Dive into the dynamic world of crypto derivatives with me, your guide to digital trading powerhouses. You want to know what lies behind the screen tickers and buzzing market floors, right? Well, it’s a universe of instruments that can skyrocket your portfolio’s value or shield it from market storms. But what exactly are these tools? Let’s unravel the mystery together. From futures that bet on Bitcoin’s next move to Ethereum swaps shaking up the finance scene, grab my hand, and let’s dive into the matrix that moves mountains of digital currency with finesse and strategy.

Understanding the Basics of Crypto Derivatives

Introduction to Crypto Futures Contracts

Crypto futures contracts are like a pinky promise on the blockchain. They say, “I’ll buy or sell a crypto at a set price later.” You could bet on Bitcoin or Ethereum, choosing to lock in a price today and settle later. It’s like a deal to buy a friend’s bike but only pay on their birthday.

The Role of Bitcoin Options in Risk Management

Now, Bitcoin options are more like a choose-your-own-adventure book. They let you buy or sell at a catchy price in the future. But you don’t have to if you change your mind. It’s like saying, “I may buy your skateboard for $50 next month—if I feel like it.” If the board gets cooler, you score a deal. If not, no sweat, you walk away.

Exploring Complex Financial Instruments

Innovation through Ethereum Swaps and DeFi Products

Ethereum swaps let you trade without a middle man. They use smart contracts to swap coins directly. This is powerful stuff for traders like us. It means we get to trade faster and in more exciting ways.

Decentralized finance, or DeFi for short, shakes things up even more. It lets us join new markets and trade in fresh ways with crypto. Picture a playground, but for trading with crypto bits like coins, tokens, and digital cash. That’s DeFi for us. It’s all run on the blockchain, ensuring our toys don’t get mixed up with someone else’s. We get to play with products that didn’t even exist before, built by folks around the world.

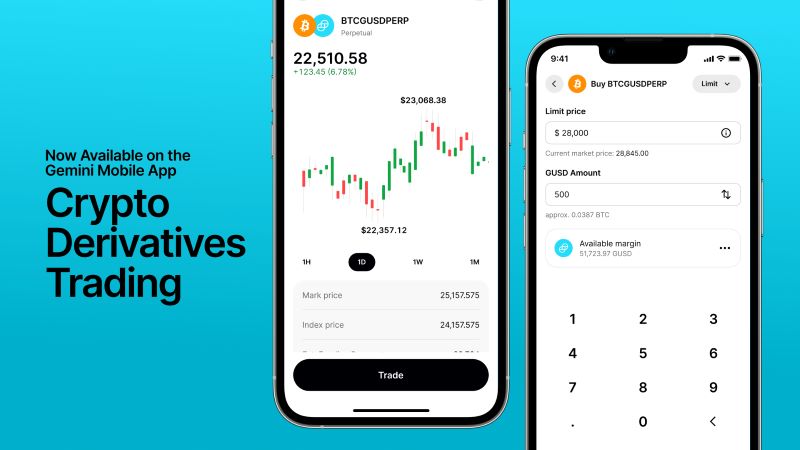

Assessing the Impact of Leverage Tokens and Crypto Perpetual Contracts

Now, leverage tokens—they’re a game-changer. They amplify our trading without needing the usual loans. Buy one of these bad boys, and you basically get to power up your trade like a video game boost. Be cautious though; with great power comes great responsibility (and risk!).

Crypto perpetual contracts are like futures but without an end date. You can bet on prices and never have to say goodbye to your position. You can stick with it like your old favorite sneakers. But this is no child’s play; watch the price moves like a hawk. Timing is key, just like in dodgeball. You’ve got to know when to leap and when to duck.

Trading crypto might seem like fun and games. But always remember we’re playing with real money. Make sure you learn the rules and start slow. And hey, have a blast discovering all these neat tools!

