Cryptocurrency moves fast and waits for no one. If you’re not equipped with the sharpest tools in the shed, you’re just another face in the digital crowd. Cue the best crypto charting tools, your secret weapon for slicing through market noise and pinpointing what really matters. Stay ahead of the curve as we dive deep into the analysis platforms that top traders swear by, the real-time solutions that separate the pros from the amateurs, and the technical mastery you need for that killer trading edge. Get ready to transform your insights and strategy with tools that are built for winning in a world where timing is everything.

Decoding the Market with Top Cryptocurrency Analysis Platforms

Leveraging Advanced Crypto Analysis Software

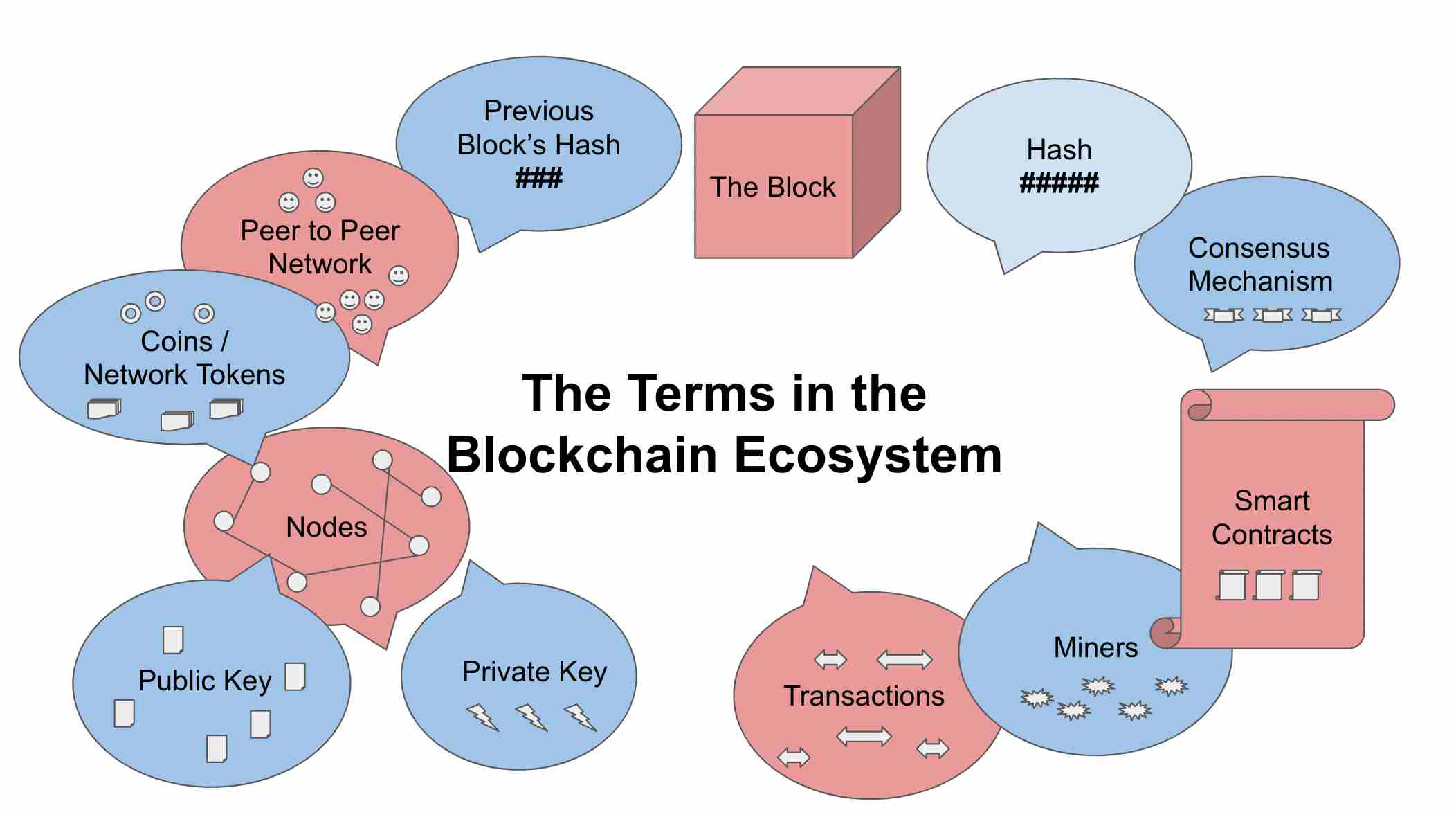

Getting into crypto trading? You need to know the best tools. Advanced crypto analysis software is a big deal. These tools let you see the market’s moves. They help you make smart choices.

