Diving into the world of cryptocurrency is thrilling but how to avoid mistakes when investing in crypto for beginners is key. It’s easy to get caught up in the buzz and make quick moves that can cost you. But don’t fret. My guide walks you through the crypto landscape while keeping those common traps at arm’s length. From grasping blockchain to crafting strategies that work, I’ll show you how to stand on solid ground in this volatile market. The goal? Smart moves, not regrets. Let’s break down what you need to know and get you investing with confidence.

Understanding the Basics of Cryptocurrency

Grasping Blockchain Technology Fundamentals

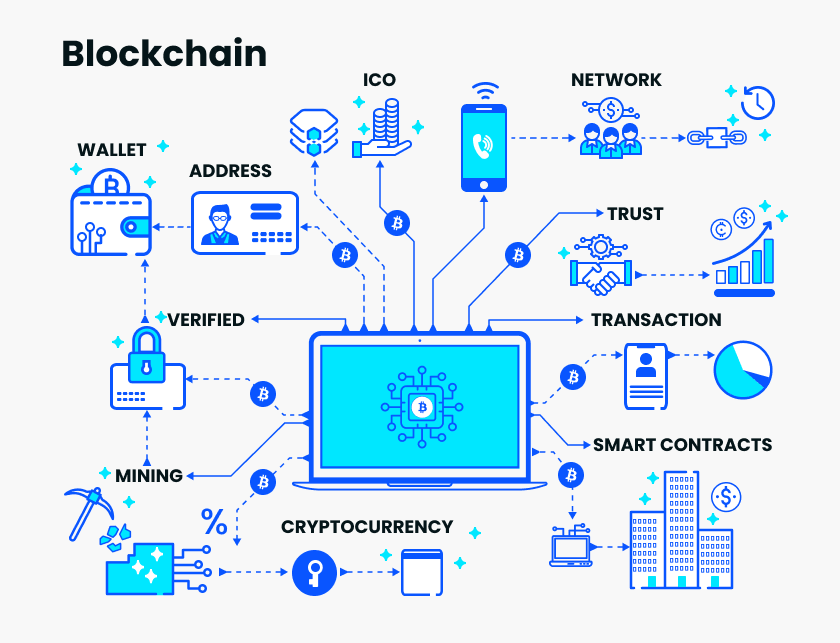

Let’s get into the nuts and bolts of blockchain. In simple words, blockchain is like a digital ledger. Everyone has a copy, so it’s super hard to cheat. Imagine everyone in your class has a list of who owns what marbles. If you get a new one, everyone updates their list. That’s kind of how blockchain works. But with digital coins, not marbles.

Blockchain is key to knowing how crypto works. Every trade, or deal you make, gets locked in. Once it’s in, it can’t change. This is why trust in crypto is high. It’s also why we call it “decentralized”. No one person or group calls the shots. With blockchain, power is spread out.

Key point? Understanding blockchain can keep you safe in crypto.

Decoding Cryptocurrency Basics for Newcomers

Welcome to the world of crypto! It’s not just about making money fast. It’s a whole new kind of asset—think of it as digital money. You use real money to buy crypto, like Bitcoin or Ethereum.

It’s like giving a special code that only you have. This code is key—never lose it! You use this code to send, get, or keep your crypto safe. This brings us to wallets. Crypto wallets keep your codes safe. They can be on your phone or even a special USB.

Now, let’s talk about ICOs, or Initial Coin Offerings. Think of it as a way for new crypto to make a big entry. They sell new coins to start a project. It’s a bit of a gamble. But knowing the project’s goals can help you decide.

The trick is to learn and not rush in. Read up, speak with others who invest, and take small steps. Go for well-known coins at first. Then, explore more as you get the hang of it.

One last tip: watch out for FOMO, the fear of missing out. It can push you to make fast, risky moves. Keep calm, think, and then act. Always remember, no one got wise by rushing in!

Crafting a Strategic Approach to Crypto Investing

Avoiding Common Beginner Mistakes in Crypto Trading

Dive in too fast, and you might sink. Slow and steady wins the race in crypto investing. Newcomers, listen up. Here’s your first lesson in avoiding beginner mistakes in crypto trading. Start with cryptocurrency basics for newcomers.

First off, you need knowledge. Understand what blockchain is. It’s not just tech jargon; it’s the backbone of all cryptocurrencies. Make sense of how it works before you invest. This understanding is your shield against bad choices.

Next up, tackle the hype. Don’t let FOMO – that’s the fear of missing out – push you to buy in at the peaks. Watch the market, wait for the dips. Patience pays off more than quick, unplanned moves.

Now, let’s talk risk. Cryptocurrency risk management for beginners is a must. Never invest more than you can afford to lose. And spread your risks. This means diversifying your portfolio. Mix coins and tokens; don’t put everything in one basket.

Developing a Disciplined Crypto Investment Strategy

How do we develop a strategy? It’s easier than you think. Start with setting realistic crypto investment goals. Ask yourself what you want from your investment. Are you in this for a quick buck or the long haul?

Mark these words: discipline is key. Create rules for when to buy and sell and stick to them. Avoid emotional decisions. Use strategies from experienced traders, like stop-loss orders to limit your losses.

Do you know what tokenomics is? It’s the economics of tokens, all about supply and demand. Understanding this can tell you a lot about a coin’s future value. And while we’re here, always – always – read the whitepapers. They’re the map to any Initial Coin Offering (ICO) journey.

