Custodial vs Non-Custodial Wallets: Unveiling the Best Choice for Your Crypto

In the diverse world of crypto, one choice stands tall: picking the right wallet. It’s much more than a place to store digital coins. It’s about control, security, and peace of mind. Do you let a company guard your crypto keys, or do you go solo and hold onto them tight? Understanding Custodial Wallets can feel like safe hands are watching over your digital stash, but with a twist: it might cost you freedom. Diving into Non-Custodial Wallets flips the script. You’re in charge, making all the calls, but with great power comes the need for sharp know-how. Comparing Wallet Types is a journey from the bustling streets of Hot to the icy calm of Cold Storage Solutions. And if that wasn’t enough, Advanced Security Measures like Multi-Sig vaults and the brave new world of Decentralized Finance Storage wait to challenge your crypto custody skills. Strap in; your perfect wallet match is closer than you think.

Understanding Custodial Wallets: Security and Convenience at a Cost

Exploring the Landscape of Custodial Wallet Security

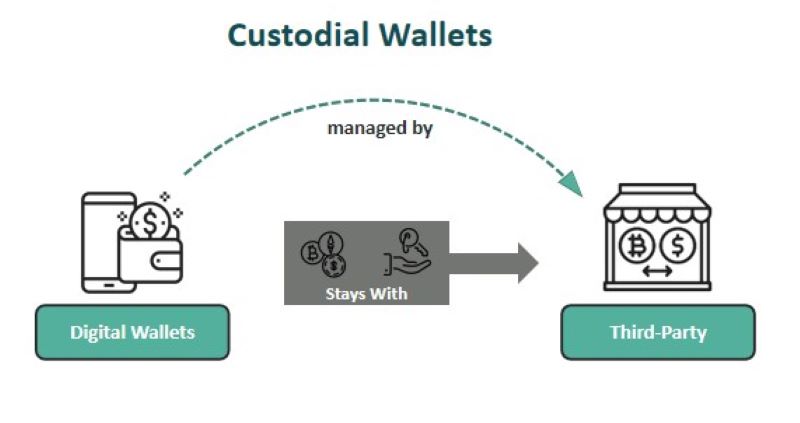

What is custodial wallet security? It means a third party keeps your crypto safe. This third party is often a company that knows crypto well. They handle the hard parts of security. But this means you trust them a lot. The good side? If you forget your password, you can get help. The bad side? If the company has problems, so does your money.

In custodial wallets, your private keys stay with the service. Think of private keys like secret codes that unlock your money. With custodial wallets, you don’t hold these codes. The service does. Why do people like this? It’s because managing these codes can be scary. Lose them and poof! Your money is gone. But when someone else manages them, it feels safer, mostly for people new to crypto. Yet, experts say this trust comes with risks.

Imagine you’re at a food truck. You want to pay with crypto. With a custodial wallet, it’s simple. Just like a debit card. The food truck doesn’t know your card number. They trust the bank system to do its job. Custodial wallets work similarly. They’re like trusted friends holding your cash.

Weighing the Pros and Cons of Exchange-Hosted Wallets

Now, let’s talk about exchange-hosted wallets. You’ve probably heard of big exchanges. They let you buy, sell, and hold crypto. They’re very handy. Plus, they offer extra services that can be useful.

But here’s the thing to remember. These wallets are online. This means they attract hackers like honey attracts bears. When hackers attack, your digital coins could be stolen. It has happened before, and it’s not pretty.

Are there benefits to using exchange-hosted wallets? Sure. They make trading easy. You can swap coins quickly. They also help new users discover crypto without fear. You just sign up, and you’re set to go.

What about the risks of custodial wallets? Well, the company has your keys. If they’re hit by a cyber attack, it’s trouble for you. Sometimes, the company might pause withdrawals. This means you can’t get your money when you want. And, with rules getting stricter, the company might need to check who you are. This is called KYC, or ‘Know Your Customer’. It’s a way to fight bad stuff like money laundering.

In conclusion, think of custodial wallets as a parking space. You park your car there because it’s handy. But it’s not your garage. There’s always a chance something could happen to your car.

Now, let’s step back and see this clearly. Sure, custodial wallets offer ease. But with great convenience comes great trust. And as Spider-Man’s uncle said, “With great power comes great responsibility.” Remember, in the world of crypto, it’s not just power—it’s your money that needs responsibility.

Embracing Non-Custodial Wallets: Mastering Private Key Ownership

The Benefits of Full User Control in Cryptocurrency Management

When you pick a non-custodial wallet, you take control. No third party holds your keys. This means you call the shots for your digital cash. It’s like having a safe only you can open. With such user control in crypto, your coins stay yours, no matter what.

You don’t worry about exchange security breach. Why? Because your money isn’t with the exchange. It’s just like keeping cash under your bed instead of in a bank. This way, hacks on exchanges can’t touch you. You also avoid risks of custodial wallets, where the exchange could mess up or deny access to your funds.

Using non-custodial options, you boost digital asset security. They give you power over wallet access control. This freedom comes with responsibility, though. You must handle your private key with care. Lose it, and your digital assets are gone, much like losing the key to that safe.