What’s a good advanced tool? Trading chart tools for crypto. They come packed with features. Imagine seeing Bitcoin’s every move. Or catching Ethereum’s price swing. You use these tools to spot trends and buy low or sell high.

Think of it like gaming. You’re the player, and these tools are your best gear. They give you an edge. With them, you’re ready to outplay others in the crypto game.

But how do these tools work? They use graphs and numbers to show crypto’s ups and downs. This makes crypto technical analysis easier. You’ll feel like a pro in no time. And here’s a secret – it’s not just for experts. Even if you’re new, these tools can guide you.

Crypto candlestick patterns? These are key in crypto. Picture them like weather signs. They warn you of storms or show when it’s all clear. Learn these patterns well! They can tell you when to enter or exit trades.

The Importance of Real-Time Crypto Charting Solutions

Now, let’s chat about real-time crypto charting solutions. Why are they a must-have? Because crypto never sleeps. It changes any time of the day. With real-time charts, you watch the action as it happens.

Picture this: You’re tracking a hot coin. The chart shows it’s about to blow up. With real-time data, you act fast. You get in or out before others even notice. And that can mean big wins for you.

Let’s not forget about altcoin charting software. If you’re after the lesser-known coins, this is your go-to. These altcoins can have huge surges. With altcoin charts, you find hidden gems before they soar.

Having a user-friendly crypto chart interface helps too. Easy-to-understand charts mean less guesswork. You get clear info to make decisions on the spot.

Ever heard of interexchange crypto price comparison? It’s a smart move. See, not all places sell crypto at the same price. With this tool, you check different exchanges. Then, you buy where prices are low.

But with all these tools, how do you choose right? Think about these questions:

- What cryptos do I want to trade?

- What features seem most helpful?

- Which charts are easy for me to read?

Answering these helps you pick the best platform. And the right choice can make all the difference.

Here’s a tip: Never stop learning. The more you know, the more power you have. With these tools and some practice, you’re set to conquer the crypto world.

Essential Technical Analysis Tools for Crypto Trading

Mastering Crypto Candlestick Patterns

To trade crypto like a pro, know your candlestick patterns. These shapes show price moves. They are vital clues to market mood. Let’s say you see a candlestick with a small body and long wick. This could mean price rejection. Meaning, the price tried to go up or down, but failed. Traders see this and think, “Prices might turn around here.”

Candlestick patterns get names like ‘hammer’ or ‘doji’. These names are shorthand for complex price tales. A ‘hammer’, for instance, hints at a price rise. A ‘doji’ suggests a battle between buyers and sellers. Knowing these helps you guess future price moves. They add depth to simple up-and-down charts.

Don’t let the names scare you. Once learned, candlestick patterns are like reading a book. You’ll turn pages of market data with ease. Plus, they make charts pop. Figures jump out with clear messages. “Buy now,” they may signal, or “hold off for better prices.”

Utilizing Indicators and Volume Data Analysis

Now, let’s talk tools beyond shapes. Indicators and volume are key. They show much more than raw price data. Indicators are like secret codes. They unlock truths about trends and momentum. Volume, on the other hand, tells us about strength. It answers, “How strong is this price move?”

Use tools like moving averages. They smooth out price jitters. You see a clearer path. This clarity helps when making buy or sell chooses. Moving averages come in types like simple or exponential. Each type gives unique insight. Remember, no one size fits all in crypto trading.

Then there’s volume. It shows interest in a coin. High volume with price up means lots of buying. High volume and price down? Lots of selling. Simple, right? But oh so useful. Volume can confirm your hunches. If a chart looks ripe for a jump, but volume’s low, you might wait. Your goal is to match good patterns with strong volume. This combo often leads to smart trades.

Crypto trading thrives on good data. Add candlestick patterns and indicators to your toolkit. Watch volume for added hints. These pieces form a puzzle. Solve it, and the market’s secrets start to show. They guide you to smarter, more informed trades. Always aim to match visual patterns with hard data. This approach lifts you above those trading on gut feel alone.

Understand this: Crypto markets are rough seas. But with the right chart tools, you’re the captain, not the castaway. Set sail with candlesticks as your stars, guided by the compass of indicators and the wind of volume data. Navigate carefully and you’ll chart a course to trading treasure.

