Dive right in. You’ve heard of making money with crypto. But what is stacking in crypto? It’s simple but huge. Imagine your digital coins, not just sitting, but earning more coins. It’s like planting seeds for a money tree. We’re breaking down how it works and how you can start. From knowing the basics to making it work for you, I’ve got the tips and the truths. It’s time to unravel the how and why to stack your way to more crypto!

Demystifying Crypto Staking: What You Need to Know

Decoding Staking: The Essential Basics

Think of staking as a way to earn more coins by saving. If you’re familiar with earning interest by saving money in a bank, you’re on the right track. Only instead of banks, we use a special crypto wallet. Imagine you help this wallet keep its crypto dealings safe. As a thank you, it gives you extra coins. Simple, right?

Staking is key to proof of stake, a crypto safety check system. It’s like a group effort to prove transactions are okay, without wasting power like Bitcoin does. By staking your digital coins, you’re saying, “I trust this trade.” The cool part? You get rewards for lending your coins to the system.

From Participation to Profit: How Staking Generates Income

Now, how does staking make you money? It’s about taking part in the crypto world’s group efforts. When you stake, you join a staking pool, kind of like a team. This team works on validating trades on the blockchain. In return, the network gives the team rewards – new coins. Think of it as getting a slice of pie for helping out at a bake sale.

You might hear a lot about passive income with staking. This means you put in your coins and the rewards come in while you do nothing more. Sounds awesome, doesn’t it? But how much you earn depends on the coin, how many you stake, and for how long. It’s often shown as APY, kind of like a yearly rate for your staked coins.

Imagine using a playground slide. The longer the slide, the longer the fun, right? Staking can be like that. If you agree to stake your coins for longer, you might end up with more rewards. Just remember, this means you can’t use those coins until the time passes. Think hard about this when you’re picking a staking pool or crypto project.

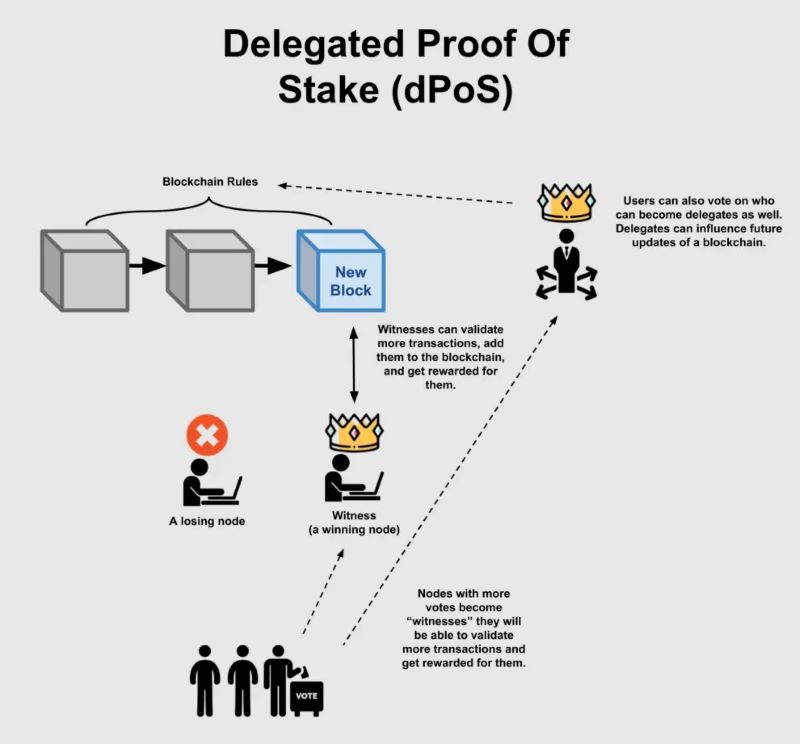

Now, what about these pools? A staking pool is a bunch of people coming together to stack their crypto. You all trust one person or a group (validators) to say trades are good. In big pools, the chances of getting a reward can rise. But, keep in mind, more people in the pool means sharing the pie into smaller slices.

So, why would you stake over mining or just keeping coins? Staking can be less costly and less work than mining. Plus, it’s often seen as a green choice since it uses less power. For simply holding onto your coins, staking gives you a chance to grow them.

