What is LSDFi in crypto? If you’ve been around the digital finance block, you’ve seen fads come and go. But here’s the game-changer—LSDFi combines liquid staking with decentralized finance, crafting a new powerhouse in the crypto world. It’s not just a trend; it’s the next step in making your assets work smarter. No smoke and mirrors, just straight-up, solid advantage-making. Stick with me, and I’ll show you why LSDFi isn’t just another acronym to forget, but a financial revolution to remember.

Demystifying LSDFi: The Fusion of Liquid Staking and Decentralized Finance

Understanding the Basics of LSDFi

What if your crypto could earn money while you just sit back? Welcome to the world of LSDFi, or Liquid Staking Decentralized Finance. It’s simple. LSDFi lets you earn more crypto without tying up your assets.

You stake your coins. This means you lock them up. But here’s the hook – you also get a token in return. You can use this token as you please while still earning rewards. That’s LSDFi explained in a nutshell.

Let’s dig deeper. Staking in cryptocurrency is like putting money in a savings account. But until LSDFi, your coins were stuck. You had no access to them. Now, LSDFi breaks the chains, offering you freedom. You get staking rewards yet still move around in the crypto world.

How LSDFi Enhances Staking in Cryptocurrency

Why choose LSDFi over old-school staking? It’s all about access and flexibility. LSDFi benefits include using staked assets as active investments. This means making your crypto work smarter, not harder.

Old ways of staking had risks. You said bye to your coins for a set time. Often, you missed out on other chances to make money. But with LSDFi, you stake and keep earning elsewhere at the same time. It’s like having your cake and eating it too.

Liquid staking has another trick. It improves DeFi liquidity. This means there’s more crypto available for swapping, lending, and trading. It helps the whole crypto system flow better. More flow means more chances to earn.

When you think about it, LSDFi is a game-changer. It’s that new friend who invites you to all the cool parties. It takes the serious business of staking and adds a layer of fun and opportunity. So, if you’re into crypto earning mechanisms, LSDFi should be on your radar.

Remember how staking used to lock up your money? Think again. LSDFi frees up your assets. Extra freedom means more choices, more chances to grow your stash.

Let’s not forget LSDFi platforms are built on blockchain technology. This means they’re safe, transparent and they work without rest. The smart contract integration in these platforms is top-notch. They automate complex processes so you can chill.

And, if you’ve heard about Ethereum staking, LSDFi spices it up too. Ethereum is a big name in the game and LSDFi is making it even better. You stake your Ether, get rewards, and still zip around the DeFi world with your LSDFi token.

In the huge puzzle of decentralized finance, LSDFi is that piece you didn’t know was missing. Plugging it in changes the whole picture. The way you earn passive income in crypto just leveled up. And this is just the beginning. There’s a lot more where this came from.

So always watch this space. Keep your eyes peeled for the DeFi market growth. Learn about managing your crypto assets like a pro. LSDFi could be your key to the next level of financial freedom in the digital age. And who doesn’t like freedom, right?

Innovations in Decentralized Finance and the Role of LSDFi

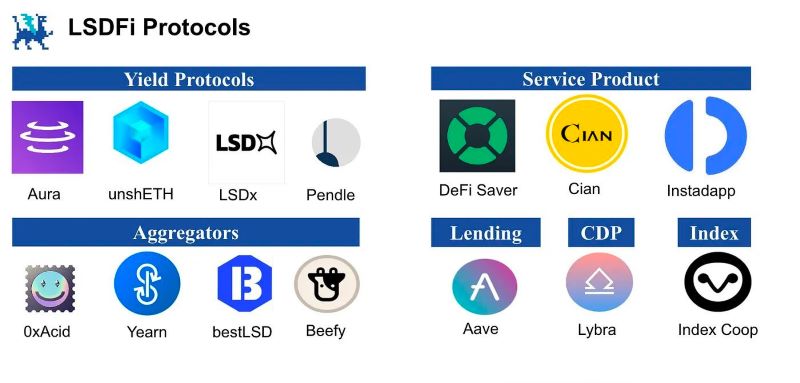

Pioneering Financial Protocols in DeFi with LSDFi

Imagine earning money while you sleep. That’s what happens with LSDFi in crypto world! You see, LSDFi lets folks earn more from their crypto coins without selling them. It’s like having your cake and eating it too. With this, you get to be part of a big group that makes moves together in the crypto market.

With LSDFi, you’re not just holding your coins. You’re using them to help keep a whole blockchain network safe and smooth. This is a smart move because it gets you rewards, like a thank you gift for doing your part! And just so you know, this is all happening on something we call a blockchain. This is where all the crypto actions live.

