Discover the art of how to make money with cryptocurrency – that’s what we’re diving into today. Picture this: digital coins stacking up in your wallet, growing not by luck, but by smart moves you’ve learned and executed. We’re not just talking pennies from heaven; we’re talking real wealth-building strategies in the booming world of crypto. It’s about knowing when to hold, trade, stake, or mine. In the upcoming sections, I’m spilling the secrets that can help you master cryptocurrency investment strategies for maximum profit. Get ready to build a robust crypto portfolio that stands the test of market cycles. As an expert who has ridden the highs and lows, my aim is to lift the veil on the tactics that can secure your financial future in this exhilarating crypto landscape. Let’s get your journey started towards grabbing a slice of the cryptocurrency treasure!

Mastering Cryptocurrency Investment Strategies for Maximum Profit

Building a Successful Crypto Portfolio

To build a strong crypto portfolio, start small. Pick a few coins you know well. Study them hard. Look at how they’ve done in the past. Are they solid? Do they have good teams? Think about Bitcoin and Ethereum. They are like the big kids on the block. But don’t stop there.

Next, explore altcoins. Altcoins are like the new kids in school. They could be big one day. Find ones with fresh ideas. Some may let you help in their system and pay you – like voting on decisions. This is part of what we call “staking coins for income.” It means you lock up some coins and get rewards. It’s like earning interest in a bank.

But remember to spread your bets. Don’t put all your cash in one place. This is called “diversify.” It’s like not eating only candy. You need veggies, too, to stay healthy. So you need different coins to make money, but not lose it all if one coin drops.

Understanding Crypto Market Cycles

“Crypto market cycles” are periods when prices move up and down. You can learn their rhythm. It’s like knowing the best time to jump rope. Jump in when it swings low; jump out when it swings high.

Pay attention to signs. Do people talk a lot about crypto? Maybe it’s getting hot. Prices might go up. But be careful. If everyone says buy, maybe it’s time to sell. That’s because when everyone’s in, prices may soon fall.

Use this trick. Buy when there’s fear. Sell when there’s greed. Keep a close eye on news and trends. Are more stores accepting Bitcoin? Good sign. Is a country saying “No” to crypto? Watch out. These things move prices.

Now, think about long-term too. Some folks buy and hold. They bet that in years to come, prices will be much higher. You don’t make quick money, but it’s less work.

To sum it up: know your coins, spread your risk, and dance with the market’s ups and downs. And always be ready. Crypto moves quick! You must, too. Stay sharp, friends. Let’s make some cash!

Diversifying Your Income with Staking, Mining, and DeFi

Staking Coins for Regular Income

Want to earn crypto without much work? Look into staking. It’s like getting paid to save money. You lock up coins in your wallet. In return, you get more coins. It’s that simple. By helping to keep a blockchain network secure, you earn rewards. This is possible with cryptocurrencies that use a proof-of-stake model. To start, choose a coin you believe in. Next, find out how to stake it—usually through your wallet or a staking pool. And there’s your regular income.

But remember, staking rewards can vary. It pays to research and pick coins with a good mix of stability and reward potential. Some coins even let you help make big decisions in their network. That’s more power for you, plus earnings. Many investors like staking for its ease and potential for steady returns. It’s a win-win if you find the right coins.

