Researching cryptocurrency projects before investing is like navigating a maze full of traps and treasures. With hype and buzzwords clouding the digital landscape, digging deep is the only way to strike gold. I get it: the crypto world buzzes with potential. Yet, some rush in and face losses. Don’t be that person. Let me arm you with the know-how to spot the gems among the rubble. It starts with smart due diligence and ends with smart choices. Let’s dive in and unearth the secrets to making informed crypto investments.

The Foundation of Crypto Due Diligence

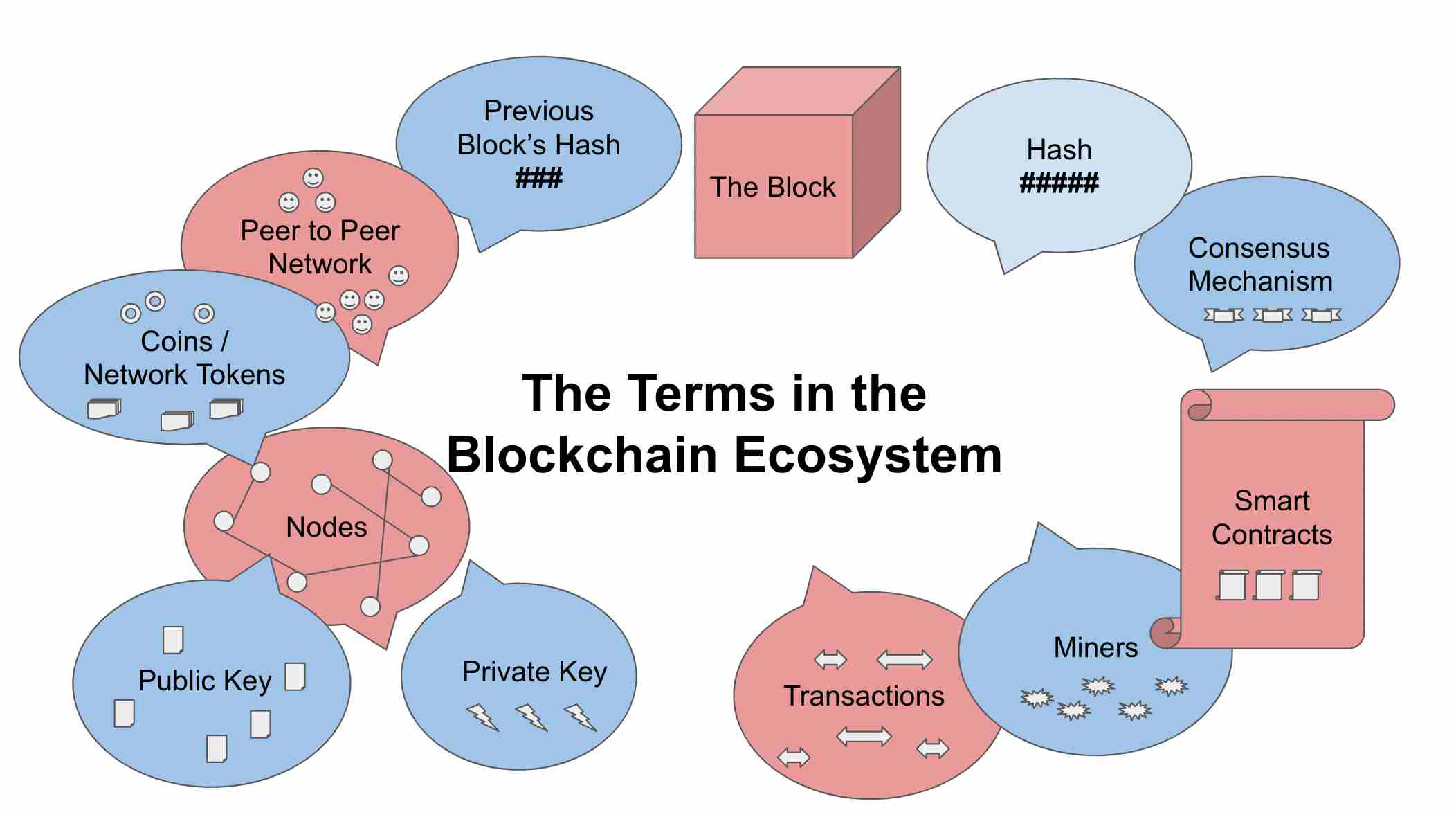

Understanding the Basics of Blockchain Project Fundamentals

When you look at a new crypto project, start from the ground up. Ask, what problem does this blockchain solve? Does it even solve a problem? Get answers. Learn how the project stands out. Is it faster, more secure, or does it cut costs? This is the meat of blockchain project fundamentals.

Facts about the team behind a crypto matter too. Do they show their faces online? Have they built successful projects before? These bits help trust grow. If they’re hiding, that’s a red flag. A clear goal and a strong team can set a project apart.

Deciphering Whitepaper Evaluation Criteria

Reading a project’s whitepaper is crucial. It’s like a map that guides you through the project’s jungle. What’s in a whitepaper? Plans, tech talk, and how the crypto works. It also shows the roadmap – what’s planned for the future. A good whitepaper is clear and makes sense. It’s your lens to see if a project adds up.

Look for how the project will make money. Or how it helps users save theirs. Check how well the whitepaper explains token use. It must have real value in the project’s world. If not, ask why the token exists at all.

Evaluating digital currencies takes effort. But it is worth it. Spot gems and avoid trouble by doing your homework. Your wallet will thank you later.

Deep Dive into Project Validity

Development Team Background Checks and Their Significance

When doing your homework on crypto, never skip checking the team behind the coin. Think of it as checking a car’s engine before buying. A good team makes a good crypto project. They should have open bios, past success in tech, and no shady history.

