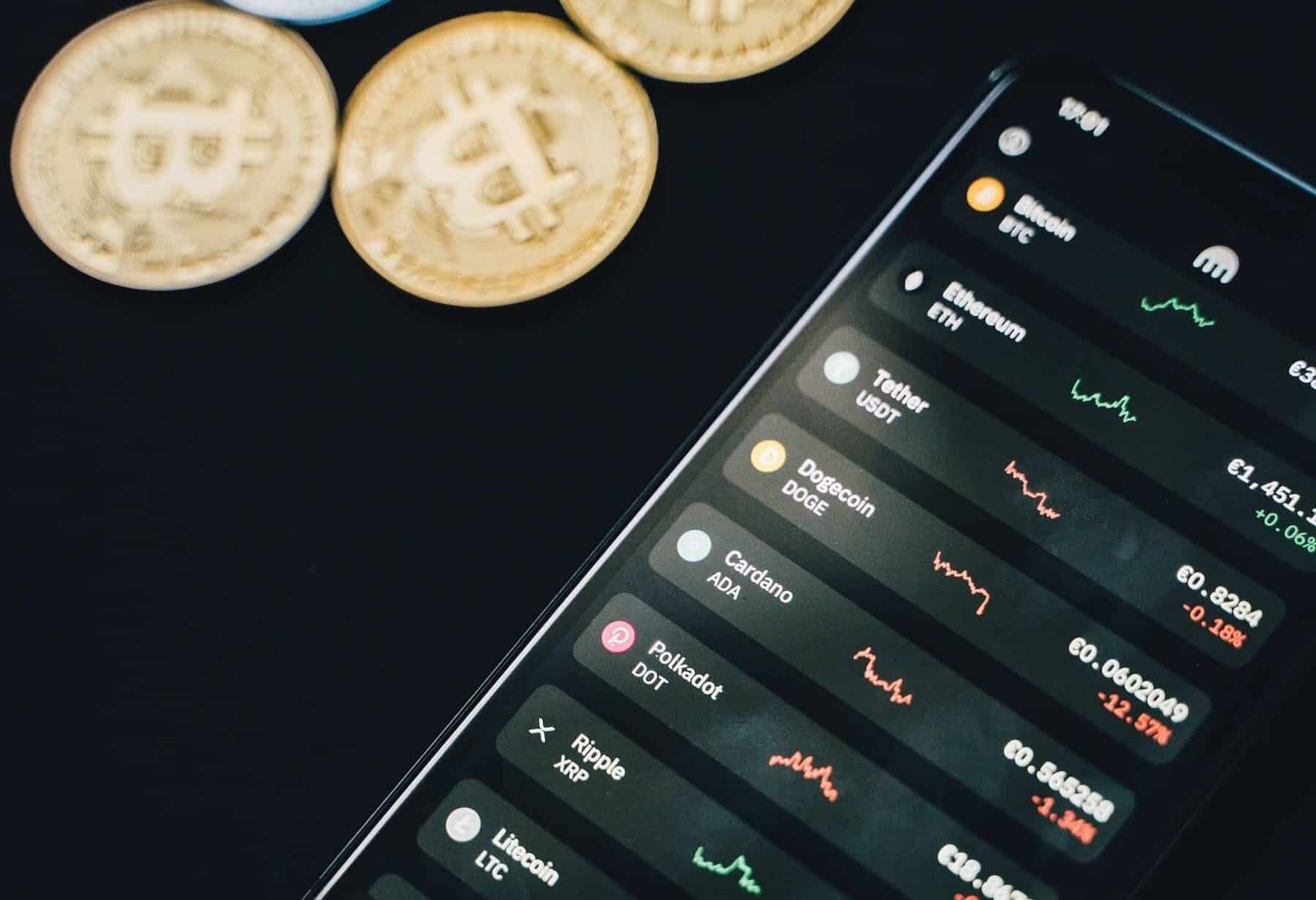

Most Secure Crypto Exchanges: It’s like a vault for your digital gold. With countless options to trade, the real deal is finding an exchange that doesn’t just meet your needs but also protects your assets like Fort Knox. You’ve heard the horror stories of hacks and lost coins; that’s why security features are non-negotiable. I get it, and I’ve got the lowdown on top-notch security so you can trade with peace of mind. Embrace the shield that guards your digital wealth. Let’s dive into the world where only the safes survive.

Identifying the Pinnacle of Crypto Exchange Security

Core Security Features to Evaluate

What makes an exchange safe? First, check for two-factor authentication (2FA). It’s a must. It stops others from getting into your account. Next, ask if they use cold storage. This means keeping crypto offline. It’s safer this way. Encryption is also key. It scrambles your data to protect it. Look for exchanges that follow the law too. They must meet rules set by governments.

These are only the basics. Good crypto marketplaces do more. They watch all trades to spot anything odd. They check users to stop bad acts like money laundering. Some even have protection funds. These can cover losses if something bad happens. Keeping user info private is also top of their list.