Navigating the Decentralized Finance (DeFi) Landscape

The Emergence of Decentralized Finance Futures

Decentralized finance, or DeFi, has changed the game. It’s not just a buzzword. It’s a revolution in trading and managing money. DeFi takes power from the big banks and gives it back to you. Here, the key players are decentralized finance futures. These aren’t your average futures contracts. They run on blockchain tech, which means they’re secure, fast, and open to all.

These crypto futures contracts let you bet on the future price of cryptos like Bitcoin and Ethereum. It’s a way to dive into crypto without buying the coins outright. But remember, futures are a promise to buy or sell an asset at a fixed price on a set date. They give you a chance to make some serious coin if you can predict where the market’s headed.

Want to know more about how these work? Just think of them as a lever you can pull to magnify your trading power. You can control more with less money down. Sounds great, right? It is, but it’s also riskier. If the price moves against you, that lever swings back hard. So, it’s crucial to get your trading strategy right.

Strategies for DeFi Options Trading and Synthetic Assets

Next up, we’ve got DeFi options trading. Options are kind of like an insurance policy for your trades. They give you the right, but not the obligation, to buy or sell at a set price. Think of Bitcoin options as a way to bet on price movements without risking the farm. They can protect your investments or help you score big time from market swings.

But there’s more to the DeFi world than just futures and options. Enter synthetic assets. These are super smart contracts that mimic the value of real-world assets. So you can trade gold, oil, or company shares, all on the blockchain, even without owning the actual thing. This opens up a whole world of trading possibilities.

And since they’re built with blockchain, you can trade 24/7, and transactions are transparent and quick. Plus, synthetic assets in crypto are borderless. You could be sitting on your sofa in Texas and trade an asset pegged to the price of a stock listed in Tokyo.

Now, let me share a secret with you. The real magic happens when you combine different crypto derivatives smartly. Mix and match your Bitcoin futures with Ethereum swaps and options. This is where strategy comes in. You start seeing patterns, trends, and opportunities that less savvy traders miss.

Learning how to navigate the DeFi landscape takes time. But it’s worth it. Every digital asset forward, every smart contract option, and even those crypto perpetual contracts are tools. Tools that can help you build your crypto trading empire.

Remember to stay on top of DeFi derivative protocols and blockchain-based derivatives. And always keep an eye on cryptocurrency derivatives regulation. These rules can change the trading game overnight.

So, whether you’re into Bitcoin derivatives trading platforms or you’re curious about Binance futures market, here’s the bottom line: DeFi can be your pathway to becoming a savvy trader. But like any powerful tool, you need to respect it and learn how to use it properly. That’s how you play it smart in the wild world of crypto trading!

Advanced Trading and Risk Management in Crypto Markets

Risk Management Techniques for Crypto Derivatives

Traders love crypto derivatives for their power to manage risk. What’s a derivative? It’s a trading tool—its value comes from an underlying asset, like Bitcoin. You don’t own the asset, but you can still profit from its price moves. There are many types of derivatives, but let’s focus on a few important ones.

Understanding Regulatory and Taxation Aspects of Cryptocurrency Derivatives

Rules for crypto are tricky. Each country has its own laws. Some are strict, others not so much. Traders need to know these rules to stay safe and legal. Taxes are part of the game when you make money in crypto. Just like when you work and pay taxes, making profits from crypto derivatives isn’t different. Working with a tax pro can help you understand what you owe.

Now, let’s dig deeper into the types of crypto derivatives that can sharpen your trading edge while staying on top of risks and rules.

Crypto Futures Contracts

Imagine betting on Bitcoin’s future price. That’s what you do with crypto futures contracts. You agree to buy or sell Bitcoin at a set price on a certain date, no matter its actual price then. This can lock in profits or protect you from price drops. If you think Bitcoin’s price will rise, you buy a futures contract. If you think it will fall, you sell one.

Bitcoin Options

Bitcoin options give you the right to buy (call option) or sell (put option) Bitcoin at a certain price before the option expires. They can be your safety net, letting you limit your losses if Bitcoin’s price dives. But if Bitcoin soars, your profits can, too. Options are all about choices. Use them to make money or to keep your portfolio safe.

