On-Chain Cryptocurrency Analysis: It’s not just a buzzword—it’s the key to unlocking market secrets that often remain hidden in plain sight. I dig into data that others overlook. I trace crypto asset flows, monitor wallet activity, and dissect smart contracts. With my skills, you’ll understand how subtle shifts could signal big changes in the market. I use on-chain analysis to give you the edge in a space where information equals power. Get ready to see the crypto world through a lens that brings its inner workings into sharp focus. Let’s reveal the story the data is dying to tell.

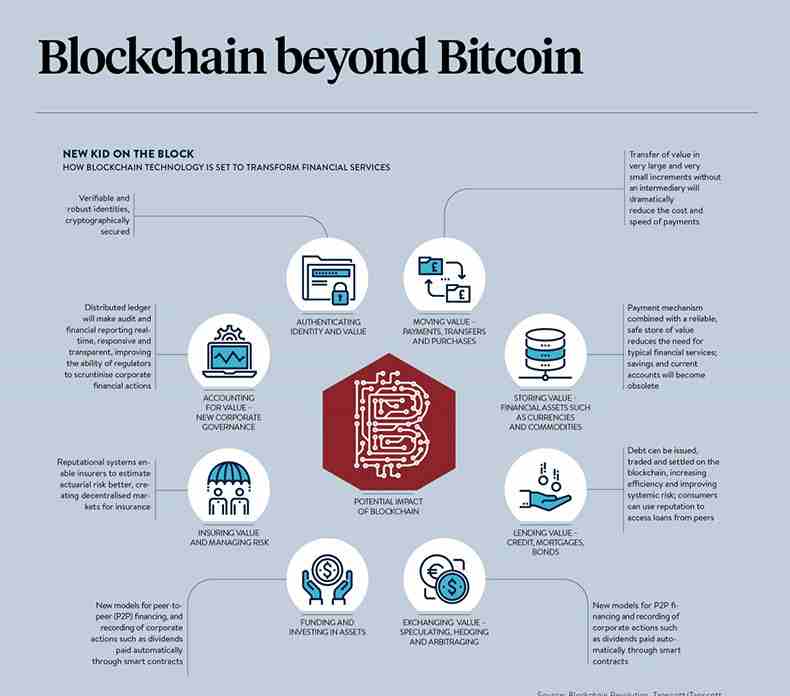

The Fundamentals of Blockchain Transaction Analysis

Unveiling Patterns in Crypto Asset Flows

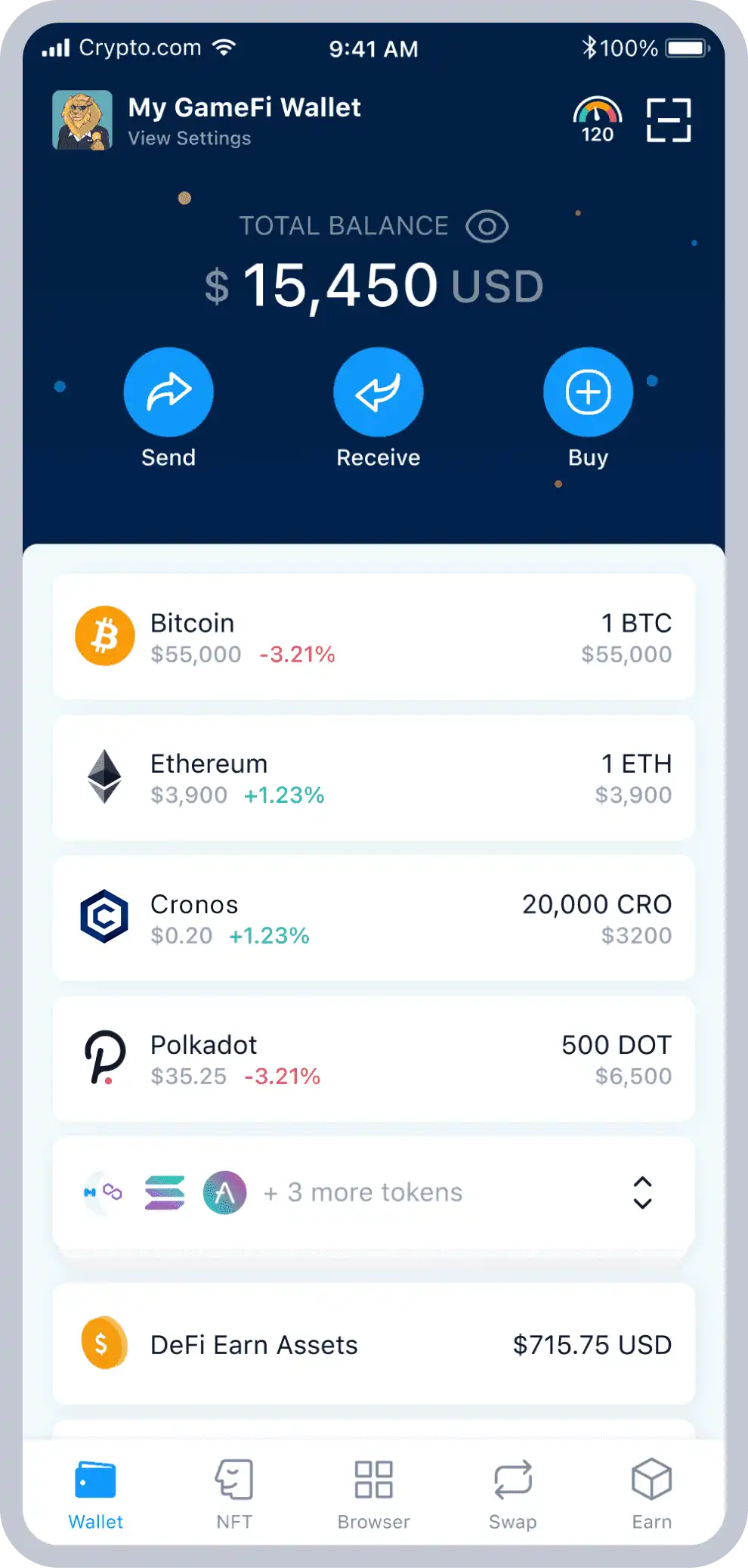

Ever wonder how money moves in crypto? Crypto asset flows show who sends and gets money. It’s like a map with lines that connect dots. These dots are wallets of users. Big spenders in crypto are called whales. Imagine watching their wallets. We see when they move a lot of money. This can make waves in the market. What whales do can tell us where the market might go.

My job means looking deep into blockchain transactions. Tools help me watch these. They tell me how money moves. I see patterns in the flow of Bitcoin and Ethereum. Each transaction is a clue. I follow these clues to tell a story. What story does a big transfer tell? Maybe a whale is ready to sell. Maybe they just like to move things around. This way, I try to guess what will happen next in the market.

Enhancing Security with Event Logging and Forensic Techniques

Security is key in crypto. We need to keep bad guys out. I use special ways to track what happens on the blockchain. This is called event logging. I see every move. I can tell if something’s wrong. I act like a detective with blockchain. I look hard at the details. If someone’s not playing fair, I can often find out. I use my skills to keep your crypto safe. This keeps the whole system strong and safe. My job helps everyone in the crypto world.

I dig into data to protect and teach. My work shows what’s safe and what’s not. I look at how smart contracts work. This checks if they do what they should. It helps us trust the system. The blockchain tells us a lot. We just need to know how to listen. I have learned to listen. I use all this info to help keep your crypto safe. It’s a big, important job that I take very seriously.

Advancements in Crypto Network Data Mining

Tracking Wallet Activity to Detect Market Trends

Let’s dive into the ocean of crypto data mining. Picture a big whale, a huge player in the crypto world. This whale swims through the digital sea, buying and selling crypto. Each move stirs the water, shaking up the market. That’s one whale wallet for you. By watching whale wallets, we learn where the market might head next.

