What is ESG in crypto? It’s your ticket to a cleaner future in finance. We often hear about ESG—environment, social, and governance—in traditional investing, but it’s time to bring this trio into the digital age. Think of it as a compass guiding investors through the world of digital assets, with an eye on doing good while making gains. So, let’s dive in and figure out how sustainable cryptocurrencies can be in our quest for a green portfolio.

Understanding ESG in the Crypto Space

Defining ESG Standards in Blockchain

Let’s dive right into what ESG stands for in crypto. ESG is about doing good while making money. It’s like having your cake and eating it too, but in finance. These standards help us pick investments that are kind to people and the planet. Imagine a world where your digital money does more than just grow.

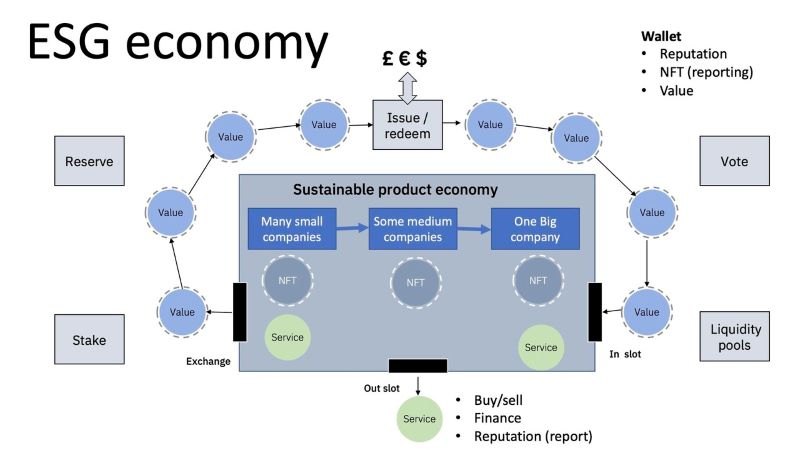

In blockchain, ESG standards check how we make and use cryptocurrencies. They ask big questions. Do they harm the air and the land? How do they treat people? Are they playing fair and open? This helps us see if a digital coin is more than just profit. It’s about making sure our digital dollars are doing the right thing.

The Importance of ESG Compliance in Cryptocurrency Investments

Why should we care about ESG when picking crypto? Simple. It’s because we all live on this earth. And we all want a fair shake. When we follow ESG rules in crypto, we pick coins that don’t just grow in value. They help in cutting down the carbon footprint of crypto mining. They make sure no one’s being treated badly.

We have seen companies get hurt when they ignore ESG. So, in crypto, being on board with ESG means fewer shocks and surprises. It’s about doing right by the environment. It’s making sure the social side is looked after. And it’s all about making sure everyone plays by the rules.

In short, it’s a three-way win. Your wallet, the folks around you, and Mother Earth will thank you. It might seem like a tough mix to get right. But it’s not just good karma. It’s good business.

Cryptocurrency is still pretty new. But it’s growing up fast. We’re getting smarter about how we can make it work for everyone. We want the good without the bad. That means green cryptocurrencies that use less power are on the rise. Projects that look at the social impact of digital currencies are getting noticed.

Crypto isn’t just about tech. It’s about trust. To get it, we need clear ESG reporting for blockchain companies. Show the world how you’re making a difference, and people will pay attention. Crypto companies with strong ESG are becoming the heroes of this story. They prove we can make money and look after our planet.

Investing with ESG in mind is about putting your money where your heart is. It’s picking the coins that stand for what you believe in. When you put your cash into sustainable blockchain technology, you’re voting for the world you want to see. Imagine a financial future that’s fair for all. It starts with every one of us making smart, caring choices.

In all, ESG in crypto is our chance to shape the future, one coin at a time. It’s about being part of a movement that’s about more than money. It’s about finding the balance between making a profit and making a difference. So next time you’re eyeing a new digital coin, think about ESG. It’s the secret sauce for investing wisely and well.

The Environmental Pillar of ESG in Crypto

Assessing the Carbon Footprint of Crypto Mining

Let’s talk trees and tech. Crypto needs energy, lots of it, for mining. Mining is how we add new coins to the system. Think of it like digital digging. But this digging can get dirty, carbon dirty. Every time we mine, computers work hard. They guess solutions to complex math puzzles. This takes a load of power.

Now, why fuss about carbon? Carbon dioxide, or CO2, is a gas. Too much CO2 warms up our planet. Not good. Crypto mining leaves a carbon footprint. This footprint measures how much CO2 we make while mining. Just as you leave a footprint in the sand, mining leaves one in the air.

Exploring Renewable Energy Solutions for Sustainable Crypto Operations

We must clean up our crypto act. Can we mine without the mess? Yes! With sun, wind, and water. These are renewable energy sources. They don’t run out. And they’re clean. No bad CO2.

Many in crypto are going green. They’re using renewable energy to mine. They know the earth matters. Solar panels turn sunlight into clean energy. Wind farms use the air’s push to make power. Hydropower comes from moving water. All these help cut the carbon footprint down.

Sustainable crypto investments mean picking the right coins. Green cryptocurrencies use less power. They don’t harm our planet as much. Look for coins that care about energy use. They’re the future.

We want a clean world. So, we go for crypto that can help, not hurt. We seek out coins mined with clean energy. We choose companies pushing for less CO2. We encourage using energy that keeps the skies clear. Let’s make an impact with one clean crypto coin at a time.