Ethereum Swaps

Swaps are a bit like trading cards. Two parties swap financial instruments. For example, with Ethereum swaps, you might trade Ethereum’s future price movements for cash. It’s a deal that allows traders to bet on cryptocurrency prices without owning the coins. It’s complex but can be rewarding if managed well.

Crypto Perpetual Contracts

These contracts are like futures but without an expiry date. You can hold onto them for as long as you like. This means you can profit as long as the market moves in your favor. They work with a mechanism called “funding rate” that keeps the market prices and the perpetual contract prices aligned.

In crypto markets, there’s a tool for every goal and risk level. From safe, steady strategies to bold, high-stakes plays, understanding how to use these instruments can amplify your trading power in the vast digital currency playground. Remember to always stay informed about the evolving landscape of regulations and taxation that come with these advanced tools. Your mastery of crypto derivatives not only can lead to potential rewards but also protects you against the turbulence so common in these markets. Keep learning, keep trading, and stay ahead in the ever-exciting crypto derivative markets.

In this post, we dove into the world of crypto derivatives. We started by breaking down basics like crypto futures and how Bitcoin options can help manage risk. Then, we looked at cutting-edge stuff like Ethereum swaps and DeFi goodies. We also talked about how leverage tokens and perpetual contracts can shake things up. Plus, we explored how DeFi futures work and smart ways to handle DeFi options and synthetic assets. Lastly, we covered how to keep your trades safe and looked at the rules and taxes for crypto derivatives.

My final take? These tools are powerful for trading and can help you outsmart risks, but remember to keep your smarts about you. Whether you’re dealing in futures, options, or swaps, know your stuff and trade smart. It’s a wild finance world out there, and staying sharp is key to winning big.

Q&A :

What Are Crypto Derivatives and How Do They Work?

Crypto derivatives are financial instruments whose value is derived from the performance of an underlying asset, which in this case is a cryptocurrency. They allow traders to speculate on the future price movements of the asset without actually owning it. Common types of crypto derivatives include futures, options, perpetual contracts, and swaps. These instruments work by enabling investors to enter into agreements to buy or sell the underlying crypto at a predetermined price at a specified future date or to exchange cash flows based on the asset’s price variance.

Which Types of Crypto Derivatives Are Most Commonly Traded?

The most commonly traded types of crypto derivatives are futures, options, and perpetual contracts. Futures contracts involve an agreement to buy or sell the crypto asset at a future date for a specific price. Options give the buyer the right, but not the obligation, to buy or sell the crypto at a predetermined price within a certain time frame. Perpetual contracts, also known as perpetual swaps, are similar to futures but without an expiry date, allowing the trade to continue indefinitely until the trader decides to close it.

How Do Crypto Derivatives Affect the Market?

Crypto derivatives can have a significant impact on the cryptocurrency market. They provide a mechanism for price discovery, allowing the market to determine the value of a cryptocurrency through trades. Moreover, these instruments can offer high liquidity and enable price stabilization through hedging strategies. However, they can also introduce higher volatility, especially in an already volatile market such as cryptocurrencies, due to the leverage often involved in derivative trading.

Are Crypto Derivatives Regulated?

The regulation of crypto derivatives varies widely by jurisdiction. In some countries, they are strictly regulated by financial authorities, similar to other financial derivatives. In such areas, platforms offering crypto derivatives trading services need to comply with specific regulations, and investors might have to adhere to particular laws. However, in other regions, crypto derivatives may operate in a regulatory gray area or be subjected to less stringent rules, leading to a varied and complex global landscape for traders and service providers.

Can Individuals Trade Crypto Derivatives, and What Are the Risks?

Yes, individuals can trade crypto derivatives, but it’s important to understand the risks involved. These instruments are complex and often come with high leverage, which can amplify both profits and losses. Potential risks include rapid price movements, liquidity issues, and the potential for complete loss of the traded capital. It’s essential for individual traders to conduct thorough research, understand the terms of their trades, and utilize risk management strategies when participating in crypto derivatives trading. It’s also wise to be aware of the regulatory environment in the trader’s jurisdiction.