If you’ve dipped a toe in the crypto world, you’ve heard the buzz about what is a layer 1 blockchain. It’s the spine that holds up the whole body of blockchain tech. Like solid bedrock, it’s where all the action begins. Today, I’m digging deep to unveil this mystery, peeling back the layers to show you the core features that make these networks tick. Be ready for a plunge into the key players and how they differ from their sprightly cousins, the layer 2 solutions, all aimed at keeping data safe and sound. If you’re yearning for simplicity in a complex crypto universe, buckle up as we explore the bedrock of blockchain technology together.

Understanding the Basics of Layer 1 Blockchain

Defining Layer 1: The Blockchain Foundation Layer

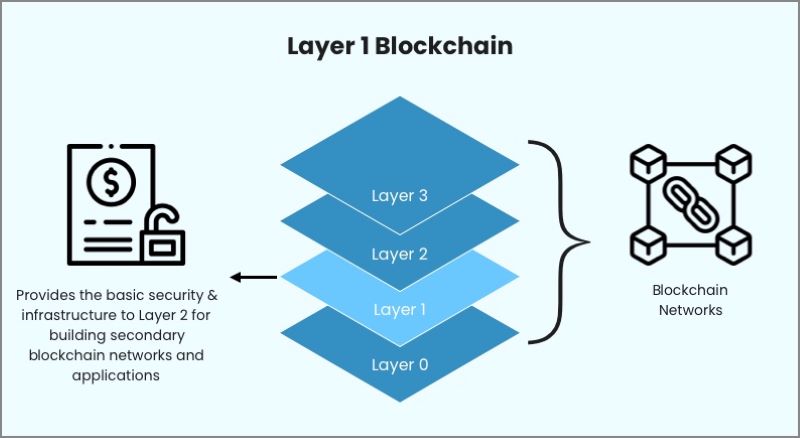

Think of layer 1 blockchain as the ground floor of a building. It’s where everything starts and holds up all that comes after it. In simple terms, layer 1 blockchain is the base layer. It’s the core framework that supports layers on top. The blockchain foundation layer includes all the basic rules. These rules are for making and recording transactions. They’re like the game rules everyone must play by. Examples of layer 1 blockchains include Bitcoin and Ethereum.

Core Features of Base Protocol Blockchains

When we dive into base protocol blockchain, we’re looking under the hood. We’re seeing the engine that powers our crypto transactions. It’s this tech that makes sure our digital money moves safe and fast. So, what makes it tick?

First off, it’s got a set of rules called “consensus mechanisms”. These are smart ways to make sure everyone agrees on the transaction records. The popular ones are proof of work and proof of stake. They’re like referees, making sure the game is fair. Proof of work makes computers solve tough math problems to add new records. Proof of stake chooses the creator of new records by who owns the most coins and is willing to “stake” them as a bet that they’re trustworthy.

But let’s not forget about how many transactions can happen at the same time. We call this “transaction throughput”. A high rate means more actions every second. It’s like a super-fast assembly line for crypto deals.

And here’s the kicker – security. You want a Fort Knox for your coins, right? Layer 1 blockchain projects focus hard on keeping your currency safe from hackers. They build thick digital walls around your money.

All this cool stuff doesn’t go very far if it can only hold a few folks at once. That’s where “on-chain scalability” pops in. It means the system can grow to support more and more people. Imagine a magic bus that gets bigger as more people hop on.

Also, we’ve got these fun things called “native tokens”. They’re the special coins that run on a blockchain. For Bitcoin, it’s, well, Bitcoin. These coins are the bread and butter of any crypto system. They keep the economy buzzing.

Lastly, the goal is to not have our wallets cry over “gas fees”. That’s the money we pay to make transactions happen. It’s like the ticket price to ride the crypto train. Everyone’s hard at work making it cheaper to buy a ticket.

That’s just scratching the surface, my friends. This layer 1 world is where all the magic starts. It’s the strong foundation that holds up all the wild and cool stuff we build on top in the world of crypto. From here, things get even more thrilling with layer 2 solutions, but that’s a story for another time.

The Key Players in Layer 1 Protocols

Examining Examples of Layer 1 Blockchains

Let’s dive right into the world of layer 1 blockchains. Think of them as the ground floor of any crypto building. These base protocol blockchains are where all the action starts. They set the rules for the game. They decide how things move and shake in the crypto world. Now, you may wonder, why should you care? Simple. These blockchains are like the engines of a car. No engine, no vroom-vroom.