Look into their work history. Have they built solid tech before? Do they show their faces and names boldly? We avoid anonymous teams, as they often signal a scam. Real projects have real people proud to show their work. Remember, they hold your money’s future. Always check who they are.

Scrutinizing Smart Contracts for Security Flaws

Next, we must poke at smart contracts like a curious mole. These digital agreements power DeFi and more. They must have zero leaks, else your money might slip away. It’s about safety. We want no bugs, no traps, just a clean, secure line of code.

Use tools like GitHub to sleuth around. Check for recent audits done by pros. Look at the contract’s history. Has it been tested in battle, or is it fresh meat? A contract well-used with no issues is a green light. But if it’s new, who knows what bugs may lurk? Always stay wary.

To keep it short and sweet, for your wallet’s sake and your peace of mind, always dig deep into who makes the coin and how it’s made. Simple steps can save you from falling into a dark pit in the shiny crypto world.

The Economic Anatomy of Cryptocurrencies

Dismantling Tokenomics: Allocation, Utility, and Distribution

Diving into tokenomics is like opening a treasure map. It shows us where the value lies. Tokenomics combines tokens and economics. In short, it’s how a cryptocurrency works. How are tokens made? How are they given out? What can you do with them? These are key questions when evaluating digital currencies.

When I look at a new coin, I first see how many there will be. This is the cap. It tells us what’s rare and what’s not. Less can mean more value. Next, I check how these coins spread out. Did the founders keep many? This can be a risk sign. A fair spread is often better.

Coins must do something useful, or they won’t last. A coin can let you vote on project choices. Or pay for things inside its own system. A good coin makes users want to use it, not just sell it. If a coin has no goal, I stay away.

Now, let’s talk about liquidity pools. What’s that, you ask? They let people trade coins easily. A pool needs two things: coins and cash. Or, two types of coins. A big, well-used pool means a strong coin. But if it’s new or empty, that’s risky. Such coins can be hard to sell later.

With too few coins in a pool, price swings can be wild. That’s bad for stable trading. I like to see coins that can handle big trades. That means a healthy coin. But how do you know a coin pool is safe? Check who controls it and where the funds go. Transparency wins trust.