Yield Farming in DeFi and the Power of Liquidity Pools

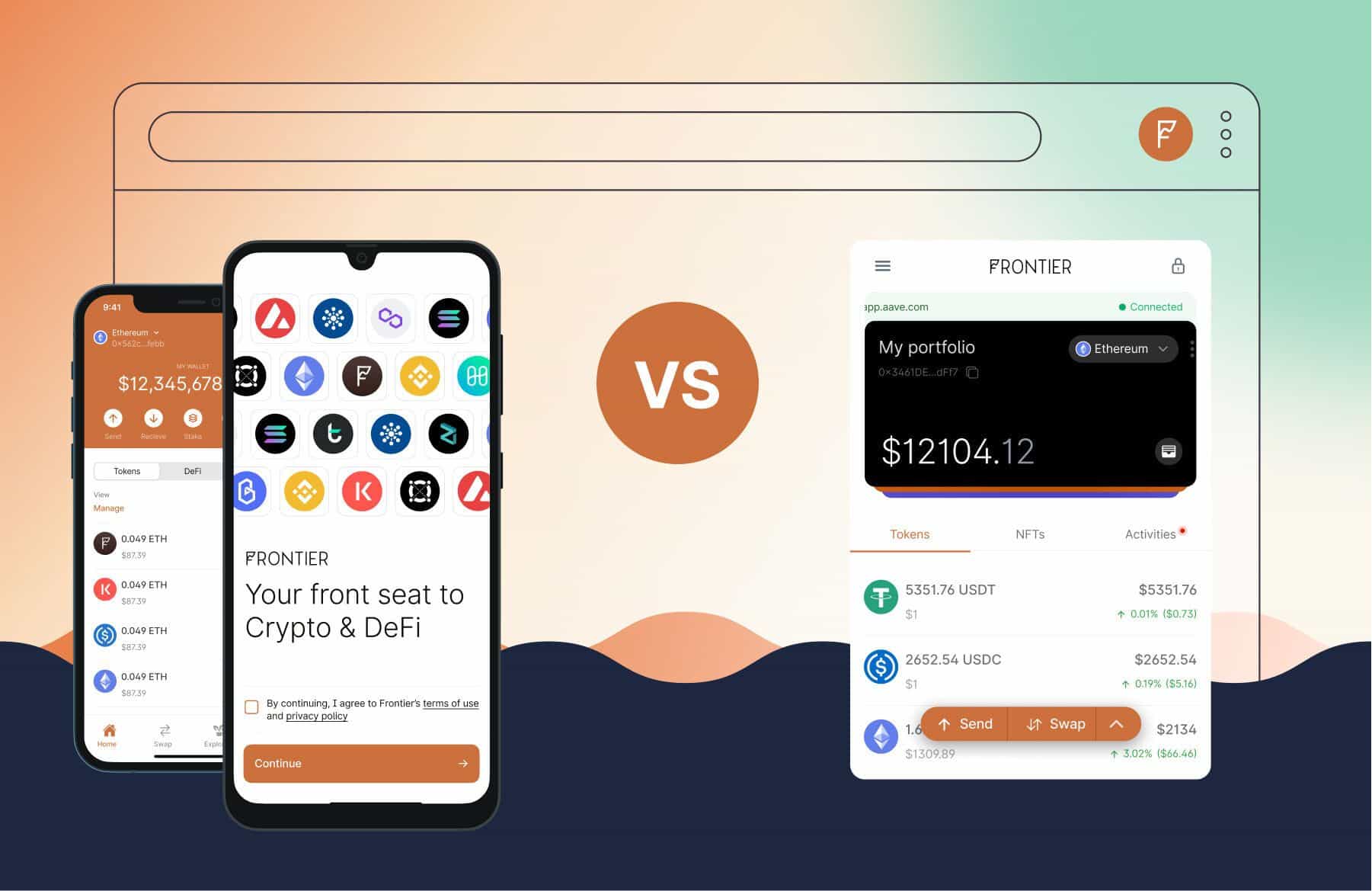

Now, let’s talk about making money with DeFi. Have you heard about yield farming and liquidity pools? They’re another way to earn passive income with crypto. It’s like being the bank in the game of Monopoly. You add your coins to a pool. Others borrow them. You get interest. Simple as that.

DeFi stands for decentralized finance. It lets you do bank-like things without a real bank. With yield farming, you earn more coins by lending your crypto. But, it’s not without risks. The value can swing a lot. So pick where to farm wisely. Look for pools with a good amount of money in them, known as liquidity. And check the trust factor of the platforms you use.

Liquidity pools are the heart of yield farming. They need lots of funds to work. That’s where you come in. As you and others add to the pool, it grows stronger. The rewards often come from fees paid by those who borrow or trade in the pool. Some pools even give out a new token as a special thank you. But make sure to check how much you could earn before jumping in.

