Ready to unlock the power of distributed ledger technology in crypto? You’ve heard the buzz about blockchain, but do you fully grasp how it’s flipping the script on digital transactions? We’re digging deep, going beyond the basics. This isn’t your average tech talk. We strip down the complexities and serve them up in bite-sized pieces. Find out what makes blockchain stand out and see what other DLTs are on the board. You’ll learn how these tech marvels build trust and boost security. Stick with me, and you’ll see how DLT reshapes finance, making everything from paying bills to global trading smoother. Get ready—this is where the future starts.

Understanding Blockchain and Distributed Ledger Technology

Explaining the Basics of Blockchain Technology

Let’s dive into blockchain, a type of DLT. It’s a chain of blocks, not real chains and blocks, but digital ones! Each block holds data, like a digital ledger book. They link together, one after the other, making a chain. Think of it like a train made up of data-carrying cars, chugging along a digital track.

When you use blockchain for crypto, it’s like writing in a book that the whole world can see. You jot down info, and boom—it’s there forever. No erasing, no ripping out pages. This makes it super safe because no one can mess with the writing without everyone else knowing.

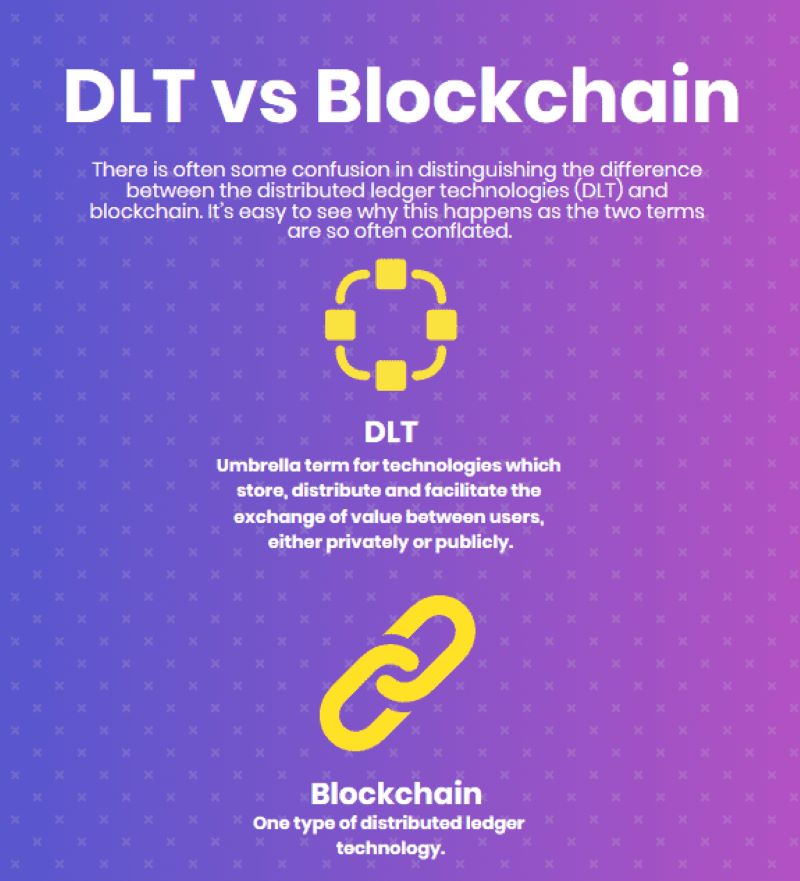

Differences Between Blockchain and Other Distributed Ledgers

So, what’s the difference between blockchain and other DLTs? A blockchain is a kind of DLT, but not all DLTs are blockchains. Sort of like squares and rectangles—you know, all squares are rectangles, but not all rectangles are squares.

Blockchains stack info into blocks then link them up. Other DLTs don’t always stack up stuff in blocks. They might use other shapes or forms but still share info across many computers. This helps so no single computer is the boss of the data, making things fair.