As an expert, I say look into staking if you plan to keep your coins for a while. The right staking strategies can pump up your digital wallet. Just don’t forget the rules and risks that come with it. Always pick a trusted platform and don’t go all in without understanding the game. Choosing wisely means taking part in thrilling staking adventures. It turns the crypto world from a wild ride to a reliable way to earn more coins.

The Pillars of Staking: Mechanisms and Models

Exploring the Proof of Stake Consensus

What is proof of stake consensus in simple terms? It’s a way to keep a crypto network safe. People lock up some coins. This acts like a security deposit. If they follow the rules, they get new coins as a reward. This is called staking.

In deeper detail, the proof of stake (PoS) mechanism is like a game of trust with rewards. Anyone staking crypto is saying, “I believe in this network’s future.” By doing so, they get a chance to validate transactions and create new blocks. Each user’s chance for this role reflects the number of coins they stake.

In traditional banking, we see money earn interest. Think of staking like that, but for the digital age. Here, you earn more coins instead of interest. It’s a core way for blockchains that use PoS to agree on new updates. It’s safer for the planet, too, because it uses less electricity than mining.

Comparing Staking and Mining: Distinct Pathways to Rewards

How is staking different from mining? While mining requires machines to solve puzzles for new coins, staking just needs you to hold onto coins to earn more.

Let’s break it down a bit more. With mining, you need pricey gear and lots of power. It’s a competition to see who can solve tricky number problems first. Whoever wins, gets new coins. It’s like a race where speed and power win.

Staking does not need powerful computers or huge electric bills. You just need coins and a digital lock-up, called a staking wallet. Your locked coins help keep the network secure. You earn more coins based on how many you stake and for how long.

Both staking and mining are ways to earn extra crypto. But they are not the same. Mining can be like a full-time job that requires lots of resources. Staking is more like a savings account that earns you money while you sleep. It’s a more passive way to grow your crypto pile.

Remember, to start staking, you’ll need to follow some rules. These include using a staking wallet and understanding the terms, like lock-up periods and rewards. Rewards from staking can be in the form of new coins or fees from the network.

Also, there are some risks. The value of your coins might swing up and down. Plus, the coins could be locked for a while, meaning you can’t sell them if you need urgent cash.

In staking, you don’t just earn. You also help decide the future of the crypto you support. That’s important because it’s like having a say in a bank you’re part of. It’s this balance of earning and participating that makes staking a key pillar in the world of crypto.

Boosting Your Staking Strategy: Maximization Tips and Tools

Selecting the Right Staking Pool for Optimal Returns

When you join a staking pool, you group your coins with others. This boosts your chances to validate blocks and earn rewards. It’s like teaming up in sports. The right team has winning strategies, top gear, and a strong fan base. A staking pool has top-notch tech, good pool size, and a clear fee policy.

Picking a pool is key for your win. Look for one with fees that don’t eat up your earnings. Check its performance history, how often it wins rewards. Ask about hidden costs or rules. Clear and fair terms make sure you get your share of the prize.

Next, meet the pool’s leader, the pool operator. They keep the pool running. They should have the tech skills and be trusted by the community. A good pool keeps you updated and safe. It follows all the rules of the coin you’re staking.

Lastly, think about the coin you choose. Not all coins can stake. For the ones that can, look at their team, their plan, and how many people use it. Do they look strong for the long run? Your earnings can grow if the coin’s value goes up.

Understanding Staking Wallets and APY Dynamics

To stake, you need a special wallet, like a piggy bank for your digital coins. But it’s smarter. It holds your coins and helps earn more over time. This piggy bank talks to the coin’s network. It says you’re helping out and should get extra coins.

Annual Percentage Yield (APY) is the rate you earn back over a year. It shows how much your staked coins could make. It’s like an interest rate for your savings. If the APY is high, you could earn more. But remember, it could change. More people staking can lower your slice of the pie. Or, if too few people stake, the network might offer a bigger reward.

So, you look for a wallet that’s easy to use, safe, and lets you join a pool. It should let you stake many types of coins, if you like variety. Security is a must. Top wallets need passwords and security measures to protect your coins. And they should let you get to your coins when you need them.

Keep an eye on the rules. Some coins ask you to lock up your coins for a while. If you take them out early, there might be a penalty. Be sure that’s okay with you before you dive in.

Knowing these things sets you up well. It helps you make smart choices. And smart choices in staking can help your money grow. That’s the magic of staking. You’re part of a team. And if you play it right, that team helps you win a piece of the crypto cake.

