Diving into cryptocurrency investment for beginners can feel like steering a ship in uncharted waters. Before you set sail on this digital voyage, there are 5 essential tips you need to grip tightly. Your financial future deserves more than just a random toss of a coin into the crypto well. Let’s break down the complex into simple steps that bolster your confidence and boost your decision-making prowess. Understand the basics, prepare your investment foundation, manage your strategies, and mitigate risks. It’s time to trade confusion for clarity and learn how to start smart in the crypto universe.

Understanding the Basics of Cryptocurrency Investment

Grasping Digital Currency Basics and Cryptocurrency 101

Diving into the world of cryptocurrency can be thrilling. It’s the frontier of finance! But before you dive, you need to understand the pool. That’s what digital currency basics are all about. Think of cryptocurrency as internet money. It’s not like the cash or cards in your wallet. It uses special tech to work. And it’s called crypto because it’s private and secure.

Digital money is like the coins and dollars you know, but it lives on computers. You can send it to people near and far. No need for banks to move it. This is all part of cryptocurrency 101 – the foundation you need to tap this market’s potential. Keep it in mind as you plan your first crypto buys.

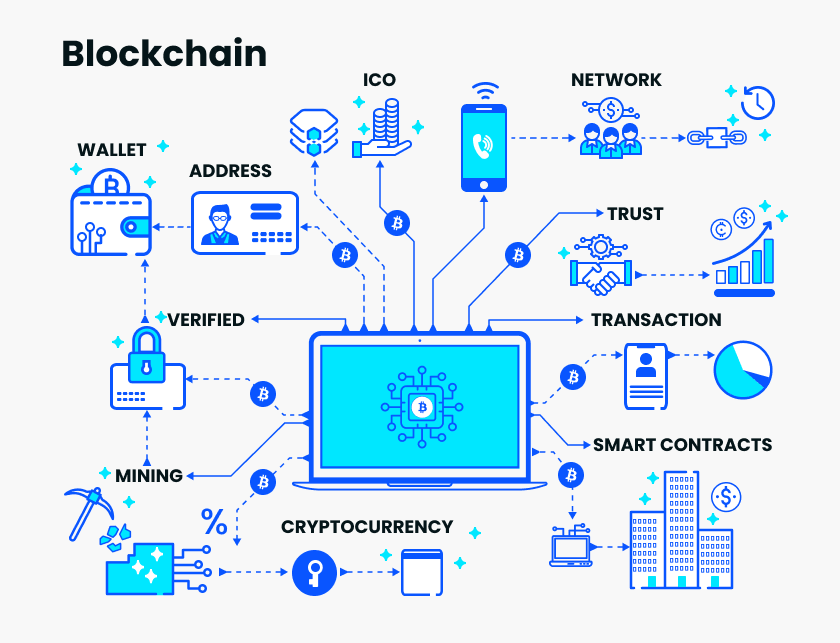

The Significance of Blockchain and How Ethereum Works

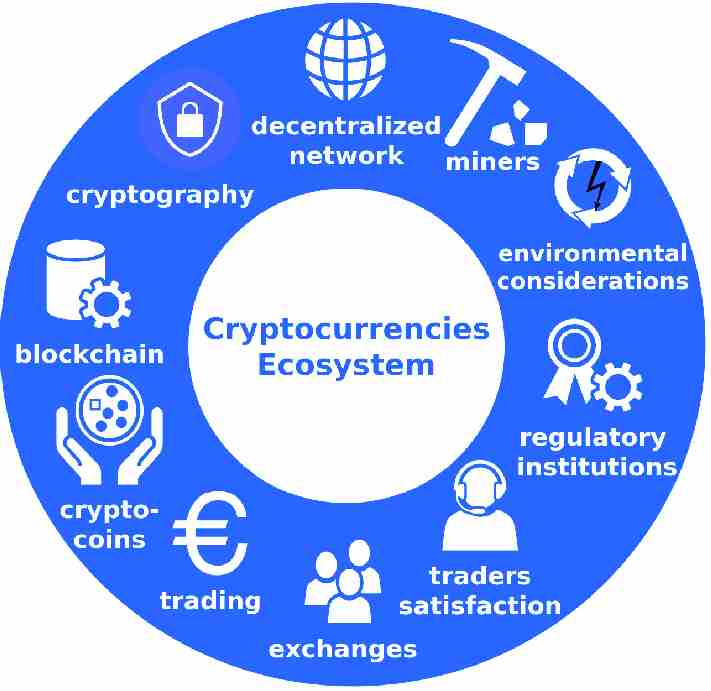

Now, blockchain is a big deal when you talk crypto. Picture a digital chain where every link holds bits of info. It’s public, so everyone can see it. But only the owner with the key can change their own link. This is where coins and tokens live. These links store details of every swap, trade, or transfer – making things clear and fair.