There are different types of these ledgers. For crypto, this means we can pick the best one for the job! Some might be faster or more private. Others might want everyone to see what’s going on. It’s like choosing the best player for your soccer team.

With DLT and smart contracts, we can make deals that are set in digital stone. They are like “If this happens, then that happens” rules written in code. They help people trust each other in the crypto world without someone in the middle, like a bank.

DLT security in crypto helps keep your money safe. It’s like a super-safe piggy bank that all your friends watch over. They all have keys, and they all need to say “Yes, open it!” for anyone to take a coin out.

The role of DLT in digital currencies is like a big ledger that shows who owns what. It makes sure that when you say you have one digital coin, you really do have it. No one can say they have the same coin twice.

In conclusion, blockchain and DLTs are like super smart digital ledgers for the digital age. They help us keep track of who owns what, make sure rules are followed, and keep bad guys out. It’s all about making digital deals safer, faster, and without needing a middle person!

The Inner Workings and Security of DLT

How Distributed Ledgers Achieve Security and Trust

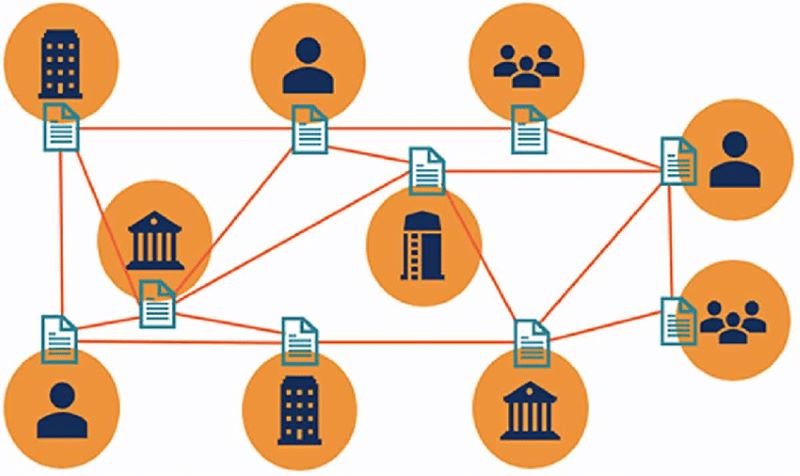

Imagine a digital book where all crypto deals get written down. Now, think if this book lived on many computers at once. Everyone could see it, but no one could change past pages without others knowing. That’s how distributed ledgers work, holding tight to security and trust.

A big question is, how do distributed ledgers work? They store data across a network. When one part updates, the rest do too. This link-up means they all match. It’s like a game where everyone must agree on the score to move on, no cheats or fibs. That’s why folks trust it so much. They use fancy math called hash functions to keep it bolt-tight.

The Role of Consensus Algorithms in DLT

Now let’s gab about something called consensus algorithms. They are rules that help all parts of a ledger agree. It’s like when kids play a game; they need rules to know who wins. These rules decide who gets to add to the ledger.

There are a few types, like proof of work or proof of stake. They each have their own way to keep things fair and secure. Proof of work makes computers solve tough puzzles. Proof of stake picks leaders based on how much coin they hold.

What’s cool is these rules make sure no one can fake a deal. Every part of the ledger has to say, “Yep, that’s right!” for it to go through. That’s one reason why crypto stays safe to trade and use.

Now, why does all this jazz matter? Well, we live in a world where we like things quick and trusty, right? Distributed ledgers give us that in spades. They let us trade cash, houses, even votes, without worry of a backstab. They’re the guts that make crypto zip and zoom safely around the world. And that’s a big win for all of us, no matter where we sling our hats.

Advancing Finance: DLT’s Role in Cryptocurrency and Beyond

Use Cases of DLT in Financial Services

Have you ever wondered how banks keep our money safe? Or how we send money across the world? Distributed ledger technology, or DLT, is a big part of the answer. It’s like a magic book that many can write in, but no one can erase or change what was written. This magic book is open to see, so everyone knows the story is true.