Private key ownership also feeds financial sovereignty in crypto—owning your financial fate. Without permission, you send and get coins. You join the world of decentralized finance storage too. This is where you take part in cutting-edge finance, without asking anyone first.

Best Practices for Non-Custodial Wallet Backup and Recovery

Key management services come in many shapes, but self-help tops them all. Always back up your wallet. You’ll hear folks say, “Never lose your seed phrase.” It’s key to getting back in, if things go south. Write it down. Store it safe. Think fireproof, waterproof, and sneak-proof.

Seed phrase management is like caring for a rare plant. Give it the right spot, away from harm, and it will thrive. With your seed phrase safe, wallet recovery is a breeze. You can free your funds if your device gives up.

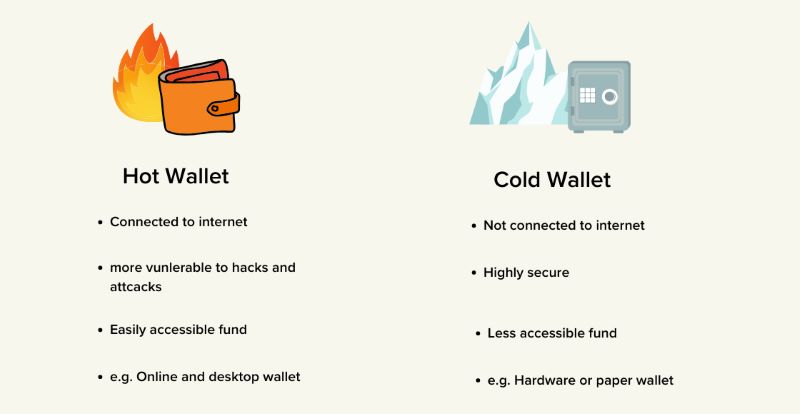

Let’s talk hot wallet versus cold wallet. Hot wallets are online; they’re easy to use but face more threats. Cold wallets stay offline. They’re like a vault—harder to get into, harder to break. Pick a hardware wallet for big savings, or a software wallet for day-to-day cash.

Wallet backup is simple. Many wallets offer easy steps to save your setup. Follow these and sleep better, knowing your digital coins stand safe. Some folks even use multi-signature wallets. They need more than one key, so it’s teamwork to open that safe. It’s like a double handshake every time you trade.

Owning a non-custodial wallet is for those who like control and don’t mind its care. It’s your crypto, your rules, your security. Set up backup, use strong passwords, and keep your seed phrase tucked away. Embrace the peace of mind that comes with mastering private key ownership.

Comparing Wallet Types: From Hot to Cold Storage Solutions

Deciphering the Differences: Hot Wallet vs Cold Wallet

Have you wondered which wallet keeps your crypto safe? Let’s find out.

First, hot wallets connect to the internet. They’re handy but also more open to hacks. With hot wallets, think of your phone’s wallet app. Yes, you can get to your coins fast for quick buys or trades. Yet, because these wallets stay online, they can tempt hackers.

Now, cold wallets, they’re the opposite. They’re offline, like a safe in the bank. So, hackers can’t easily touch them. Cold storage means things like paper wallets or hardware wallets. This way, your coins rest offline, far from sneaky cyber-thieves.

Imagine having a vault for your digital cash – that’s cold storage. Your crypto stays put unless you decide to connect and use it. It’s like tucking your cash under your mattress, but much safer.

Hardware vs Software Wallets: Features and Risks Analysis

Let’s get into hardware versus software wallets. It can get confusing, but hang tight.

Hardware wallets are like a USB stick for your crypto. Plug it into a computer, and there you go, your coins are ready to spend or move. They’re part of cold storage, so they’re not online all the time. That’s good for keeping your stash safe.

Think of a hardware wallet as a key to a very secure safe. You own the key, so you control the safe. Lose the key, though, and you’re out of luck. Always keep backup info, like a seed phrase. It’s a series of words that can help you access your coins if something goes bad.

On to software wallets. These run on your devices like computers and phones. They’re often free and easy to use. Many folks start with these. Software wallets are good for getting the hang of crypto fast.

But here’s the thing. Since they’re online a bunch, hackers could try to crash the party. So, use strong passwords and think about two-factor authentication. That’s like adding a big guard dog on top of your password.

Always be on guard about where you click and what you download. Bad software can sneak in and cause trouble.

So, hot or cold? Hardware or software? It comes down to how you use your crypto and how you like to manage risk. Hot wallets with their ease of access or cold wallets and their tighter security? Hardware wallets with that solid safe feeling, or software wallets for speed and simplicity?

Now, what do you think fits you best? There’s no one-size-fits-all here. Your crypto journey is yours to chart. Just make sure your map has safety written all over it!

Advanced Security Measures: Multi-Sig and Decentralized Finance Storage

Enhancing Security with Multi-Signature Wallets

Multi-signature wallets need several keys for a crypto transaction. They work like bank safes where you need more than one key to open. This means added safety for your coins.