Ethereum is a special kind of crypto. It’s not just a coin; it’s a platform, too. Think of it as an amusement park. Besides rides (coins), it has space for games (apps). People build these “games” to use and trade just like rides. This platform is a home where other digital coins can grow. Knowing how Ethereum works gives you more than one way to join the crypto game.

With these kinds of tools – from the simplest coins to whole platforms like Ethereum – you’ve got many paths to explore. It’s less about picking the “best” one and more about finding the right fit for you. Choosing a crypto exchange and picking a good wallet are just parts of this journey. You need to think about keeping your digital coins safe, too.

Remember, when buying for the first time, go slow. Look at the risks. It’s not a race. Investing in bitcoin for starters can be a smart move, but there’s a bunch of other coins, called altcoins, that might suit you too. What’s good? What’s risky? Ask those questions. Mix things up in your digital basket. Don’t bet the farm on one thing.

In the beginning, setting up a crypto investment plan may seem tough. But once you get these basics, it’s like learning to ride a bike. Once you know, you’re set to go. Take time to learn. Study each part – digital currency basics, what the blockchain is, how Ethereum and other altcoins work. This know-how is your power, your toolset for this new world of crypto.

Managing crypto assets is key. Start small, learn as you roll. And remember to step back and see the big picture. How does all of this fit with your money goals? Ask yourself, what do you want from your investments in the long run? The answers will guide your strategies, from building a diverse portfolio to choosing the right time to buy or sell.

In the end, getting the basics down is a must. It’s the groundwork for any smart crypto journey. So, before you take that leap, take a breath. Learn the ropes, get your gear, and prepare to discover a whole new world of digital wealth.

Preparing to Invest: Setting a Solid Foundation

Choosing the Right Crypto Exchange and Wallet

Starting in cryptocurrency? Pick a good exchange and wallet first. Think of these as your bank and wallet in the crypto world. A solid choice here is like building a house on rock, not sand. So picking where to buy and keep your digital cash is key. When you’re a beginner in crypto, you must learn the cryptocurrency basics. Like how you keep cash in a wallet and bank accounts safe with a PIN, your digital currency needs a safe spot too. A crypto exchange is where you trade money, like dollars, for crypto. For this, a reliable exchange is a must.

What is blockchain and understanding Ethereum for novices is also important as they’re the tech behind most coins. With many altcoins out there, you want an exchange that offers a variety. When picking your exchange, check if they have the coins you want. Fees, security, and ease of use are also top things to look at.

Now, where do you keep your crypto safe? In a crypto wallet. Here there are two types: hot wallets (online) and cold wallets (offline). Hot wallets are good for quick access to trade but think of cold wallets like a safe for your valuables.

Formulating Your Initial Investment Strategy and Asset Allocation

Got your exchange and wallet sorted? Next up, let’s talk strategy. Your starting plan should have rules on how much to put in and where. Long-term plans or quick trades – you need to know your own style. Investing in Bitcoin for starters might seem tempting, but don’t put all eggs in one basket.

First-time crypto-buying tips? Split your investment across different coins—this is diversifying. Why do this? Well, if one coin drops hard, you won’t lose it all. There are risks to crypto investments like any money-making chance. Know the ups and downs before diving in.

Digital asset allocation is all about balance. Think of how you split a pie into slices. Some big, some small. Your biggest slice should be in coins you trust the most, but mix it up. This mix can include steady players like Bitcoin and new promising altcoins.

Managing crypto assets is no kid’s game, but it’s not rocket science either. Know the risks, make a plan, stick to it, and be ready to learn. Starting your crypto journey can be full of twists, but by choosing a safe exchange and wallet, and setting a smart plan, you’re on the right path.

Avoid fancy words, don’t follow hype and always check facts when learning about decentralized finance (DeFi) or peer-to-peer transactions. Stay safe and smart out there in the crypto land—you got this!

Strategies for Crypto Investment Management

Diversifying Your Portfolio and Understanding Market Analysis

To start in cryptocurrency, smartly spread out your investment. This method is called diversifying your portfolio. It means not putting all your cash into one coin. You may wonder, “Why should I not invest all in Bitcoin?” Precision demands a clear response: Despite its fame, Bitcoin’s price can swing widely, like other cryptos. So, spreading your money reduces risk if one coin drops in value.

By learning how to manage a mixed bag of coins, you dodge big losses. The keyword is balance. For those just starting, diversifying helps keep your money safer. This means owning different kinds such as Bitcoin and altcoins. It’s like not eating only apples but also oranges, bananas, and grapes. Each fruit has its unique taste and health perks.

Next comes making sense of cryptocurrency market analysis. It’s about watching and making sense of price moves. Let’s say someone asks, “What is blockchain?” Simply, it’s a digital ledger that records all crypto transactions. This tech backs up most coins and hints at their safety and future value. Knowing this helps you understand why prices change.

Understanding market trends is much like surfing. You learn to ride the waves, not fight them. This skill helps you spot good times to buy or sell. Look at graphs, read about global events, and watch for big changes. Think of it as another game on your phone. You learn the rules, play often, and with time, you’ll score better.