Customizing Your Cryptocurrency Analysis Experience

Making the Most of Customizable Cryptocurrency Charting

In trading, one size does not fit all. Especially in the fast-paced world of cryptocurrency. Every trader has a unique style, and customizing your tools is key. Customizable cryptocurrency charting is like setting up your racing car. You adjust your seat, mirrors, and steering wheel for the best control.

Charting software for digital currencies often comes with features for personal tweaks. You can set up price alerts, pick colors that are easy on your eyes, and even create unique indicators. For seasoned traders, advanced crypto analysis software offers scripts. These scripts allow crafting custom tools that can hunt down patterns most don’t see.

Let’s talk about crypto candlestick patterns. They tell stories of market sentiment and potential moves. Being able to highlight specific candlestick patterns can declutter your analysis. Customizable charting offers this, tailoring your view to only what matters to you.

Indicators utilized in crypto trading also benefit from customization. You can alter settings for indicators like RSI or MACD to match your strategy. This fine-tuning can mean catching a trend early or spotting a reversal just in time.

When exploring coin market cap charts, customization helps highlight the cryptos buzzing with potential. You can filter out noise and focus on coins that meet your criteria.

For those into altcoin charting software, customization means you can set up different profiles. One for Bitcoin, one for Ethereum, and so on. This way, you switch scenarios quickly, saving precious time during trading hours.

Remember, with great power comes great responsibility. Custom charts can improve your trades but rely on knowledge and experience. Start simple, learn your tools, and customize as you grow.

The Rise of Mobile Crypto Charting Apps

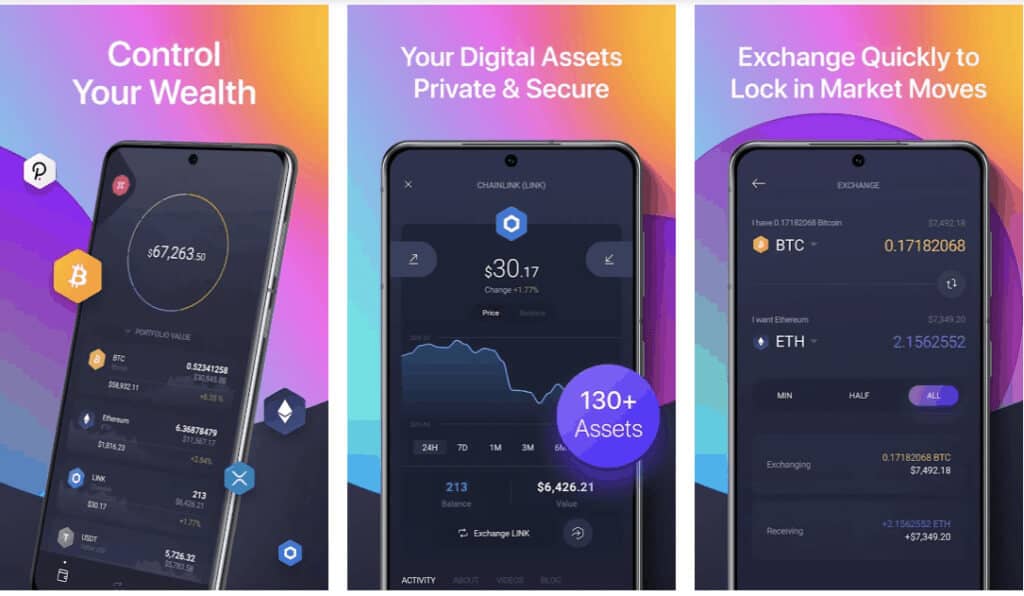

Ever wish you could keep an eye on the market wherever you are? Well, mobile crypto charting apps are your answer. They put the power of desktop platforms right in your hand.

Mobile apps offer real-time crypto charting solutions. So, traders can spot opportunities the second they arise. Handy for catching those short-lived spikes in price action.

Some think mobile charts are too simple. That’s not true. The best apps pack many features from their desktop cousins. They have technical analysis tools, like trend lines and volume data. Some even offer alerts. This means you get notified the moment your trading conditions are met.

They are simple to use too. User-friendly crypto chart interfaces on mobile make trading less of a hassle. You swipe, tap, and pinch your way through charts – no mouse needed!

Being able to explore chart patterns for crypto traders on the go is a huge plus. Volume data analysis in crypto doesn’t wait for you to get back to your desk. Being mobile-ready means you stay ahead of the game, anytime, anywhere.

