Diving into the world of digital currency can feel like uncharted waters. Trust me, I’ve been there, and I want to guide you through the crucial steps of how to trade cryptocurrency with ease. Getting it right from the start can save you time, money, and a lot of headache. In this post, you’ll learn the no-nonsense essentials: from nailing down the basics, crafting a solid trading plan, using the right tools, to keeping your coins safe. Ready to turn your crypto curiosity into savvy trading? Let’s get started!

Understanding the Basics of Cryptocurrency Trading

Grasping Cryptocurrency Trading Basics

Let’s dive into the heart of trading in the wild world of cryptocurrency. Imagine a place where you can make profits by buying and selling digital money. It sounds thrilling, right? Before you start, get the lowdown on the basics. Learning how to trade involves knowing when to buy and sell crypto. It can lead to making cash, but careful strategies are key.

When you trade, you’re guessing if a crypto’s price will go up or down. You make moves based on what you think will happen. Fundamental analysis helps here. It looks at big picture stuff like news or a coin’s purpose. Technical analysis is cool too. It means checking out charts and patterns. Think of it like a weather forecast, but for crypto prices.

To win at this game, you need to get good at crypto market analysis. This skill tells you when to jump in or step out, keeping your cash safe. It’s about staying sharp and savvy in an ever-changing market. Now, let’s talk trading pairs. They are like dance partners in crypto – one leads, the other follows. For instance, BTC/USD pairs Bitcoin with the US dollar. Simple enough, right?

Selecting a Digital Currency Exchange

Not all places where you trade are the same. Picking the right digital currency exchange is like choosing a good pair of sneakers. You want it to fit well and feel right. Your perfect trading platform should line up with your needs. They all have ways to buy and sell, but some have more tools or lower fees. Some are great for experts, and others are better for newcomers.

Security is a deal-breaker. Your exchange must keep your cash and info safe. Look for ones with a solid rep for securing cryptocurrency transactions. This can help you sleep at night, knowing your investment is safe.

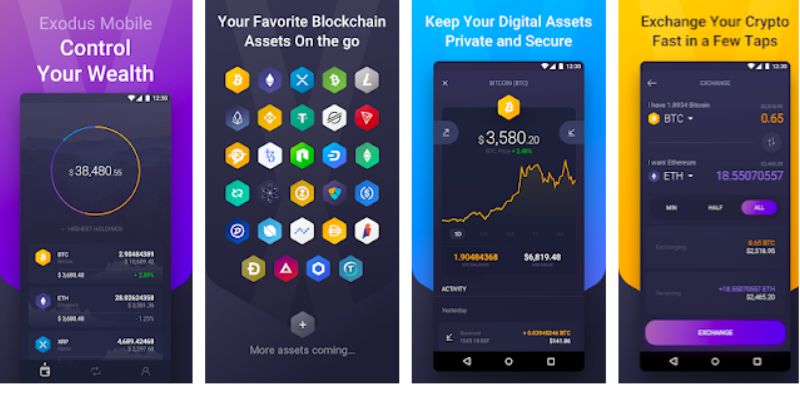

Setting up a crypto wallet is also important. Think of it as your superhero utility belt for holding crypto. It stores your coins so you can use them easily. Make sure to pick one that’s as strong as a fortress. It adds another layer of defense against the bad guys online.

By now, you might think trading is all rainbows and sunshine. But hold on – managing trading risks in crypto is serious business. Learn to protect your assets. One misstep could mean losing a big chunk of change. Always look before you leap, and don’t bet the farm on a hunch.

Start this adventure with these basics fresh in your mind. They’ll help you move with confidence as you step into the crypto ring. It’s not just brainy stuff, it’s about being smart and safe while aiming for the win. Remember, the goal is to make profits, not just take part.

Ready to begin? Find a comfy spot, pop open your laptop, and let’s get trading. There’s a whole world of digital currency waiting for you. And hey, who knows? You might just be the next crypto whiz kid on the block.

Developing a Trading Strategy

Applying Fundamental and Technical Analysis

To win at trading crypto, you need a good plan. Like a coach before a big game, study your plays. This means learning about fundamental and technical analysis. Think of these as your map and compass in the trading world.