DLT has many uses, especially in finance. Banks use DLT to move money quickly and safely. They use smart contracts too. Smart contracts are like deals that happen all by themselves when certain things get done. This means things can happen fast, without waiting for a person to say “go.”

With DLT, you can also track things. Like seeing where your apple comes from, or making sure a diamond is not from a bad place. It’s all about having trust—knowing that the records are true and nobody messed with them.

Enhancing Payment Systems and Interoperability with DLT

Now, let’s talk about payments. We all pay for stuff every day, right? But it can take time. With DLT, sending money can be as easy as sending a text message. And because of DLT, different payment systems can talk to each other better. That means no more waiting days for a check to clear.

Imagine you have a wallet full of money from different places. One is for the bus, one is for games, and one is for shopping. Wouldn’t it be cool if they all worked together? With DLT, this can happen. So, no matter where your money comes from, you can use it anywhere, just like that.

DLT can also keep our money safe from bad people. Because all the records are there for everyone to see, it’s hard for someone to steal or cheat. This means you can feel good about your money being safe.

DLT is not just about money, though. It’s about making all kinds of deals and trades better, easier, and safer. From buying a house to trading cards—DLT changes the game. It makes sure everyone plays by the rules, and even helps save trees by cutting down on paper.

So, what’s the big deal with DLT? It’s about trust and making life easier. It’s about knowing that when you do something, it’s done right and fair. And it’s about taking the “wait” out of “waiting” so we can all move faster in this busy world.

DLT isn’t just a buzzword; it’s a real tool that’s making things better for everyone. From banks to playground trades, it’s the silent hero keeping things smooth and honest. That’s pretty awesome, don’t you think?

The Future of DLT: Scalability, Governance, and Innovations

Navigating Scalability Challenges in Distributed Ledgers

As we dig deep into DLT, we face a big task: making it faster as it grows. Scalability is how well a system can grow to handle more work. Simple, right? But with DLT, as more people join and use the network, it’s like a party that gets too crowded, making it hard to move around.

To solve this, we think about things like the network’s design and the rules for adding transactions. We aim for a DLT that can serve more people without slowing down. Picture a highway adding lanes to ease traffic; that’s the kind of smooth sailing we’re after. Now imagine, instead of bank tellers, we have smart contracts. They’re like computer programs that manage the flow of digital cash with rules set in code. They help DLT stay fast and fair.

Breaking it down, let’s talk types. We’ve got public ledgers open to anyone — think Bitcoin. Then there are the private ones, where entry is limited. Both have their place. For example, a public ledger welcomes anyone to help verify transactions, while a private ledger keeps things more controlled.

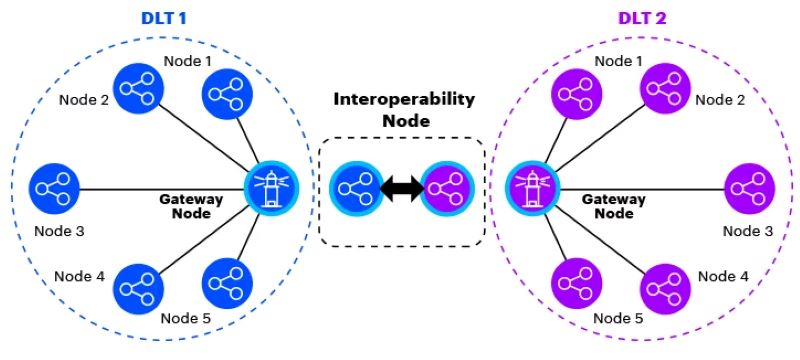

Now, making these systems work well together is key. This is what we call interoperability. Think of it as making sure your phone can call someone else’s, no matter the brand. With DLT, different systems talk to each other so your digital cash moves smoothly across networks.

We do this with things called cross-chain technology. It’s a bit of genius that lets different DLTs connect. This way, digital money can hop from one blockchain to another. It’s like having a universal key for every digital lock.