In both staking and yield farming, there’s a lot to consider. Which coin or platform to choose can be tough. It’s key to weigh up the rewards against the risks. And don’t forget to look at how long you need to keep your coins locked up. Sometimes the longer you stake, the more you make. But you won’t be able to use your coins during that time. So plan your money to make sure that works for you.

These passive income methods both bank on time and patience. It’s not about quick wins. More about slow and steady growth. If that sounds good, they could add a nice boost to your crypto earnings. And you keep learning. As crypto keeps growing, so do the ways to make money from it. Keep your eyes open for new chances, and you could see your digital wallet grow.

Riding the Volatility Wave: Trading and Arbitrage Techniques

Technical Analysis in Crypto Trading

Crypto trading can be a wild ride. Prices jump up and down like kids on a trampoline. But if you learn to read the charts, you can spot trends and make smart moves. That’s called technical analysis. You look at past price actions and try to guess where they’ll go next.

Let’s say you want to trade Bitcoin. You’ll watch how its price has changed over time. You’ll see patterns. Maybe it goes up every time it hits a certain low point. You use this info to decide when to buy or sell.

Technical analysis isn’t just guesswork. It uses math and charts. Moving averages, for example, help you see the trend among all the ups and downs. If the price regularly touches a moving average line and then bounces back, that could be your buy signal.

But remember, crypto can be tricky. Even with technical analysis, there’s no sure thing. So always start small and never risk more than you can afford to lose.

Capitalizing on Arbitrage Opportunities in Crypto

Have you ever seen the same thing cost different amounts at different stores? That’s like arbitrage in crypto. It’s buying a coin cheap on one exchange and selling it for more on another.

Here’s how it works. One exchange might have Bitcoin for $30,000. Another might be selling at $30,500. You buy from the cheaper place and quickly sell at the higher price. That $500 difference is your profit. This happens because exchanges aren’t perfectly in sync.

But you’ve got to be fast. Prices change in seconds. You need a good plan and maybe even automated tools to help you move quickly.

One key thing is to know your exchanges. Some have lower fees. Others move faster. Pick the right ones for your arbitrage.

You also need to watch out for rules and limits. Some places only let you take out a bit of money at a time. Make sure you won’t get stuck with coins you can’t sell. And remember, every trade can bring tax stuff to deal with.

Arbitrage can be a way to make money with a little less risk. You’re not betting on prices going up or down. You’re just spotting the price gaps and acting on them.

So that’s how you can ride the wild waves of crypto by trading and looking for arbitrage chances. Just keep a cool head and do your homework. And never forget, all trading has risks, so play it safe to keep those profits rolling in.

Long-Term Wealth Generation and Risk Management in Crypto

Crafting a Long-Term Crypto Holding Strategy

You want to make money with crypto, right? Think long game. It’s not just about quick wins. A smart long-term strategy can turn your crypto stash into a mighty oak of wealth. So, what’s the trick? First, know what you buy. Do your homework. It’s like picking players for a winning team. Look for solid coins with strong teams and big goals.

Here’s a solid tip: split your cash. Put some into big-name coins like Bitcoin or Ethereum. They’ve been around the block. They’re like the wise elders of the crypto world. Then take a chance on some younger, snappy altcoins. But play it smart. No putting all your eggs in one basket. You could get burned if that one coin tanks.

Another cool move? Initial coin offerings, or ICOs. It’s like getting in on the ground floor. But caution is key. Not all that glitters is gold. Some ICOs are solid gold, but others are just shiny on the outside. Invest in ICOs with clear plans and real-world use. That’s how you spot the winners.

Now, let’s chat about holding on for that gold. Staking coins can hook you up with that sweet passive income. Lock up your coins, earn rewards. Easy-peasy. But which coins? Go for the ones known for staking. Research their returns and how they keep your coins safe.