Navigating Risks and Advancing Security in Staking

Mitigating Staking Risks: Best Practices in Digital Asset Security

Staking is just like planting a money seed and watching it grow. But it’s tricky. You’ve got to guard it well. Crypto staking basics tell us it’s a way to earn more coins. But how do we stay safe?

First, know who you deal with. Only use trusted staking platforms. They’re like your gardeners. They must know their stuff. Don’t let anyone near your money tree just because they promise big fruits. Do your homework. Check reviews from other crypto farmers like you.

Now, let’s talk tools. You need a staking wallet, made just for holding your coins safe while they grow. It’s like a locked greenhouse for your money seed. And guess what? You get to hold the key.

What about staking income generation? When you stake your coins, they help make sure all transactions are true. You become part of the club that keeps the crypto world honest. And for that, you earn rewards. Think of it as getting paid to be the neighborhood watch of the blockchain.

Some say staking vs mining is an easy choice. Well, not so fast. They’re different paths to reward. Mining takes more power — like heavy farm machinery. Staking is lighter on resources. More like hand tools for your garden. Choose the way that fits best for your plot in the crypto land.

Validator Node: Setup, Responsibilities, and Security Concerns

Setting up a validator node is serious business. It’s like agreeing to watch over a whole section of the blockchain farm. And you can’t just set it up and forget. No siree!

Being a validator means you check and approve blocks of transactions. It’s a big job. And if you mess up, or if your node acts naughty, you can lose some of your stake. In the staking world, we call this “slashing.” Not as fun as it sounds, trust me.

So how do you set up this all-important validator node? Well, each blockchain has its own rules and tools. Like different gardens need different setups. Usually, you’ll need a computer that’s always on, a solid internet connection, and some technical know-how. Or, you can join a staking pool and let them do the heavy lifting.

Security is number one. Keep your computer safe from hackers and bugs. Use strong passwords and think about cold staking — that’s like having an extra sturdy fence around your garden.

Remember, staking rewards are sweet, but you want to avoid sour situations. Keep these tips in mind, and you’ll be well on your way to growing your crypto garden with peace of mind.

We dived deep into crypto staking, showing you the essentials and how you make money from it. We compared staking to mining, uncovering different ways to earn. Tips to boost your staking game were shared, along with smart choices for staking pools and wallet insights. Staying safe with staking means following best practices and knowing the ropes of validator nodes. Remember, research is key, and a smart staker always stays informed. Keep these points in mind and you’re on your way to being a crypto staking star. Stay sharp, stay secure, and may your digital assets thrive!

Q&A :

What does stacking mean in the context of cryptocurrency?

Stacking in the realm of cryptocurrency refers to the process where users hold or lock up their digital assets to support the operation of a blockchain network. This is typically done in a proof-of-stake (PoS) or similar consensus mechanism, where the crypto assets are staked to earn validation rights and rewards. This incentivizes the maintenance of the network’s security and integrity.

How do you stack crypto, and is it profitable?

To stack crypto, you generally need to own a certain amount of a cryptocurrency that uses a proof-of-stake or similar model. Most often, this involves using a cryptocurrency wallet or an exchange that allows staking. The profitability of stacking crypto depends on several factors, including the stake amount, the network’s staking rewards, the coin’s price stability, and the inflation rate. It’s important to conduct thorough research and consider potential risks before staking your assets.

What are the risks of stacking in cryptocurrency?

Stacking, like many other cryptocurrency activities, involves several risks, including liquidity risk (not being able to convert your crypto to fiat quickly), market volatility (chances of the currency’s value dropping), and validator risks (if one is running a node and fails to validate correctly). There’s also the risk of the staking pool or platform becoming compromised. Always examine the security and reputation of the platform you use for stacking.

Can stacking in crypto be considered a form of passive income?

Stacking in cryptocurrency can be seen as a form of passive income as it allows you to earn rewards over time based on the amount of cryptocurrency you hold and stake. However, unlike traditional passive income sources, stacking’s return on investment can be much more variable due to the volatile nature of cryptocurrencies.

Are there minimum requirements for stacking crypto?

Yes, different cryptocurrencies have different minimum requirements for stacking. These can range from a minimal amount of tokens to more significant investments, as well as minimum staking times or lock-up periods. It’s essential to check the specific requirements of the cryptocurrency you’re interested in stacking before you begin.