The Advantages of LSDFi Over Traditional Staking Mechanisms

Now, you might wonder, why not just stick with regular staking? Good question! Regular staking is cool, but LSDFi has some neat tricks. It lets you get your staking rewards faster and gives you more freedom with your coins. With the old way, your coins were stuck until you finished staking. But with LSDFi, you can keep earning while still being free to move your coins if you need to.

It’s kind of like when you have a piggy bank. With the old way, you had to wait to open it. But with LSDFi, you can take out money and still earn interest on what’s left. Neat, right? This is super good for people who want to make money but also might need to use their coins for other things.

Plus, when everyone joins in on LSDFi, it’s like a big pool party. But instead of swimming, we get our crypto to work together. This makes the whole group strong and everyone gets a slice of the pie. It’s all about sharing and helping each other out in the world of crypto.

One more thing. It might sound super techy, but it’s not too hard to get. Even if you’re new to this, you can jump right in. There are places that make it easy to start with LSDFi. And trust me, once you get the hang of it, you’ll see why so many people are talking about this cool new trend in money land.

There you have it, folks. LSDFi is changing the game in how we use our crypto coins. It’s making waves in the pool of money and tech, and it’s letting everyday people like you and me dive into possibilities that weren’t there before. So next time you hear about LSDFi, remember it’s all about making your crypto work smarter, not harder, and having the freedom to keep earning even when life happens. Now, isn’t that something worth exploring?

LSDFi Investment Strategies: Maximizing Yield and Security

Crafting DeFi Investment Strategies with LSDFi Functionality

I get it, finance can be dull. But mix in LSDFi, and it’s like a finance fiesta! LSDFi stands for Liquid Staking Decentralized Finance. It’s the new kid on the blockchain block. Instead of just holding crypto, you can now make it work for you. Think of LSDFi as your money-maker genie in the crypto world.

To start, LSDFi lets you stake coins and still use them. Yes, you heard me. You can earn staking rewards and move your assets around. This is possible due to liquid staking. This term is just a fancy way of saying you can lock up your coins and get a token in return. This token shows you have coins working behind the scenes. It’s kind of like getting a claim ticket for your coat at a party. You can trade the ticket, knowing your coat is safe.

Now, let’s talk about crafting strategies. In the LSDFi realm, a good strategy balances earning with safety. You look for platforms that use LSDFi function. This can boost your earnings and keep risks low. Think of it like picking the right tools for a job.

For instance, if we peek at Ethereum staking, LSDFi lets you stake your Ether. But unlike traditional staking, you’re not stuck. You get a token, often called stETH, which you can use like regular Ether. So, while you’re earning rewards for staking, you can also play the field with your stETH.

Balancing Rewards and Risks in LSDFi Platforms

Every investment can be a rollercoaster. Even with LSDFi’s perks, it’s key to weigh rewards against risks. On one hand, you’ve got the potential for sweet, sweet passive income. On the other, the bumpy ride of the DeFi market. It’s about finding that sweet spot between making gains and staying safe.

With any LSDFi platform, look into its track record. Is it stable? What kind of DeFi security measures are in place? You want your assets to be as snug as a bug in a rug.

Then there are the yields. Staking rewards can make your eyes pop with their rates. But keep your cool. High rewards can come with high risks. It’s a game of balance. Like a seesaw, keep your crypto earnings stable with smart choices.

And don’t forget about LSDFi’s other benefit: DeFi liquidity solutions. This is all about making sure you can trade without making waves in the market prices. With good liquidity, you’re like a ninja—moving swiftly and silently.

To wrap it up, remember, LSDFi isn’t a one-size-fits-all. Check out each platform, its LSDFi tokenomics, and how it works with financial protocols in DeFi. This will help you craft an investment strategy that sings your tune.

So there you have it. LSDFi flips the script on passive income in crypto. It brings together the best parts of staking and fluidity in your crypto asset management. Dive into LSDFi, and watch your digital finance strategy blossom!

Future-Proofing Finance: LSDFi’s Impact on Blockchain Scalability and Interoperability

Enhancing DeFi Liquidity and Scalability through LSDFi

Imagine you have cash but can’t spend or invest because it’s locked away. That’s a big problem, right? Well, in the world of crypto, this problem existed too. But not anymore, thanks to LSDFi. So, what’s LSDFi? It is a new way to use your crypto and still earn from it. Now, you might ask, why is LSDFi important?