Liquidity Pool Safety and Coin Market Cap Insights

Liquidity equals safety in crypto land. Safer coins make it easy to get in and out. A coin’s market cap can guide us here. What’s market cap? It’s all coins out there, times current price. A high cap can mean a sturdy coin. But it’s not foolproof. A big cap with tiny trading volumes is a red flag. It might be inflated.

The strength of a coin’s market cap ties to its network security. A coin must be tough for hackers to touch. Network checks must tick off many boxes. Could bad actors attack the nextwork? Your investment must stay secure. These security layers matter a lot.

Evaluating a coin isn’t just math. It’s also about people. A strong community keeps a coin alive. Before I invest, I measure this pulse. I look at chats, forums, and online buzz. Active talk is good. Silence or anger, not so much. A healthy project breeds a lively, happy user base.

When you mix wise tokenomics with firm liquidity and a solid community, you get potential. Not just any coin can be a gem. But with a sharp eye and the right checks, we can spot the stars. It’s not just about the coin’s today. It’s the promise of its tomorrow. A strong foundation today can build a bright future.

Beyond the Code: The Human and Regulatory Aspect

Gauging Community Engagement and Developer Activity

Have you heard of crypto’s buzzing forums? They’re gold mines! Strong community talk often means a project’s hot. But a quiet chatroom? Red flag! Check for daily active users. Lots? Great sign!

Now, let’s dig at the devs. They build the project’s bones. Their hustle gives it life. Are they fixing bugs quick? Pushing updates often? These are big green lights. A tip-top team is king in crypto land.

Compliance, Partnerships, and Detecting Red Flags in Crypto Projects

Kicking off, is the project playing by the rules? No-go zones flash bright red for investors. You want your coin above board, pals.

Next up, who’s buddying up with whom? Solid partners can mean a strong future. But watch out! A quick splash of big names doesn’t always spell success.

Mind the exit signs – if a team is shady, or updates start to vanish, take care. You might just dodge a bullet (or an exit scam).

In closing, crypto’s wild west days are fading. It’s all about smart investing, friends. Dive deep, stay sharp, and mine those digital gems wisely!

To wrap things up, we’ve explored how to really know your crypto before investing. Starting with blockchain basics and what makes a good whitepaper, we’ve covered essential ground. We dug deep into checking out the team behind a project and the smart contract they offer. We also cracked into the economic guts of cryptos, like token distribution and liquidity pools.

My final thoughts? Taking these steps can save you from bad choices and lead to smarter bets in the crypto space. Don’t just dive in—do your homework, stay aware, and invest wisely. That’s how you win at this game. Always remember: looking well before you leap can mean the difference between sinking and swimming in the deep waters of cryptocurrency.

Q&A :

What should I consider when researching cryptocurrency projects before investing?

When looking into cryptocurrency projects, it’s pivotal to evaluate the project’s whitepaper for clarity on goals, technology, and a roadmap for the future. The team’s background and track record should also be assessed. Additionally, consider the community and developer engagement, market potential, competition within the space, and any legal or regulatory issues.

How can I spot red flags in cryptocurrency projects?

Be cautious of projects with anonymous teams, unclear roadmaps, unrealistic promises of returns, and lack of transparency. Also, keep an eye out for minimal code activity on repositories, poor communication on social media platforms, and a lack of endorsements from known community figures.

What resources are useful for researching crypto investment opportunities?

Utilize resources such as the project’s official website, whitepapers, blockchain explorers, and platforms like CoinMarketCap or CoinGecko for market data. Cryptocurrency forums, Reddit, and social media channels are also valuable for community sentiment, while GitHub provides insight into development activity.

How important is the community’s role when researching crypto projects?

The community’s role can be an indicator of a project’s credibility and potential for growth. A strong, active community often contributes to the development, outreach, and support of a project. It can also drive the adoption rate, influence the stability of the cryptocurrency, and act as a network for troubleshooting and ideas.

Can technical analysis be a part of researching cryptocurrency projects before investing?

While technical analysis can offer insights into market trends and investor behavior, it should be used as a complement to fundamental analysis when researching cryptocurrencies. Investigating the project’s fundamentals, purpose, utility, market dynamics, and development activity is crucial for a holistic understanding before investing.