Choosing these apps can be overwhelming though. There are so many! Focus on reliability, the variety of tools offered, and how well it fits your trading style.

In a nutshell, customization and mobile apps breathe life into your crypto analysis. They let you build a space where your trading can thrive. Always remember to start slow, master the basics, and then, customize away!

Building a Winning Crypto Trading Strategy

Recognizing Vital Chart Patterns for Crypto Traders

Chart patterns are traders’ bread and butter. They show us how prices move. Think of them like tracks left by animals. By following these tracks, we spot where the crypto market could go next. There are lots of patterns to know, but some key ones are vital.

Head and Shoulders, for example, often hints at a trend switch. A rise could be about to fall. Or the other way ’round. Wedges can also signal a change or a pause before the trend keeps going.

Spotting these patterns comes with practice. Use top cryptocurrency analysis platforms to bend these tools to your will. Good charting software for digital currencies will make your life much easier. You’ll spot patterns and snag those trading chances.

Remember, crypto doesn’t sleep. This means you need trading chart tools for crypto that work any time. You don’t want to miss out on a trade because your tools took a nap, right?

Integrating Blockchain Analytics Tools into Your Strategy

Blockchain analytics tools are like having a superpower. They let you see deep into the crypto world. You’ll check out transactions and track coins moving. This is big for figuring out what’s going on behind price shifts.

Here’s how to use them:

When you see a big move in price, head to your blockchain analytics tools. Check if big amounts of Bitcoin or Ethereum have been moved. This can offer clues. Maybe a whale is making moves, and you want to follow along.

Incorporating these tools means you’re not just guessing. You make choices based on real actions in the blockchain. It’s smart, and it can set you apart from traders who just rely on gut feelings.

Find crypto technical analysis platforms that blend charting with blockchain data. This way, you get the full picture. You use not just the shape of market trends but the heartbeat of the blockchain itself.

Trading crypto is an adventure. A good one can see the signs and use the right tools to find treasure. Chart patterns and blockchain analytics – these are your maps and compass in the vast crypto sea. Use them well and keep a sharp eye. The market’s secrets won’t stay hidden for long.

In this post, we’ve looked at great tools for crypto analysis. Advanced software and real-time charting help you make smart moves. We also talked about key analysis tools. Knowing candlestick patterns and using volume data matter a lot. Custom charts and mobile apps let you trade on the go. And a strong strategy comes from knowing chart patterns and blockchain tools.

My final thoughts? These tips and tools are big helps for anyone in crypto. Use them right, and you can trade better and smarter. Remember, stay sharp and keep learning. That’s how you win at crypto trading.

Q&A :

What Are the Top Crypto Charting Tools Currently Available?

When it comes to analyzing cryptocurrency trends and making informed trading decisions, utilizing the best charting tools is essential. Currently, some of the most respected and widely-used crypto charting tools include TradingView, Coinigy, and Cryptowatch. These platforms offer a variety of charts, technical indicators, and drawing tools that cater to both beginner and advanced traders.

How Can Beginners Benefit from Using Crypto Charting Tools?

Beginners can greatly benefit from using crypto charting tools as they provide valuable insights into market trends and asset price movements. These tools often feature user-friendly interfaces with customizable options, helping new traders to understand the basics of technical analysis and gradually build their trading strategies. Moreover, many charting tools include educational resources to aid beginners in navigating the complexities of the crypto markets.

What Features Should You Look for in a Crypto Charting Tool?

When selecting a crypto charting tool, there are several key features to consider including a wide range of technical indicators, real-time data, customizability, user support, and interoperability with various exchanges. Additionally, having access to historical data, various time frames, and the capability to perform backtesting can give traders an edge. Ensure the tool is robust and capable of handling rapid market changes typical in the cryptocurrency environment.

Is It Worth Paying for Premium Crypto Charting Tools?

Investing in premium crypto charting tools may be worth considering for those who are serious about their trading strategies. Premium features often include more advanced technical analysis options, priority customer support, additional integrations, and sometimes, zero-delay data feeds which can be vital for day trading. However, your trading volume, frequency, and strategy complexity should dictate whether a premium tool is necessary.

Can Crypto Charting Tools Predict the Market Accurately?

While crypto charting tools are sophisticated in providing historical and real-time data analysis, they cannot predict market movements with absolute certainty. These tools are best utilized to identify trends, patterns, and potential support and resistance levels. Traders should combine chart analysis with other methodologies such as fundamental analysis and stay up to date with market news to make more informed decisions.