Stablecoins Explained: Are They the Future of Cryptocurrency?

Today’s money game is changing, and what are stablecoins? They’re digital bucks that don’t ride the wild price waves like Bitcoin does. Picture a kind of crypto that plays it cool, keeping its chill when market storms hit. It’s like your money’s wearing a life jacket, safe from sinking. We’ll dive into how these steady players work and if they’re set to reign in the future’s money scene. It’s simple, insightful, and you’ll come out knowing if stablecoins are the real deal or just a buzz. Join me, and let’s break it down.

Understanding Stablecoins: Definitions and Functions

What are Stablecoins?

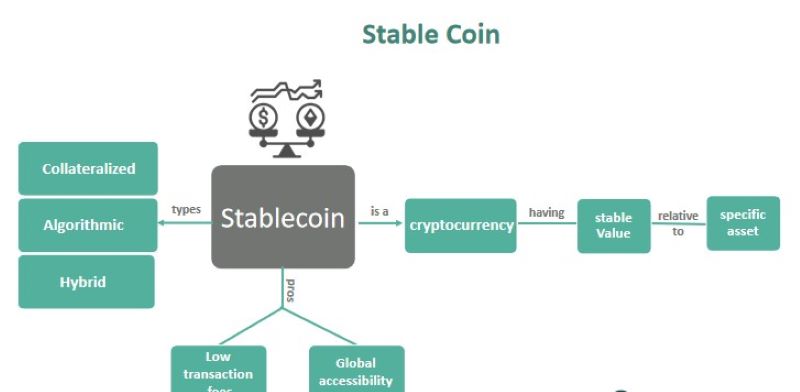

Stablecoins are a type of digital money. They’re like other cryptocurrencies, but with a twist: they aim to keep their value stable. Think of them as a bridge between the rapid world of crypto and the steady pace of regular cash. They don’t jump up and down in value like Bitcoin often does. This makes people and businesses more likely to use them for day-to-day things like buying groceries or paying rent, which can be tricky with other types of crypto that change in value a lot.

Price Stability Mechanisms and Value Maintenance

So, how do stablecoins stay so steady? It’s all about their design. Some are tied to actual money or things like gold – these are called “fiat-collateralized” stablecoins. They’re like a promise that for every digital coin out there, there’s real cash or gold sitting somewhere safe. It’s similar to having a piggy bank for every digital dollar you own.

Others are “crypto-collateralized,” which means they use other cryptocurrencies as backing but keep a larger safety net. It’s a bit like padding a fall with extra cushions. Then, we have “algorithmic stablecoins.” They’re not backed by cash or other coins. Instead, they use computer rules to control how many coins are out there, aiming to keep their value from going up and down too much.

Stablecoins are shining stars in the world of “decentralized finance” or DeFi for short. This is the land of financial activities built on blockchain, the same tech behind most cryptocurrencies. But even in DeFi, keeping stablecoins, well, stable, is key. It’s done through smart contracts – bits of code that live on the blockchain and work automatically to balance things out.

Why does all this balancing act matter? To make stablecoins useful for everyday use. By tying their value to things we already trust, like dollars or gold, stablecoins are easier for us to understand and trust too. And when we trust them, we use them more – for everything from saving money to buying coffee, right there alongside our regular cash.

There’s a lot of talk about how these coins affect banks. Stablecoins show us a new way to do banking, one that’s all about tech and less about big buildings full of vaults. This is exciting but also a bit scary for old-school banks. It forces them to think about how they work and how they might need to change in the future.

Lastly, let’s not forget that while stablecoins promise a lot, they come with risks too. They rely on being properly managed and on keeping those real or digital reserves safe. And just like any new tech, rules and checks are super important. This helps keep everything fair and safe, for both the people using them and the whole financial system.

Stablecoins are much more than just a fad in crypto. They have a real shot at changing how we think about and use money. Like everything new, they have their growing pains. But as they learn to walk and then run, we might just find ourselves racing right alongside them into the future of finance.