To be among the most secure cryptocurrency platforms, exchanges take many steps. They build strong systems to protect against hacks. They run tests to find any weak spots. And they keep up with new tech in security. A trustworthy exchange must work hard every day to keep your digital wealth safe.

Notable Security Breach Incidents and Learnings

Have there been big security failures in crypto? Yes, several times. Learning from them is vital. In the past, some top secure crypto trading platforms got attacked. Hackers took millions in crypto. But each hack taught us how to be safer.

After attacks, the best protected bitcoin exchanges improved their walls. They set up new rules and better systems. Exchanges learned to store most crypto in cold storage. They made signing in tougher, using things like 2FA. And they began to check on users a lot more.

These steps upped safety in crypto exchange systems. They made it harder for hackers to get through. Each lesson helped create high-security crypto marketplaces. Now, finding reliable crypto exchanges means looking for these tough security measures.

We can’t stop all attacks. But we can make it harder for them. We learn from each mistake. We use that knowledge to build stronger armor for digital funds. This is how we fight against those looking to steal our crypto. With new solutions, we strive to be hack-resistant. We earn the trust of users worldwide.

Advanced Protection Techniques in Cryptocurrency Exchanges

Multi-Layered Defense: Understanding Multi-Tier and Multi-Cluster Systems

What makes certain cryptocurrency exchange security stand out? It’s a robust multi-tier and multi-cluster system architecture. This setup creates layers of barriers against attacks. Think of it like a bank vault with many locked doors in a row. Hackers have to get through each door. They often can’t, so your digital money stays safe.

Multi-tier means different parts do separate tasks. For example, one part handles user logins. Another might take care of trades. This way, if hackers breach one part, they don’t get to them all. Multi-cluster systems spread out the data across many servers. Even if one gets hit, the exchange keeps running.

Safety in crypto exchange matters because hacks can happen. Look for exchanges that use these smart designs. They show that a platform doesn’t skimp on safety. It’s like a strong castle with tall walls and a deep moat.

The Role of Cold Storage and 2FA in Asset Protection

Cold storage crypto is where most secure cryptocurrency platforms keep funds offline. It’s like a safe hidden away from thieves. Even when cyber crooks strike an exchange, they can’t reach this offline stash.

Two-factor authentication (2FA) is another shield. It checks who you are in two ways before letting you in. Imagine a guard who asks for your ID and then your secret handshake. It keeps unwanted visitors out of your account.

Top secure crypto trading platforms mix cold storage and 2FA for better safety. They ensure that secure digital currency trading isn’t just a wish. It’s real. When both are in place, your crypto isn’t just secure. It’s super secure.

Using 2FA is easy. You might get a code on your phone when you log in. It’s a quick step for peace of mind. Remember, having two locks is better than one. Especially when it comes to your crypto cash.

In a world where digital dangers lurk, these techniques are vital. They are the strong armor in a knight’s defense. Best protected bitcoin exchanges use them. So should you. Look for these protection stars when you pick a place to trade.

These steps keep you and your crypto safe. In a sea of ever-growing cyber threats. It’s how reliable crypto exchanges earn your trust. They don’t just promise security; they practice it. Every. Single. Day.

And remember, no matter how high-tech an exchange gets, your habits matter too. Be smart. Choose strong passwords. Don’t share your secrets. Simple rules like these bolster the big security walls exchanges build for you. It’s teamwork at its best. With it, we make the high-security crypto marketplaces we all want and need.

Regulatory Framework and Compliance in Crypto Trading

Importance of KYC/AML Policies for User Safety

Know Your Customer (KYC) and Anti-Money Laundering (AML) are crucial for safety. These rules help stop bad acts like money wash and fraud. They make sure people are who they say they are. When you sign up for a top secure crypto trading platform, you give ID proof. This shows the platform you’re a real person with honest goals.

With KYC/AML, exchanges watch for strange money moves. They check to see if funds come from legal sources. This keeps everyone using the platform safe. Think about it like a safety check at the door. It might seem like extra steps, but it keeps out trouble.

These checks also back up the reputation of the most secure cryptocurrency platforms. A good name means new users and more trading. Safety in crypto exchange grows trust. More trust means more people want to use these platforms.

Navigating Through Exchange Insurance and User Privacy Protocols

Ever worry about what happens if a crypto exchange gets hit by thieves? That’s where insurance comes in handy. Secure digital currency trading sites often have insurance for this. This means if the worst happens, you may not lose all your coins.

User privacy is big too. Top secure crypto trading platforms protect your personal stuff. They use things like two-factor authentication (2FA) to double-check it’s really you. Encrypted crypto exchange systems keep your chats and data secret. Only the person meant to see your messages can.

These platforms also use advanced tools to spot hackers before they strike. They look for small signs that something’s not right. If they find something odd, they act fast to stop any theft.