Social Responsibility and Governance in Digital Currencies

The Social Impact of Cryptocurrency Initiatives

Have you heard about the cool ways crypto is helping people? It’s true! Many crypto projects are not just about making money. They help folks in need and make lives better. For instance, some coins help by sending money fast to places hit by disaster. No need for banks or waiting. It’s like a superhero rushing to the rescue with cash help.

Remember the keyword here is “social impact of digital currencies”. This means we think about how a coin or a project makes a positive change in communities. It could be about giving loans to small businesses or supporting education. It’s not just about cash. It’s also about making good things happen for all.

Think about it this way. When we choose to support these projects, we’re voting for a kinder world. And that’s a win for everyone.

Governance Practices and Compliance Measures in Crypto Firms

Now, let’s chat about rules and fair play in crypto. Governance in crypto means making sure everything is above board. We want companies that are open about what they do. Trust is key. If a crypto company follows good governance practices, they tell us how they work, who leads them, and if they stick to the rules.

When you hear “esg compliance in bitcoin”, it’s like a trust check for your digital coins. It means the Bitcoin world is looking out for cheats and lies. They’re protecting your investments by keeping things clear and clean.

Crypto companies with strong esg show they care by being honest and following these rules. They check where money goes to block bad folks from using it in harmful ways. Good governance helps us feel sure our digital dollars are safe and doing good.

When companies show good governance and care about social impact, it’s like a green light for investors who care about doing the right thing. We see companies stepping up, and it makes us want to be part of the change. Let’s pick investments that stand for good and lead the way to a brighter future for all.

Making Ethical and Sustainable Crypto Investment Choices

Evaluating ESG Ratings for Crypto Assets

When we talk about money, we want it clean, right? Same goes for crypto. ESG ratings help us see if a crypto is playing fair and taking care of our planet. What are ESG ratings for crypto assets? They’re scores showing if a digital coin is good or bad for the environment, society, and how it’s run.

We all know money doesn’t grow on trees, but mining crypto shouldn’t hurt trees either. These ratings are like a report card for cryptos. They tell us how much energy mining uses, if the company behind it cares for society, and if it’s run honest and straight.

Identifying Green Cryptocurrencies and ESG-Focused Blockchain Projects

We’re treasure hunters, but instead of gold, we hunt green cryptocurrencies. What are green cryptocurrencies? They are digital moneys that don’t harm Earth. They use less power and come from smart tech that looks after our world.

Imagine a world where your money helps the Earth breathe easier. That’s what green cryptos and ESG projects do. They use energy from the sun and wind, not from stuff that smokes and pollutes. Such coins make sure everyone wins – the people, the planet, and even our pockets.

Blockchain isn’t just a buzzword; it’s like a trusty notebook that keeps track of everything honestly. Projects with good ESG focus on making things better, not just richer. They handle money so that it helps people, follows the rules, and doesn’t leave a mess.

Think like a gardener – plant your investments in green crypto soil, and watch them grow! Good choices now will let you harvest fruits that are ripe and ready for a cleaner, kinder world. Exciting, huh? Let’s keep our eyes on these fresh picks and grow our future, one eco-smart choice at a time!

We dove deep into what ESG means for the crypto world. First, we broke down ESG standards and why they matter in blockchain tech. Knowing this helps us pick better crypto investments. Then we checked out how crypto mining affects the earth and how renewable energy could fix it. We can’t skip the role of crypto in social issues and how firms govern themselves. This is big for trust.

In the end, smart choices come from checking ESG scores and finding the greenest projects. Making ethical picks in the crypto space means doing a bit more homework. But it pays off for our planet and our pockets. Let’s keep pushing for crypto to do good for all.

Q&A :

What is ESG and how does it relate to cryptocurrency?

Environmental, Social, and Governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. In the context of cryptocurrency, ESG factors involve assessing the environmental impact of crypto mining, analyzing how crypto companies address social issues and labor rights, and examining their governance practices, including transparency and the fair treatment of stakeholders.

How does ESG affect the investment in cryptocurrency projects?

ESG factors can heavily influence investor decisions when it comes to cryptocurrency projects. Investors may look for projects with low energy consumption, beneficial social impacts, and strong, ethical governance. Cryptocurrency projects that emphasize ESG compliance may attract more investment and gain a reputation for sustainability and responsibility, potentially increasing their long-term viability.

Can cryptocurrencies be sustainable according to ESG criteria?

Yes, cryptocurrencies can be sustainable according to ESG criteria. Many crypto projects are striving for greater sustainability by reducing their carbon footprint through the use of renewable energy sources for mining operations and blockchain management. Additionally, projects can focus on social and governance issues by promoting inclusivity and creating transparent systems that prevent fraud and enhance security.

What measures are being taken to improve the ESG score of cryptocurrencies?

To improve their ESG score, cryptocurrency projects and platforms are taking various measures. Environmental measures include transitioning to more energy-efficient consensus mechanisms like Proof of Stake (PoS) or adopting carbon offset practices. Social measures may involve using blockchain technology to bolster financial inclusion or collaborating on philanthropic initiatives. In terms of governance, cryptocurrencies are working on improving regulatory compliance, enhancing security features, and ensuring the decentralization and transparency of their systems.

How does ESG impact blockchain technology development?

ESG considerations are increasingly becoming a crucial part of blockchain technology development. Developers are encouraged to devise solutions that minimize the environmental impact, such as optimizing code for energy efficiency or selecting sustainable energy sources. Socially, blockchain can provide tools for social empowerment through decentralized financial services. Governance-wise, blockchain projects focus on creating systems that ensure fair decision-making processes, transparency, and accountability to foster trust among users and stakeholders.