Fundamental analysis helps you get the big picture. It’s like looking at how healthy a tree is before picking its fruits. You ask, “Is this coin worth it?” Look at the project behind the coin, its team, and how it stands out. Are people talking about it? What about its tech and new updates?

Technical analysis is different. It’s all about charts and trends. Imagine you’re tracking animal prints in the woods. This shows you where prices may go next. You check past prices and volume. Patterns in these can hint at what happens next.

Use both of these to scout out your trades. With them, you can decide when to buy and sell crypto. This mix gives you a strong tool to face the ups and downs of the market.

Exploring Different Crypto Trading Strategies

There’s more than one way to make profits with crypto. You can go fast or slow. It’s like choosing between sprinting or a long jog. Here are some popular strategies:

Day trading is the sprint. It means buying and selling on the same day. You watch the markets all day to catch quick price moves. It can be risky, so keep your eyes open!

Swing trading takes a bit more time. You hold on to your coins for days or weeks. Like a hawk in the sky, you wait for the right moment to swoop in. You’re after bigger price shifts.

Then there’s arbitrage. This is like finding a shortcut on a hike. You buy crypto cheap on one exchange and sell it for more on another. It’s about spotting price differences.

Each tactic fits different people. It’s like picking the right shoes for an activity. Know your style, your time, and what you can handle.

Good tools also help manage trading risks crypto traders face. For safety, think of setting up a crypto wallet as putting on your seat belt before driving. Have stop-loss orders in place. It’s like having a backup parachute when skydiving.

Now, let’s talk platforms. There are many trading platforms for crypto. Each one has its own twist. Find one that suits your needs. Some have low fees, others offer rare coins. And remember, different tools can help. Trading bots and signals are like bringing a friend who’s great with maps on a hike.

Lastly, always be prepared. The weather changes fast up in the crypto mountains. Know the crypto market analysis like a weather report. Be ready if a storm hits. Keep learning and stay on top of news and trends to stay safe!

Tools and Analysis for Informed Trading Decisions

Utilizing Crypto Trading Tools and Signals

To make smart moves in trading, you need the right tools. Think of these tools as your secret weapons. They help you spot chances to buy or sell before others do. Let’s chat about crypto trading platforms first. These platforms are where all the action happens. You want one that’s easy to use and understand. It needs to have all the details about different crypto coins. This way, you can make quick choices based on fresh info.

Now, onto trading signals. Signals are like tips that tell you when it’s a good time to trade. They can come from trading bots or experts who know a lot about the crypto market. But be careful! Always check who’s giving the signal and if they’re usually right.

When you get a handle on tools and signals, trading feels less like a wild guess. It’s more like having a map where X marks the spot for treasure.

Interpretation of Crypto Charts and Market Analysis

Ever looked at crypto charts and felt lost? I get it. But once you decode them, they’re gold mines for making profits. Charts show you what’s been happening with a coin’s price. They also hint at what might happen next. This is where you use two types of spy skills. The first is fundamental analysis. This means looking at big events or news that affect the whole market. It’s like understanding what makes a storm form before it rains.

The second skill is technical analysis. It’s all about patterns. If you look close enough, the price moves in ways that repeat. Spot these patterns, and you can guess what comes next. But don’t just look once and think you’ve got it. Always keep an eye out. The more you practice, the better you get.

Understand these charts and analyses, and you’re set. You’ll see chances to make money others might miss. And remember, in crypto trading, being spot-on is key. Use good tools, check those signals, and learn to read charts like a pro. This can all add up to smart trades and cool profits.

Make sure to use these insights with care, though. Combined with a solid plan and risk control, they can help you stay on the winning side of trading.

Risk Management and Secure Trading Practices

Setting Up a Crypto Wallet and Managing Risks

Before buying or selling crypto, get a crypto wallet. It keeps your coins safe. We call this wallet security. A good wallet protects your money just like a safe. Use strong passwords and keep them secret. Learn about crypto wallets. They come in different types: some live online, and others are devices or apps. Each has its own use and risk level.

Smart traders manage risks. They don’t throw all their money into one crypto coin. They spread it out. This is called diversifying. It reduces the risk of losing everything. Set limits on how much you might lose. Use tools like stop-loss orders. They sell your crypto if the price drops too much. This limits your loss. It’s like a safety net. Think ahead about what risks you can accept. Don’t risk more than you can afford to lose.