Governance Models and Compliance in DLT Ecosystems

But here’s the trick: Keeping DLT safe and in line with the law. Enter governance, the system of rules that manage who gets a say and how decisions are made. It’s like having referees in a game, making sure everyone plays fair.

In DLT, we need smart minds to make rules that fit the digital world. This is our governance model. It looks at cool things like who gets to join the network and how we agree on what’s true on the ledger. We want everyone to trust the system, so we need clear rules that everyone knows.

We also have to play by the big rules — the law. Compliance means making sure that the DLT doesn’t step out of line with legal stuff. We don’t want our digital party to get busted by the law, right? So we stay sharp, act honest, and keep check on each transaction. This helps us fight fraud and keep the network clean.

To wrap it up, we’re always pushing to make DLT better. We keep it fast, we make sure it talks well with others, and we stick to the rules. With each change, we unlock new ways to handle our digital cash, smart contracts, and even more stuff we’ve not thought up yet!

In this post, we’ve uncovered the nuts and bolts of blockchain and other types of distributed ledger technology (DLT). You now know how they differ and why they’re such a big deal. We’ve seen how DLT ensures secure and trusted transactions through clever consensus methods.

We’ve also explored DLT’s huge impact on finance, from cryptocurrencies to making payments smoother. Finally, we eyed the road ahead, looking at how DLT must grow, and the rules it follows.

It’s thrilling to see where DLT will take us. Its power to change how we handle money and data is just starting. The tech is growing, and so is our smart use of it. Keep watching this space – DLT’s journey is ours too, and it’s far from over.

Q&A :

What is distributed ledger technology in the context of cryptocurrency?

Distributed Ledger Technology (DLT) is a digital system for recording transaction of assets in which the transactions and their details are recorded in multiple places at the same time. In the context of cryptocurrency, DLT refers to the technological infrastructure and protocols that allow simultaneous access, validation, and record updating across multiple nodes (or computers) on a network. The most famous example of DLT in the cryptocurrency realm is blockchain, which underpins digital currencies like Bitcoin and Ethereum.

How does distributed ledger technology enhance security in cryptocurrency transactions?

Distributed Ledger Technology enhances security in cryptocurrency transactions through its decentralized nature, which removes the need for a central authority and makes it extremely difficult for bad actors to manipulate the data. In DLT systems, each transaction is encrypted and linked to the previous transaction, and copies of the ledger are spread across the network’s nodes. This means that to alter any information on the ledger, a hacker would have to attack the majority of the nodes simultaneously, which is practically implausible due to the computational power required.

What are the key differences between blockchain technology and distributed ledger technology?

Although the terms “blockchain” and “distributed ledger technology” are often used interchangeably, they are not identical. Blockchain is a type of DLT, essentially a subset where data is stored in blocks that are then chained together. However, not all DLTs necessarily utilize the block and chain system. Some may use other structures such as directed acyclic graphs (DAGs). The key difference lies in the data organization method; while blockchains group data into blocks and form a chain, other DLTs can store data in various formats and do not require chaining.

Can distributed ledger technology operate without cryptocurrency?

Yes, distributed ledger technology can operate without cryptocurrency. While DLT is a fundamental technology behind cryptocurrencies, its application extends beyond just the financial sector. DLT can be used in various industries including supply chain management, healthcare, intellectual property rights management, and voting systems, to manage different types of records without the involvement of digital currencies.

What future developments are expected for distributed ledger technology in the crypto industry?

The crypto industry anticipates several future developments in the field of distributed ledger technology. These developments include the integration of artificial intelligence (AI) for predictive analytics, improved scalability solutions to handle an increasing number of transactions, advancements in interoperability to enable different DLT networks to work together seamlessly, and enhanced privacy features like zero-knowledge proofs. There is also a growing emphasis on sustainability, with efforts to minimize the environmental impact of mining and consensus mechanisms used in DLT. These innovations aim to refine the technology further, making it more efficient, secure, and suitable for a broader range of applications within the crypto industry and beyond.