The Variety of Stablecoins and Their Designs

Fiat-Collateralized Stablecoins and Their Dominance

Let’s talk about stablecoins like your friend explaining a cool game. First, they’re like tokens that stay the same value. Think of them as arcade tokens, but for the digital world. They don’t jump up and down in price like Bitcoin does. Now, how do they keep their value steady? Easy. Each one is matched with real money, like dollars, in a bank. This kind is called “fiat-collateralized stablecoins.” This means they’re backed up by money we all know and use.

These coins are super popular. Why? Because people trust that real money’s there. You can trade a digital token for a real dollar any day. They’re like a bridge between dollars in your wallet and coins in a game. It makes sense folks feel good about them. They bring the steady hand of dollars to the wild world of crypto.

They’re also easy to check on. The companies that make them must show they really have the money they say they do. This keeps everything above board. People and businesses like knowing what they’re dealing with. It’s no wonder these coins rule the market.

Exploring Crypto-Collateralized and Algorithmic Stablecoins

So, now we dig into the other kinds of stablecoins. You’ve got the “crypto-collateralized” bunch. These are backed up by other cryptos. It’s a bit like putting down a deposit. You lock up some crypto as a promise. The value is kept stable by some smart tech that watches the market. If prices move too much, the system reacts to fix it.

These are riskier though. Since crypto prices can swing wildly, you might need to put down more crypto if prices fall. It’s like paying extra to make sure your arcade token keeps working.

Then there’s the new kid on the block: “algorithmic stablecoins.” These have no real money or crypto holding them up. It’s all about code. The code runs the show by making more coins or taking some away. This keeps the coin’s value from changing a lot. Think of it as a seesaw. The code adds weight to one side or the other to keep it level.

But, these are super tricky. Since there’s no real money or crypto backing them up, if people start to worry, there might be trouble. If everyone tries to leave the game at once, the seesaw might break. That’s why these need trust and smart code to work.

Stablecoins shake up how money works. They make trading and saving easier in the cyber world. Plus, they don’t pick a side. They can lend a hand to your cash or your Bitcoin wallet. There’s a stablecoin for everyone, but picking one needs a smart choice. Look at how they’re backed up and how new tech can help or hurt. This is the key to using them right in the world of crypto.

Integrating Stablecoins in the Financial Ecosystem

Stablecoin Adoption and Its Impact on Traditional Banking

Stablecoins shake things up in the world of money. These digital coins match real-world money, like dollars or euros. People use stablecoins for quick and cheap money transfers. They work well with online trading too. Banks are noticing. They wonder how stablecoins might change the way we bank.

Banks have always been the big players in finance. But stablecoins let people do bank-like things without a real bank. You can send, save, or borrow money all through stablecoins. More people are using them every day. As they get popular, banks are thinking hard about what comes next. Will they join in or stand back?

Regulatory Landscape and Compliance for Stablecoin Issuance

When someone makes a new stablecoin, they must follow rules. These rules help keep our money safe. Not everyone can just make a stablecoin. They must show they have the money to back it up. Stablecoin creators work closely with groups that watch over financial safety. This includes governments and other big finance groups.

These rule makers are always watching. They want to make sure stablecoins are stable. If too many people want to take out their money at once, there could be trouble. That’s why having strong rules is important. It keeps everyone playing fair. Stablecoins must be trustworthy and legal, so everyone can feel good using them.

Stablecoins are a team player in finance, working with banks and laws. They might change how we use money. But first, they must show they’re safe and play by the rules.

The Future Prospects of Stablecoins in Cryptocurrency

Stablecoin Market Dynamics and Investment Potential

Let’s dive into stablecoin magic. Imagine money that dances to a digital tune! Stablecoins, simply put, are like digital dollars with superpowers. Picture your cash linking arms with technology, creating money that moves fast and stays steady.

Why do folks use them, some ask? They offer a smooth ride where most cryptos bounce like pogo sticks. They cling to a fixed value, mostly to the mighty US dollar. So, when you hear “USD pegged cryptocurrencies,” it’s stablecoins taking a pinky promise to match the dollar’s muscle.

Here’s where it gets cool. You have types, choices, flavors! First, you’ve got the “fiat-collateralized” folks. They’re like a kid with a piggy bank; they hold real cash to back their digital coins. Next up, “crypto-collateralized” types. These guys are like acrobats, balancing on a stack of other cryptos. Last, “algorithmic stablecoins” which use super smart math tricks to keep their cool without a piggy bank or a crypto stack.