Compliance with Cryptocurrency Regulations and Tax Implications

Trading crypto means you must follow the rules. These rules can change and differ by place. Some rules talk about how much you can trade. They also say who you can trade with. They’re there to stop money from being used the wrong way. Know these regulations well. It keeps you safe and out of trouble. Speaking of rules, don’t forget about taxes. Trading crypto has tax costs. Keep records of your trades. Figure out your profits and losses. It helps with tax time. If you’re not sure, ask a tax pro. They know this stuff well.

Don’t get caught by surprise with fees. Each trade can have a fee. Fees can be small, but they add up. Know the fees before you trade. On some platforms, you can trade with borrowed money. This is called margin trading. It’s risky. You can lose more than you have. Use it with care. Same with leverage. It can boost your trade size. It’s like using a lever to lift something heavy. But if prices move against you, watch out. You can lose fast.

Don’t jump into trading without a plan. Good traders know why they trade. They pick a strategy that fits their goals. Crypto trading is not a game. It’s real money on the line. Take it seriously. Be smart about your trades. If you lose, learn from it. If you win, understand why. Each trade teaches you something.

Remember, trading is not just about making profits. It’s about keeping your money safe, too. Build your skills. Understand the market. Use tools and analysis to guide you. With patience and practice, you can trade with confidence.

In this post, we learned how crypto trading works and how to pick a digital currency exchange. We then looked at building a trading strategy using analysis and different methods. Next, we talked about tools and signals for trading, as well as reading charts and market analysis. Lastly, we covered how to manage risks with a crypto wallet and follow rules and taxes.

As an expert, I tell you, smart trading takes practice. Keep these tips in mind, and remember to start small, be patient, and stick to your strategy. Happy and safe trading!

Q&A :

What steps should a beginner take to start trading cryptocurrency?

To embark on cryptocurrency trading, a beginner should first educate themselves on the basics of blockchain and how various cryptocurrencies function. It’s important to choose a reputable cryptocurrency exchange platform and create an account, ensuring the security of personal information and funds with strong passwords and two-factor authentication. Before investing, one must research the market, understand trading pairs, and consider starting small to gain experience. It’s also advisable to stay updated with cryptocurrency news, trends, and regulatory changes that could impact the market.

How can I ensure safe and secure cryptocurrency trading?

Ensuring safe and secure cryptocurrency trading involves choosing a well-established and secure exchange which offers strong security measures such as two-factor authentication and cold storage of assets. Traders should also utilize personal security practices, such as using a hardware wallet for storing significant amounts of cryptocurrencies, being wary of phishing scams, and never sharing private keys. Keeping software up to date, using secure and unique passwords, and regularly checking account activity can also increase security.

What are the key indicators to consider when trading cryptocurrency?

When trading cryptocurrency, key indicators to consider include price trends, volume, market capitalization, and historical data. Technical analysis tools like moving averages, Relative Strength Index (RSI), and Bollinger Bands can provide insights into market momentum and potential price direction. Traders often watch for patterns in candlestick charts and use indicators to predict price movement. It’s also important to monitor news and developments that could impact the market sentiment and subsequently, cryptocurrency prices.

Can you make money by trading cryptocurrency and how?

Yes, it is possible to make money by trading cryptocurrency by buying low and selling high, or through short-selling, where traders bet on the price going down. One can also engage in day trading, swing trading, or arbitrage opportunities within different exchanges. However, it’s essential to remember that cryptocurrency markets are highly volatile and carry risks. Educated trading decisions, a well-thought-out strategy, risk management, and not investing more than one can afford to lose are crucial.

What are the common risks associated with cryptocurrency trading?

The common risks associated with cryptocurrency trading include market volatility, which can lead to substantial price swings, and the potential loss of investment. Other risks consist of regulatory changes that can impact the market, cybersecurity threats, and the possibility of fraud or scams. Liquidity risk is also a concern, as some cryptocurrencies may not be easily converted to fiat currency or other cryptocurrencies without affecting the market price. Traders should be well-informed and cautious when entering the cryptocurrency market.