It solves a huge issue in crypto called ‘liquidity.’ This means your crypto can move around easier, like water flowing freely. And who doesn’t want that? It also makes sure there’s enough for everyone to trade. Just think how great it is when you can buy and sell without waiting. That’s what LSDFi does for the crypto world.

LSDFi works like a key that unlocks your funds. You stake your coins, which helps keep the network safe, and in return, you get a new token. This token is special. You can trade it, sell it, or use it for other investments. It’s like having your cake and eating it too!

When it comes to growing your money, staking in cryptocurrency with LSDFi is like planting a seed that keeps growing. You earn rewards just for staking your coins. These rewards are extra money in your pocket! That’s not just good for you; it’s good for everyone in DeFi.

Fostering Interoperability and Automated Strategies with LSDFi Smart Contracts

Let’s get into something cool called smart contracts. They are like robot helpers in the blockchain world. With LSDFi, smart contracts become even better. They talk to each other across different blockchains. This connection is what we call ‘interoperability.’ Why is that super helpful? Because it lets all kinds of crypto projects work together like a team.

LSDFi uses these smart contracts to make automated strategies. Think of it like setting up a lemonade stand that runs by itself. It makes money while you play! That’s what LSDFi smart contracts do. They manage your crypto without you having to lift a finger.

But here’s the catch. Working across different blockchains isn’t easy. Each one has its own rules, like different towns with different laws. LSDFi makes sure these towns speak the same language. This means you can use your crypto on more projects without any fuss.

In summary, LSDFi is about making your crypto work smarter, not harder. It’s for anyone who wants to earn more without getting stuck. LSDFi is changing the game, making sure your money is always ready to grow. Isn’t that what we all want in the end? A way to make our money work for us. That’s the smart move, and it’s why LSDFi is the talk of the town in crypto.

We dove deep into LSDFi, blending liquid staking with finance that’s decentralized. You now know the basics and how LSDFi makes staking in crypto better. We looked at how LSDFi leads in DeFi and beats old staking ways. Smart ways to invest in LSDFi to get more yield and stay secure were shared, too. Lastly, we saw how LSDFi changes the game for blockchain’s growth and working together.

I’ve shown you how LSDFi is not just a buzzword; it’s a powerful tool. It’s paving the way for more fluid assets and smarter finance on the blockchain. With LSDFi, your money is not locked up; it’s free to work for you. This tech is shaping a future where finance is more open, linked, and efficient. Keep your eye on LSDFi. It’s more than a trend—it’s finance evolving right before us.

Q&A :

What is LSDFi in the context of cryptocurrency?

LSDFi, though not a commonly known term in the crypto space, is likely shorthand for a type of digital financial instrument within the ecosystem. If we consider similar acronyms, LSDFi could hypothetically stand for ‘Liquidity, Security, Decentralization Finance’ which could potentially refer to financial products or services that prioritize these aspects in the crypto market. Due to the speculative nature of the term, it’s advisable to look for relevant and official financial protocols or platforms that accurately represent what LSDFi stands for in cryptocurrency.

How does LSDFi impact the trading of digital assets?

Assuming LSDFi represents a unique finance protocol, its impact on trading digital assets would largely depend on its specific functionality. If it embodies liquidity, security, and decentralization, it could facilitate smoother and more secure trading experiences. It might offer better liquidity options for traders and contribute to a more resilient financial ecosystem within the crypto market. However, since LSDFi is not a well-established acronym, it’s crucial to conduct thorough research on the actual platform or protocol in question.

Can LSDFi be considered a safe investment in the world of cryptocurrencies?

Safety in cryptocurrency investments is often evaluated based on the legitimacy, security mechanisms, and the team behind a project. If LSDFi refers to a specific financial project, its safety would need to be assessed by looking at these areas. It’s important to remember to always perform due diligence and research before investing in any crypto-related project. Keep in mind that the volatility of crypto markets means that even investments in well-established cryptocurrencies can be risky.

What are the key features to look for in an LSDFi platform, assuming it exists?

Should LSDFi be connected to a real platform or financial instrument within the crypto space, typical features to look for might include smart contract efficiency, strong security protocols, high liquidity pools, and perhaps a decentralized governance structure. Transparency in operations, a clear audit trail, and user-friendly access are also important features that could make such a platform more appealing.

What role does decentralization play in LSDFi?

In cryptocurrencies and blockchain technology, decentralization is a core principle that minimizes control by a single entity and distributes it across a network of participants. If LSDFi is related to decentralized finance (DeFi), then by definition, decentralization would be central to its operation, ideally offering a more democratic financial system, reducing single points of failure, and increasing security and transparency in transactions.