Growth in Token Value: With a reasonable token allocation structure and mechanisms that encourage participation within the ecosystem, the value of the U2U token could experience significant growth in the future. Investors can take advantage of this opportunity to increase their assets by holding tokens long-term.

- Profits from Staking and Yield Farming: Investors can earn stable profits from staking U2U tokens or participating in yield farming activities. These opportunities help investors grow their assets sustainably while ensuring safety for their investments.

- Participation in DAO Governance: Investors can engage in the decentralized governance process of the project through DAO. This not only allows them to influence project development but also enables them to receive rewards for their active participation in governance.

- Engagement with DeFi Financial Services: U2U Network offers decentralized financial services that allow investors to participate in activities such as lending, borrowing, and trading. This opens up many opportunities for investors to leverage modern financial services and increase their profits.

Challenges Not to Be Overlooked with U2U Network’s Tokenomics

However, like any blockchain project, the Tokenomics of U2U Network also presents challenges that investors need to carefully consider. One of the biggest challenges is the volatility of token value. Despite having a reasonable token allocation mechanism, the cryptocurrency market remains highly volatile, which could affect the value of the U2U token.

Additionally, participation in staking and yield farming activities is not without risks. If the ecosystem fails to maintain liquidity and stability, investors may face difficulties withdrawing funds or achieving expected profits. Although U2U Network has mechanisms to protect token value, changes in market factors can still impact investor returns.

Finally, an unavoidable challenge is competition within the DeFi market. While U2U Network has unique factors, other projects may offer similar or even superior products within such a fiercely competitive market. Investors need to stay informed and conduct thorough analyses before making investment decisions.

The Tokenomics of U2U Network represents an attractive and promising model that opens up many opportunities for investors. However, like any investment, there are certain risks involved. Therefore, Cryptomarketpulse advises you to thoroughly research all opportunities and challenges to make accurate investment decisions moving forward.