Cryptocurrency Volatility Management and Mitigating Investment Risks

Let’s face it; crypto can be a wild ride. Prices zoom up and down like a six-year-old on a sugar rush. This is where you smarten up about volatility. You can’t dodge it, but you can prep for it. How? Spread out the risk. It’s like not putting all your ice cream scoops in one cone. If it topples, there goes your treat.

Another smart move is yield farming in DeFi. Think of it like planting seeds in different fields. Some crops may fail, but others will thrive. DeFi’s like the new frontier for farmers. But remember, with high returns come high risks. Only play with the cash you can afford to wave goodbye.

Be a hawk with market analysis. Watch trends like a nosy neighbor. When does Bitcoin usually dip? What’s buzzing in Ethereum smart contracts? These tidbits can help you decide when to hold or fold.

Crypto lending and borrowing can be cozy for your wallet too. You lend out your coins, get interest back. It’s like your money’s working a side hustle without you lifting a finger.

Remember, we’re building wealth brick by brick. And in crypto land, it pays to be patient and shrewd. Don’t rush. Good things take time, and that’s how you build a fortress from your crypto coins. Keep your eyes on the prize, play safe, and watch your crypto garden grow.

In this post, we tackled how to make more money through smart crypto moves. First, I showed you how to put together a killer crypto portfolio and how market cycles work. This is your base. Then, we talked about staking, mining, and diving into DeFi. These strategies are top-notch for earning more without selling your coins.

Next, we hit trading hard. Crypto is like a wild wave – you got to ride it right. I went deep into trading smarts with technical analysis and using price differences to your advantage.

Last up, it’s all about playing the long game. How do you hold on to your coins and not lose your shirt when prices go nuts? I laid out a clear plan for that.

To wrap it up, remember, crypto isn’t just luck. It’s about smart plans and sticking to them. Use what you’ve learned here and you’re well on your way to making serious coin. Stay sharp and manage those risks – your future self will thank you.

Q&A :

Can you really make money through cryptocurrency trading?

Absolutely, individuals can make money through cryptocurrency trading. Much like stock trading, cryptocurrency trading involves buying at a lower price and selling at a higher price to make a profit. However, the cryptocurrency market can be very volatile, requiring both education and a keen sense of market timing to be successful.

What are the common methods to earn money with cryptocurrency?

There are several methods to earn money with cryptocurrency, including:

- Trading: Buying and selling coins on various cryptocurrency exchanges.

- Investing: Holding onto coins for a long period in the hope that they will appreciate in value.

- Mining: Using computer power to validate transactions on the blockchain and earning coins as a reward.

- Staking: Participating in a network’s proof-of-stake consensus mechanism to validate transactions and earn rewards.

- Yield Farming and Liquidity Mining: Providing liquidity to decentralized finance (DeFi) protocols and earning interest or tokens in return.

What risks should I consider when making money with cryptocurrency?

The risks involved in making money with cryptocurrency include:

- Market Volatility: Cryptocurrency prices can be extremely volatile, leading to the potential of significant losses.

- Regulatory Changes: Changes in regulations can affect the value of cryptocurrencies or the ability to trade them.

- Security Risks: Wallets and exchanges may be vulnerable to hacking and other security breaches.

- Liquidity Risk: Some cryptocurrencies may not be easily convertible to cash or may have thin trading volumes, making it difficult to sell large quantities without affecting the market price.

How much initial investment is needed to start making money with cryptocurrency?

The initial investment required can vary widely. You can start with as little as you’re willing to risk, sometimes even a few dollars, particularly on platforms that offer fractional trading. However, more significant funds may provide more opportunities and flexibility. It’s critical to never invest more than you can afford to lose.

How do I start making money with cryptocurrency if I’m a beginner?

If you’re a beginner looking to make money with cryptocurrency, consider the following steps:

- Educate Yourself: Learn the basics of how cryptocurrency and blockchain technology work.