But how? These wallets need more than one person to say “Yes” to any big move. This helps keep thieves out. If one key gets stolen, your money stays safe. Think of it like a team working to protect your cash. Each team member holds a piece of the puzzle. To solve it, and get to the cash, they must work together.

Regulatory Compliance: Balancing Security and Financial Sovereignty

You might ask, “Why care about rules for holding my own money?” Here’s the thing. Laws help stop bad folks from doing harm with money. As a wallet keeper, you want to be safe, but also free. It’s like driving. We follow rules to stay safe but still want to go where we wish.

So, with crypto, there’s a balance act. We use rules like KYC (know your customer) to keep things clean. But also, we keep our right to handle our cash as we see fit. Remember, staying within the law means staying out of trouble. And trouble is something we want to avoid, especially with crypto where stakes can be high.

By using multi-signature wallets, we add layers of defense. We make it hard for bad guys. Plus, we stay honest, and follow the rules. It’s like having the best of both worlds. We get stronger protection and keep our freedom in the world of digital cash.

In this post, we dove into the essential details of custodial and non-custodial wallets, aiming to clarify the fuzzy areas in crypto storage. We learned that custodial wallets offer ease but at a privacy and control cost. Then, we embraced the full control that comes with non-custodial wallets, stressing the crucial role of backup and recovery.

We compared hot and cold wallets, helping you see their unique functions and inherent risks. Hardware and software wallets were also put under the lens, giving insight into their features.

Finally, we explored advanced safeguards like multi-sig wallets, and how they align with the evolving demands of decentralized finance while considering regulation.

Always remember, your wallet choice can greatly influence your crypto experience; security, ease, and control are the deciding factors. Choose what fits your needs best, and stay informed about best practices for safekeeping your digital assets. Your financial sovereignty depends on it.

Q&A :

What is the difference between a custodial and a non-custodial wallet?

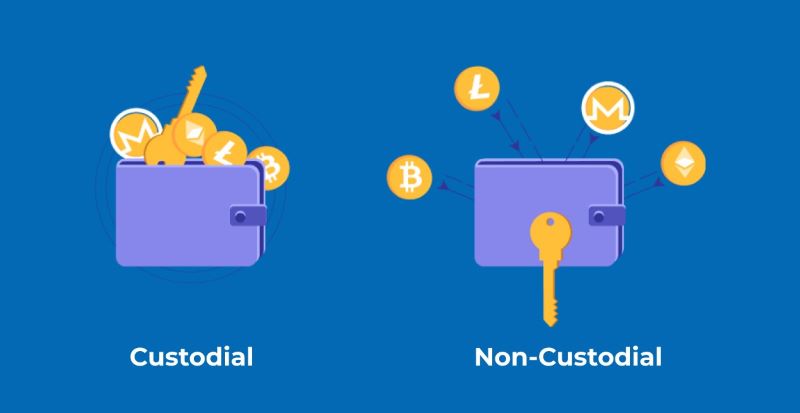

In the realm of cryptocurrency, the primary difference between custodial and non-custodial wallets lies in who holds the private keys. A custodial wallet is one in which a third party, such as a cryptocurrency exchange, holds the private keys. This means that they have control over your funds. Non-custodial wallets, on the other hand, are controlled solely by the user, who holds the private keys. This grants the user full control over their funds without the interference or oversight of a third party.

What are the benefits of using a non-custodial wallet?

Using a non-custodial wallet offers a number of advantages, chief among them enhanced security and privacy. As the owner of the private keys, the user has sole access to their funds, reducing the risk of theft or loss due to hacking of exchange platforms. It supports the decentralized ethos of cryptocurrency by removing reliance on intermediaries. Additionally, users are free to interact with their funds as they wish, without restrictions that custodial services might impose.

Are custodial wallets less secure than non-custodial ones?

Custodial wallets can be considered less secure than non-custodial ones primarily because the security of your assets depends on the security measures of the third party holding your keys. If the third party is compromised, your funds could be at risk. This makes them targets for large-scale hacking attempts. However, custodial services may offer user-friendly features and easier recovery options in case of lost credentials, which can be beneficial for users who are not confident in handling their security.

How do I choose between a custodial or non-custodial wallet?

Choosing between a custodial or non-custodial wallet depends on your preference for control versus convenience. If you prioritize security and direct control over your crypto assets, a non-custodial wallet may be the best choice. However, if you are new to cryptocurrency or prefer a more convenient method to access your funds, potentially with integrated services like trading and lending, then a custodial wallet might suit you better. It’s important to assess your technical knowledge, security commitment, and convenience needs before making a decision.

Can I switch from a custodial to a non-custodial wallet?

Yes, it is possible to transfer your assets from a custodial to a non-custodial wallet. The process typically involves withdrawing your cryptocurrencies from the custodial service to the public address of your non-custodial wallet. Be sure to exercise caution during this transfer to avoid any mishaps, such as entering the incorrect address and losing your funds. Always verify the non-custodial wallet’s compatibility and security beforehand to ensure a smooth transition.