Some famous names you might have heard? Bitcoin and Ethereum. They’re like the big folks on campus. They started the party and keep the beats going. But there are others too, each with its own flavor. There’s Cardano, championing proof of stake, and Solana, known for its speedy transactions.

But wait, there’s more. These networks handle all sorts of tasks, from sending cryptos across the globe to letting apps run on their systems without hitches. They bring to life all those cool apps you hear about – yes, the decentralized ones. And the native tokens like BTC and ETH? They are the stars of the show on these networks.

Layer 1 vs Layer 2: Comparing the Layers of Blockchain

Now, the word on the street is, “What’s the diff between layer 1 and layer 2?” Let me lay it out. Layer 1 is the foundation. It’s the raw land where everything gets built. Think of it as a base where you set your house. Layer 2? That’s like the fancy stuff you add to your house – like a hot tub or a game room.

But here’s the scoop. Layer 1 blockchains have a heavy job. They carry the weight of making sure transactions are solid and the network’s secure. That’s why some brains in the space are looking at layer 2 solutions. They want to make things zip faster without bogging down the foundation layer. It’s all about working smarter, not harder.

So, you see, layer 1’s are the unsung heroes. They make sure everything ticks without drama. And when they hit a snag with too many people at the party – that’s where blockchain scalability comes in. Folks are looking at ways to grow these networks without losing a beat. That’s a tough gig, no doubt. But hey, isn’t that what innovation’s all about?

Some say it’s about pumpin’ up block size or getting shard chains in the mix. Others talk ’bout gas fees and how to keep them from burning a hole in your wallet. But whatever the fix, remember, the bedrock comes first – and that’s layer 1. Once we get that part right, the sky’s the limit. So next time you’re reading up on ICOs or staking your coins, tip your hat to those layer 1 protocols. They’re keeping the lights on in crypto land.

Consensus Mechanisms: Ensuring Integrity and Security

From Proof of Work to Proof of Stake: A Transition in Consensus

In the world of blockchains, how we confirm transactions matters a ton. It’s like how adults use rules to make sure no one cheats in a game. In my work, I focus on layer 1 blockchains. Here, we need strong rules—consensus mechanisms—to keep everything fair and safe.

Let’s talk about Proof of Work (PoW). You might know PoW from Bitcoin. It’s a way to agree on the blockchain without needing a boss. Computers solve hard puzzles to get the chance to add new blocks of transactions. It’s secure, but requires lots of power.

Now, many are switching to Proof of Stake (PoS). Instead of puzzles, owners ‘stake’ their cryptocurrency. If they try to cheat, they lose their stake. It uses less power and can handle more transactions. People like PoS because it’s faster and greener than PoW.

The Emergence of Delegated Proof of Stake

Another cool update in consensus is Delegated Proof of Stake (DPoS). Picture PoS but with a twist. In DPoS, coin holders vote for a few to do the hard work of adding blocks. It’s like choosing class reps to speak for all. DPoS is even quicker and often used in newer blockchains.

Each method makes sure transactions are correct and keeps the blockchain safe. They’re vital for blockchain foundation layers to work. Each has its own perks, like how fast they are or how much they help the planet.

When we build layer 1 blockchain projects, we think hard about these rules. They shape how the blockchain runs, how secure it is, and how many dApps it can support. It’s a big deal in the blockchain base protocol.

Trust is key in cryptocurrency. Consensus mechanisms in the blockchain give us that trust. Whether it’s PoW, PoS, or DPoS, they all aim for a network that’s fair and lasting.

As an expert, my job is to help these layer 1 blockchains be the best they can. To do that, we keep looking at how we reach consensus. We want a system that handles many transactions without breaking a sweat. But we also want it to be safe for your stuff and kind to the world.

So, you see, these changes in rules aren’t just for fun. They’re building a stronger bedrock for the entire crypto world. And that means more cool stuff for everyone—like faster and cheaper ways to buy, sell, or just use apps on the blockchain.

By understanding these consensus mechanisms, we’re learning the language of blockchain. And with this knowledge, we’re all better set to explore the vast universe of crypto tech.

Scaling the Blockchain: Challenges and Innovations

Addressing Scalability with On-Chain Solutions

Blockchains need to handle lots more data as they grow. Just like a road gets busy, the network needs to keep traffic moving. Think about layer 1 blockchain as the bedrock. It holds everything up! But there’s a snag. Sometimes it gets too crowded, like a traffic jam. That’s where scaling comes in. To scale means making the blockchain fast and roomy for all its users.