Now you ask, what about regular folks who use crypto? Their moves matter too. When many folks act the same way, it’s a trend. By tracking wallet activity, we see these trends. We can spot when people flock to buy or when they’re rushing to sell. This gives us a peek into the future of the market.

Deploying Blockchain Explorer Tools for In-Depth Analytics

Think of blockchain explorer tools like super goggles. They let us see the crypto world in sharp detail. These tools help us dig into bitcoin data, make sense of ethereum transactions, and more. They’re like our detective kit for blockchain puzzles.

When we use these tools, we spot patterns. We see how crypto flows from one place to another. This shows us the health of the crypto world. Is money moving quick? Are folks paying more to make their transactions swift? Answers to these questions show us the pulse of the market.

With these explorer tools, we also keep an eye on smart contracts. We want to make sure they’re working right. By checking smart contracts, we safeguard the money in them. It’s like making sure the doors are locked in a bank.

Digging through ledger entries, we also catch bad players. Our goal is to keep the crypto space safe for everyone. We log every move on the chain, making sure nothing fishy slips by. By doing this, we help build trust in crypto. Everyone should feel their investment is secure.

In a nutshell, data mining gives us the map to treasure in the crypto seas. From tracking wallets to dissecting data blocks, every bit helps. It’s all about shining a light on the hidden corners of the blockchain. So, we can make wise choices and keep the digital currency ship sailing smooth.

Investigating Smart Contract Efficacy and Behavior

Conducting Comprehensive Smart Contract Audits

When we explore smart contracts, think of them as digital deals that live on the blockchain. They work on their own when set conditions are met. But how can we trust them? Here’s where audits come in. An audit is like a health check for a smart contract to find any flaws before they cause trouble.

Now, you may wonder, what exactly does a smart contract auditor look for? An auditor digs into the contract code to ensure it’s safe and does what it should. They check for bugs and weaknesses that could let someone hack the contract. They also look for ways the contract could run in an unexpected way.

An important thing an auditor checks is how a contract handles money. Does it let only the right people withdraw funds? They check if the contract locks funds forever by mistake. They also see if the contract can talk safely with other contracts it needs to.

By doing these checks, auditors help everyone using the blockchain. They make sure smart contracts are strong and work well. This helps people trust that their digital deals will go as planned.