In short, secure blockchain platforms focus on rules and tools to keep you safe. They use KYC/AML to keep bad guys out. They have insurance in case something bad happens. They use cool tech like 2FA and encryption to keep your info under wraps. Remember, when you’re picking a crypto spot to trade, these things matter a lot! They keep your digital wealth secure and let you trade without fear.

The Evolution of Secure Exchange Technologies

Encrypted Systems and Secure Blockchain Innovations

When it comes to keeping our digital wealth safe, we all want the most secure cryptocurrency platforms. It’s not just about finding the top place to trade. It’s about knowing our coins are protected by the best security out there. Let’s start with encrypted systems. These are like secret codes that only you and your exchange know. They scramble your data so hackers can’t make sense of it. This keeps your info safe and sound.

To find the most secure crypto trading platforms, look for exchanges using these secret codes. They should also have a strong blockchain. This is like a digital ledger that’s super hard to change once info gets added. The best blockchain innovations keep check of all trades. They make sure everything is clear and can’t be messed with.

Assessing the Trustworthiness of Decentralized Platforms

Now, let’s chat about a type called decentralized platforms. These cut out the middle man. It’s just you and another person trading directly. Sounds good but it’s tricky to know if they’re safe. You should check if they’ve passed tough checks and if they follow strict rules. This is called “regulatory compliance.” It makes sure the platform plays by the rules.

These platforms should also do checks on their users. This means looking into who is trading. It’s like the safety checks banks do. They’re known as KYC, which is short for “Know Your Customer” and AML for “Anti-Money Laundering”. These checks help keep everyone safe from bad actors.

On top of that, search for hack-resistant tech. Look at their history. Have they been hacked before? What did they learn? A good platform learns from the past to keep you safer. They also store a lot of coins offline in what’s called “cold storage.” It’s like a digital vault that is extra safe because it’s not on the internet.

And don’t forget about 2FA, or two-factor authentication. It’s like a double lock on your account. Before trading, always ask, “Does this exchange have 2FA?” This adds another step to logging in, which can keep thieves out.

To wrap it up, finding safe places to trade online can be tough. But if you know what to look for like secret codes, strong blockchains, and tough user checks, you can trade without the worry. Always pick the best protected bitcoin exchanges or other crypto platforms. This will help you sleep at night, knowing your digital dollars are defended.

In this post, we dug into the world of crypto exchange security. We looked at key features that keep your assets safe, and learned from past breaches. We explored how things like multi-tier systems, cold storage, and 2FA build a stronger defense. Regulations like KYC/AML are also huge for safety. Plus, we saw how tech evolves to protect your trades better.

My final take? Security in crypto isn’t just important; it’s vital. Every trader needs to know about it. Ensuring safety when you trade is a must. Stay smart, stay safe, and keep trading with confidence.

Q&A :

What are the top-rated most secure cryptocurrency exchanges?

When looking for the most secure cryptocurrency exchanges, user reviews and industry experts often highlight platforms with robust security measures, such as two-factor authentication (2FA), cold storage options for digital assets, and insurance policies. Top-rated exchanges typically include Binance, Coinbase, Kraken, and Gemini. They are known for their strict security protocols, regular audits, and compliance with relevant regulations, ensuring a secure trading environment for their users.

How do most secure crypto exchanges protect user funds?

Most secure crypto exchanges employ a variety of strategies to protect user funds. Key measures include the use of cold wallets to store a significant portion of digital assets offline, thus reducing the risk of online hacks. Implementing 2FA provides an additional layer of security for user accounts. SSL encryption helps safeguard data transmission, and regular security audits identify potential vulnerabilities. Furthermore, some exchanges offer insurance to cover potential losses from breaches.

Can secure crypto exchanges prevent all types of cyber threats?

While secure crypto exchanges invest heavily in security infrastructure and protocols to protect against a wide range of cyber threats, no system can guarantee absolute immunity. Advanced persistent threats (APTs) and new forms of malware are constantly developing. Exchanges continuously update their security measures in response, but users must also take personal precautions, like using strong passwords and avoiding phishing schemes, to minimize risk.

What measures should I take to enhance security on crypto exchanges?

As a user, you can take several measures to enhance your security on crypto exchanges. Always activate 2FA on your account and use strong, unique passwords. Regularly update your software to patch any security flaws. Be wary of phishing attempts by verifying the authenticity of emails and websites. Consider using hardware wallets to store your cryptocurrencies offline, and only keep the necessary amount of currency on the exchange for trading.

Is it worth paying higher fees for more secure crypto exchanges?

While no one likes to pay high fees, the cost can often reflect the quality of security measures a crypto exchange has in place. Paying slightly higher fees can be considered an investment in the safety of your assets. Secure exchanges maintain robust infrastructures and may offer insurance, which all contribute to operational costs passed on to users as fees. Assess the security features versus the fees to determine if the cost is justified for your peace of mind and the safety of your investments.