Balancing Long-Term Objectives with Short-Term Trading Tactics

Managing crypto also means knowing your goals. Are you in for a quick win or a big goal years away? For long-term plans, pick coins you trust and hold them. “What is Ethereum?” It’s a platform for many digital tasks and also a coin, a good pick for many investors. It’s got strong tech and a busy community behind it.

Short-term trading is like sprinting. Quick moves can lead to quick cash. But this isn’t easy and holds more risk. It’s about buying low, selling high, fast. By learning crypto technical analysis, you can make better guesses. This is studying past price patterns to guess future moves.

To wrap up, treat crypto like a team sport. You need a mix of players — diverse coins, analysis skills, and different game plans for different times. This way, each part backs up the other. Then you’re set to face the crypto world with a smart play in every match.

Remember, stick with it, keep learning, and adjust as you learn. Your patience and smarts will serve you well as you manage your crypto journey.

Mitigating Risks in Your Cryptocurrency Journey

Recognizing and Avoiding Common Scams and Frauds

Start smart by knowing the risks. Crypto scams are real and smart folks can fall for them. Remember, if it looks too good to be true, it probably is. So how can you spot these scams? One big red flag is promises of big money fast. It doesn’t work that way; investing takes time.

What sort of scams should you look out for? Watch out for fake apps, emails that fish for info, and scam calls. They might look like they’re from real crypto firms. Always double-check and never share your keys or codes.

Navigating Regulations, Tax Implications, and Secure Storage Solutions

Diving into cryptocurrency means learning new rules. It’s not just about making money; you need to do things right and stay safe. Tax rules for crypto can be tricky. You have to report what you make from crypto, just like a regular job.

How do you keep your digital coins safe? A secure wallet is key. Think of it like a safe for your money. It locks away your crypto with a secret code only you know. And backing up your wallet keeps your money safe, even if your computer breaks.

Remember, starting with digital currency is just like any adventure. With the right knowledge and tools, you’ll be set for success. Keep learning and soon you’ll be teaching others the ropes too!

We covered a lot in this post about smart cryptocurrency investment. Starting with the basics, we learned how digital currency and blockchain like Ethereum shape our choices. Picking the right exchange and wallet is key. Next, we talked about making your first plan for your money and spreading it across different assets.

Knowing how to mix keeping your money safe for years with making quick trades is part of the game. We also went over how to stay clear of scams and handle the rules and taxes smartly.

Investing in crypto can be a thrill, but it’s serious business, too. Stay sharp, learn well, and you can make wise moves that may pay off. Remember, no one wins without playing it smart with their cash and their choices.

Q&A :

What are the first steps for beginners to invest in cryptocurrency?

Investing in cryptocurrency can be an exciting venture for beginners. To get started, beginners should familiarize themselves with the basics of blockchain technology and understand how different cryptocurrencies operate. It’s essential to conduct thorough research to choose the right exchange, set up a digital wallet for storing cryptocurrency safely, and start by investing in well-established coins like Bitcoin or Ethereum to minimize risks. Setting clear investment goals and understanding the volatility of the market will also help in making informed decisions.

How much money should a beginner invest in cryptocurrency?

As with any investment, beginners should only invest money they can afford to lose due to the high volatility associated with cryptocurrencies. It’s generally recommended to start small, possibly with a fractional investment in a cryptocurrency, to gain exposure without facing significant financial risks. Constructing a diversified investment portfolio and employing the dollar-cost averaging technique could also be beneficial for mitigating risks while investing in this emerging market.

What are the key strategies for managing risks in cryptocurrency investment?

When it comes to managing risks in cryptocurrency investment, beginners should ensure they diversify their portfolio to spread risk across different assets. Implementing stop-loss orders can limit potential losses if the market takes a downturn. Staying informed and up-to-date with market trends, regulatory news, and technological advancements is crucial. Additionally, avoiding FOMO (Fear of Missing Out) and not investing based on hype can protect beginners from making impulsive, high-risk decisions.

Which cryptocurrencies are best for a beginner to invest in?

For beginners, it’s advisable to consider starting with the more established and widely recognized cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) due to their longevity and larger market capitalization. These cryptocurrencies are typically more stable compared to lesser-known altcoins and have a track record of recovery after market downturns. However, beginners should conduct thorough research and consider market trends, use cases, and technology before deciding to invest in any cryptocurrency.

Can I make money through cryptocurrency investment as a beginner?

Yes, beginners can make money through cryptocurrency investment, but it is important to approach it with caution and a clear strategy. The cryptocurrency market can offer significant returns, but it is also known for its volatility and unpredictability. Beginners should educate themselves, start with a manageable investment, and avoid making decisions based on emotion or market hype. Consistent monitoring and a willingness to adjust strategy as needed can contribute to potential financial gains in the cryptocurrency market.