So, how do we address this? We use on-chain solutions to make traffic flow better without changing the basic rules, or the layer 1 blockchain foundation layer. These solutions work directly on the blockchain to help it handle more action. Think bigger blocks, so more stuff can fit. Or faster blocks, so it’s like going from a slow walk to a sprint!

Now, layer 1 blockchain projects are getting smart. They work on two big things to make everything smoothe. First is blockchain security. It’s a must! We can’t have anything messing up the blockchain. Second, we ensure high transaction throughput. That’s a fancy way for saying the blockchain can handle lots of trades all at once without bugging out.

For the tech heads out there, these on-chain solutions often mean messing with stuff like block size and blockchain rules. Tough work, but oh so worth it.

Blockchain Scalability: The Role of Shard Chains and Block Size

Let’s chat about shard chains. Shard chains split a blockchain into smaller, easier to manage pieces. Imagine breaking up a big pizza so everyone gets a slice faster. It’s a smart way to speed things up on the blockchain network types we see today.

Block size also plays a big part. Bigger blocks can hold more info, making the network faster. But making blocks too big can cause new problems, like only people with powerful computers can keep up. And we sure don’t want that!

This stuff matters a lot when we look at blockchain scalability. It’s all about letting more people join the party without the music stopping. When blockchains can handle more folks doing their thing, from smart contract platforms to playing games, it means we’re doing it right.

Now I know these ideas can sound like a mouthful. But they’re the meat of making cryptocurrencies work even better for everyone. And yeah, it can be tricky, but when we nail it, your transactions fly like a bird, and your gas fees in blockchain? They drop, making you smile at the savings. It’s like finding a shortcut on your way home. Suddenly, the road is clear, and you’re cruising.

So when we talk layer 1 blockchains, remember, it’s all about building strong and making room for tomorrow’s digital towns. That’s what we’re aiming for every day – bigger, faster, and safer roads for our digital coins and codes to zoom along.

We dove deep into the world of Layer 1 blockchains, the tough bones that hold up the whole crypto body. We kicked off with the base ideas, showing what these blockchains are all about. Then, we met the big shots, looking at examples and how Layer 1 stands apart from Layer 2. Next, we tackled how these chains make sure all is fair and secure, by moving from proof of work to proof of stake and even to folks who delegate their stake. Lastly, we faced the big issue of growing bigger without breaking down, checking out cool ways to do it.

Here’s the deal: Layer 1 blockchains are key. They’re the ground that lets the whole crypto world stand tall. With smart ideas and tech, they’re finding new ways to let more people in and keep our digital cash safe. And that’s what makes them shine. Keep an eye on them, they’re going places!

Q&A :

What exactly is a Layer 1 Blockchain?

Layer 1 blockchains form the foundation of the cryptocurrency ecosystem. They are the original underlying networks upon which various digital assets and smart contracts operate. By providing the basic framework for transaction processing and finality, Layer 1 blockchains such as Bitcoin and Ethereum maintain and secure distributed ledgers without requiring another overlaying network.

How does a Layer 1 Blockchain differ from Layer 2 solutions?

Whereas Layer 1 blockchains are the primary infrastructure for cryptocurrencies, Layer 2 solutions are built on top of these existing blockchains to enhance scalability and efficiency. Layer 2 solutions, like Lightning Network for Bitcoin and Plasma for Ethereum, aim to increase transaction speeds and reduce costs without altering the original blockchain’s protocol.

What are some common examples of Layer 1 Blockchains?

Common examples of Layer 1 blockchains include Bitcoin, Ethereum, Binance Smart Chain, and Cardano. These networks operate their own consensus mechanisms (such as Proof of Work and Proof of Stake) and are responsible for processing and confirming all transactions on their platforms.

Why is the scalability of Layer 1 Blockchains often discussed?

Scalability is a crucial issue for Layer 1 blockchains as they typically handle a high number of transactions. As the blockchain ecosystem grows, the volume of transactions can lead to network congestion, slower processing times, and higher fees. Thus, the scalability of these foundational networks is frequently discussed concerning their ability to support a growing user base and transaction volume.

What are some solutions to improve Layer 1 Blockchain scalability?

To improve scalability, Layer 1 blockchains may undergo network upgrades that include sharding, which splits the network into smaller pieces, or altering the consensus mechanism to a more efficient one such as Proof of Stake. Additionally, innovative coding and optimization of blockchain protocol can contribute to higher scalability on Layer 1.