Investors bump into stablecoins and think, “Hey! Safe harbor!” in stormy crypto seas. That’s because they expect a steady value and can sleep without nightmares of wild price swings. Plus, diving into decentralized finance (DeFi)? You’ll need stablecoins as your ticket in.

Now, they’re not without risks. Some have had bad days, where their peg to the dollar went wonky. And there’s chit-chat about how well these babies are backed by real dollars or assets. That’s where the sharp eyes and minds come in, checking that everything’s shipshape (that’s your auditing of stablecoins).

Are Central Bank Digital Currencies (CBDCs) the Next Evolution of Stablecoins?

And now, the next big wave could be CBDCs, or central bank digital currencies. These are like stablecoins’ big brothers, with a government badge. Central banks worldwide, from big shots like the US and China, are peeking into this candy shop.

By creating their own digital money, banks look to keep their hand on the wheel. This promises smoother cash flow in digital markets and keeps the banks’ role snug and secure in our wallets. CDBCs could sway the dance floor where stablecoins boogie, shaping how we use and trust digital dough. These digital currencies pack the promise of easy, safe, and fast money moves across borders.

But wait, there’s a twist! If a country fires up its own digital currency, it might knock stablecoins off the stage, or at least shake up their show. So, what we’re eyeing is a tango between new-age stablecoins and old-school central banks. Each step, twist, and turn could lead to a new future for how money wiggles into our lives.

In the end, it’s a nifty story of money evolution, from shells, to coins, to paper, to pixels. The question is, will stablecoins be the trusty steeds we ride into the sunset or just a handy bridge to the next big thing in money? Only time will tell, but for now, they’re a buzzing topic in the sprawling cipher of crypto!

Alright, we’ve journeyed through the stablecoin universe, from what they are to how they work. We saw why people choose stablecoins, looking at how they keep their value. We explored different kinds, like those backed by real money and others tied to crypto or algorithms.

Then, we dived into how stablecoins are changing money matters and the rules they follow. Lastly, we thought about their future, their growing market, and how they might shape new digital money from banks.

Here’s my final take: Stablecoins are a big deal. They’re more than just digital cash. They could change how we see and use money forever. Keep an eye on them! They’re not just a trend, they’re stepping stones to the future of finance.

Q&A :

What Exactly Are Stablecoins?

Stablecoins are a type of cryptocurrency designed to offer stability in value by being pegged to a stable asset, such as the US dollar, another currency, or a commodity like gold. They aim to combine the best aspects of cryptocurrencies — such as security, privacy, and digital convenience — with the stable valuation of traditional fiat currencies.

How Do Stablecoins Maintain Their Stability?

Stablecoins maintain their stability through various mechanisms. The most common approach is by backing each stablecoin with an equivalent amount of a stable asset, like fiat currency or gold, held in reserve. This backing can be verified through regular audits. Other stablecoins use algorithms to manage the supply of the token to keep its value steady.

Why Would Someone Use Stablecoins Over Traditional Money?

Stablecoins are used over traditional money for several reasons. They offer the instant processing and security of payments of cryptocurrencies while aiming to avoid the price volatility. Furthermore, they are borderless and can be transferred across the globe quickly and with lower fees compared to traditional banking systems. They’re also accessible to people without access to conventional banking.

Are Stablecoins Safe to Invest In?

Like any investment, stablecoins come with their risks. While they are designed to be safe and stable, there’s still the potential for technical issues, regulatory changes, or problems with the reserve assets’ management. Investors should conduct thorough research and consider the stability and reputation of the stablecoin issuer before investing.

What’s the Difference Between Stablecoins and Other Cryptocurrencies?

The primary difference between stablecoins and other cryptocurrencies is volatility. While the value of most cryptocurrencies, such as Bitcoin and Ethereum, can fluctuate wildly, stablecoins aim to maintain a steady value. This stability is typically achieved through a reserve of assets or through algorithmic mechanisms, setting them apart from the speculative nature of other cryptocurrencies.