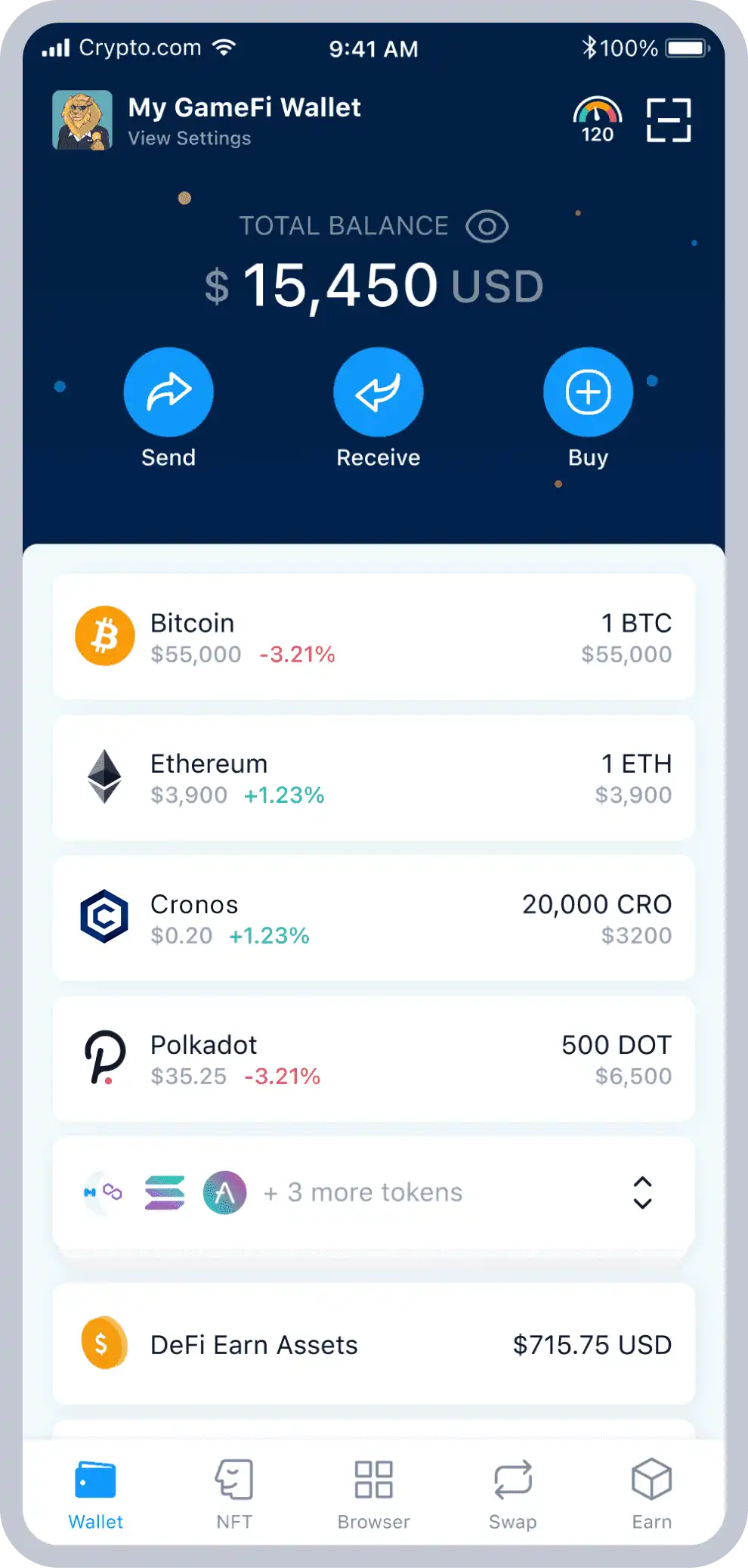

- Choose a Secure Wallet: Find a reliable and secure digital wallet to store your cryptocurrency.

- Research and Select Your Cryptocurrency: Research different cryptocurrencies and their use cases to select the ones you believe in for investment.

- Start Small: Begin with a small investment to get used to the volatility and mechanics of the market.

- Use Established Exchanges: Start trading on reputable and user-friendly cryptocurrency exchanges.

- Stay Updated: Continuously monitor market trends, news, and analysis to make informed decisions.