Understanding Tokenomics through Contract Interactions

Tokenomics is the study of how cryptocurrencies work within the broader ecosystem. It looks at things like supply and demand, how transactions affect prices, and how new tokens can change the market.

When a smart contract is used, it can affect tokenomics in big ways. Here’s an example. A new game on the blockchain might let you earn tokens. But what happens if everyone earns too many tokens too fast? The value could drop, and the game might not be fun or fair.

That’s why tracking how contracts interact with tokens is key. Analysts watch these interactions to see trends and predict changes in the market.

By looking at data from blockchain transactions, we see how contracts play with the market. This can show us where the market might be going. And knowing this helps people make better choices when they buy, sell, or trade tokens.

In summary, it’s like being a detective. You gather clues from the blockchain to see how smart contracts and tokens work together. This helps keep the world of digital money safe and easy for everyone to understand.

Understanding the Dynamics of Decentralized Finance (DeFi)

Analyzing Liquidity Pool Mechanics and Stability

In DeFi, you may hear about “liquidity pools.” What’s that? They’re like shared money pots. People put in their cash, cryptocurrencies in this case, so there’s enough for others to swap different types. When there’s more money in the pool, it’s easier to make big trades. Think of a huge toy box; the fuller it is, the more likely you can find the toy you want, right? That’s what these pools do; they make sure you can trade without waiting.

Liquidity pools need to be stable too. Why? If they are not, swapping gets tough. Prices can swing wildly if a big trade empties it, sort of like if someone took all the toy cars, leaving none for others. We don’t want that in DeFi. So, experts track all this, making sure the pools stay full and fair.

Impact of Network Fees on DeFi Protocols and Participants

Now, let’s chat about network fees. That’s the cost to make a transaction happen. It’s kind of like paying for a ride to the store. In DeFi, those fees can change a lot. If the network is busy, think of rush hour traffic; it costs more. When it’s quiet, fees go down. Why should you care? Because these costs can affect when and how you use DeFi.

When fees are high, some people may not trade, as it’s too costly. This means less cash in our liquidity pools and makes things less stable. Those who track network fees help us pick the best times to use DeFi. It’s like knowing when to hit the store for less traffic and a smoother ride.

So we see how vital these two parts – pools and fees – are for DeFi to work well. They’re like gears in a big clock, helping everything run right. By understanding this, you stay smart about your trades in this exciting space.

We’ve traveled quite the journey together through the land of blockchain tech today. First, we looked at how subtle patterns in crypto help us understand asset flows. Remember, event logs and forensics can boost our security measures.

Then we dove into data mining within crypto networks, seeing how tracking wallet action sheds light on market shifts. Tools like blockchain explorers? They’re our best friends for deep analytics.

We didn’t stop there; we explored smart contracts, performing audits, and really getting the hang of tokenomics. Finally, we tackled the complex beast that is DeFi, grasping both the perks and challenges of liquidity pools and network fees.

Now, as we wrap up, keep in mind that the road ahead is vibrant and ever-shifting. Blockchain isn’t just tech—it’s a new language we’re all learning. And with every transaction, contract, and protocol we analyze, we’re not just watching history; we’re writing it. Keep your eyes keen, your mind sharp, and hey, let’s enjoy the ride in this vast crypto universe.

Q&A :

What is on-chain cryptocurrency analysis?

On-chain cryptocurrency analysis involves the examination of transaction data stored on a given blockchain. Experts look into metrics such as transaction volumes, active addresses, token distribution, and more to gauge the health and activity levels of a cryptocurrency. This analysis can provide insights into market sentiment and potential price movements.

How does on-chain analysis differ from traditional market analysis?

On-chain analysis is unique to cryptocurrencies, deriving data directly from the blockchain, which is a transparent ledger of all transactions that have occurred. This is different from traditional market analysis, which may rely on financial statements, economic indicators, or stock price charts. On-chain data provides a real-time, comprehensive view of digital asset flows and can indicate trends not immediately apparent through traditional methods.

What are some common metrics used in on-chain cryptocurrency analysis?

Common metrics in on-chain cryptocurrency analysis include the number of transactions, value of transactions, total fees paid, hash rate, the concentration of large holders (whales), and exchange inflows and outflows. Analysts may also track the number of active addresses, net network growth, and token issuance schedules. These metrics help create an overall picture of the blockchain’s current use and the assets’ potential future behavior.

Can on-chain analysis predict cryptocurrency price movements?

While on-chain analysis can provide valuable insights into investor behavior and the fundamental health of a blockchain network, predictions of specific price movements are challenging due to the volatility and complexity of cryptocurrency markets. Nonetheless, some patterns derived from on-chain data can indicate the potential for price increases or decreases, serving as one tool among many for informed investing decisions.

Where can individuals learn more about on-chain cryptocurrency analysis?

Those interested in learning more about on-chain cryptocurrency analysis can explore a variety of resources including online courses, tutorials, blogs, and books focused on blockchain technology and data analysis. Additionally, several platforms and analytical tools cater specifically to on-chain data, offering dashboards and metrics for users to explore and interpret independently.