Have you set up a crypto wallet? It’s where you’ll keep your digital cash. Secure it like you would your physical wallet. Scams and frauds are out there, ready to trip up beginners. Learn the signs and steer clear.

One last thing: the crypto market is a rollercoaster. Brace for ups and downs. Keep an eye on the news. It often drives the crypto markets. Engage with crypto community forums too. They’re gold mines for tips and support.

To wrap it up, remember: learn the ropes, don’t yield to hype, manage risks carefully, and march to a disciplined strategy. Good luck on your crypto journey!

Risk Management and Diversification for Crypto Beginners

Implementing Cryptocurrency Risk Management for Beginners

Risk is big in crypto trades. You need to check how much you can lose without a sweat. Only use money you can afford to let go. This keeps you safe if prices fall. It’s like wearing armor. You’re ready for attacks on your cash.

Next, learn about “stop-loss orders.” They are like safety nets. If your coin falls to a price you set, it sells right away. This can limit your losses. It’s like having a guard that says, “That’s enough!” once a line is crossed.

There is also the “only invest in what you know” rule. Study coins before you buy. This means reading a lot and asking questions. Try to find out how coins work, what they aim for, and who makes them. This knowledge helps you choose better.

Remember, scams and cons are everywhere. They can strip you of your coins. Be cautious of offers that sound too good to be true. Research and double-check before you hand over your crypto.

The Role of Portfolio Diversification in Mitigating Risks

Spreading your money across different coins can shield you from sudden drops. If one coin does poorly, another might do well. So, a weak coin won’t wreck your whole wallet. Think of it like planting many kinds of seeds. Some may not grow, but others will, and your garden thrives.

But how do you choose what to buy? Look for variety. You want coins that don’t follow the same pattern. Some coins might be steady but grow slow. Others might be fast and risky. Having both can balance your chance of winning and losing.

Beginner crypto portfolio diversification is not just about picking coins. It’s about your goals and how long you want to hold. Some folks like to get in and out fast. Others sit tight and wait. Which one are you?

To wrap it up, risk in crypto is a big deal, but you can be smart about it. Use the tools and rules to keep a safe distance from trouble. Keep learning, and don’t put all your eggs in one basket. The key is to stay cool, be patient, and play it smart.

Staying Informed and Secure in Your Crypto Journey

Recognizing and Avoiding Crypto Scams and Frauds

When you step into the crypto world, it’s like exploring a vast forest. Scams and frauds can be the hidden traps. Learn to spot them. Here’s what to watch for:

Fake websites: Always double-check the URL. A slight misspelling can lead you to a scammer’s den. Look for the secure “https://” and a padlock icon.

Phishing emails: Never click on unknown links. Scammers trick you to give up your keys. They’ll take your coins in a blink.

Too good to be true: High returns with no risk? That’s a lie. Reality is, all investments have risks. If it sounds perfect, it’s a trap.

Unverified apps: Use only trusted apps. Scammers might offer fake ones to steal from you. Research and use official app stores to stay safe.

To stay ahead, ask yourself, “Does this seem legit?” If not, back away and research. Your caution is your shield in crypto.

Utilizing Crypto Community Forums and Reliable Information Sources

Community is your crypto compass. It guides you to safe and smart choices. Meetings, forums, and online chats can help you learn. They’re where newbies and pros share and grow. Use the community to confirm if something is real or not.

Here’s how you can use forums:

Ask questions: No question is too simple. Ask and learn from others.

Share stories: Got a cool crypto experience? Share it. You might help a fellow investor.

Check facts: Heard something new? Run it by the community. Someone might have the scoop.

Learn from pros: Some traders are like crypto wizards. They know the spells to grow funds.

For new tips and solid facts, check CoinDesk or Cointelegraph. Read and understand the journey before you.

So, remember, scams are the blight of the crypto world. Spot them with a keen eye and ask for wisdom from your community. Trust in verified sources to keep your journey safe. Stay smart, stay secure, and let the adventure of crypto investing begin!

We’ve covered a lot of ground in this blog post. We started with the basics of cryptocurrency and how blockchain works. You now know what crypto is and how it functions. Then, we dove into how to start investing wisely, focusing on smart, disciplined strategies. We learned that to succeed, it’s crucial to avoid rookie trading errors.

We also discussed managing risk and why spreading your investments matters. This helps you not lose everything if one investment fails. Finally, we stressed the importance of staying safe. You’ve got tips for spotting scams and finding good info in crypto communities.

The world of crypto can be thrilling, yet challenging. With the right knowledge from this post, you’re set to explore it with confidence. Dive in, stay sharp, and grow your skills. The crypto journey is worth it – and so are you.

Q&A :

What are the common mistakes beginners should avoid when investing in cryptocurrency?

Investing in cryptocurrency can be exciting, but it’s important for beginners to navigate this volatile market with caution. The common mistakes to avoid include failing to conduct thorough research, investing more than one can afford to lose, not diversifying one’s portfolio, neglecting security best practices such as using two-factor authentication, and having a short-term mindset in what is typically a long-term investment.

How can beginners educate themselves before investing in crypto?

Before taking the plunge into crypto investing, beginners should focus on educating themselves. This can involve learning the basics of blockchain technology, understanding different types of cryptocurrencies and their use cases, and following reputable news sources and industry experts. Free online courses, webinars, podcasts, and community forums can also provide valuable insights and foster a deeper understanding of the market dynamics.

What should I consider when creating an investment strategy for crypto?

Creating an investment strategy for cryptocurrency involves several key considerations. Define clear investment goals and time horizons, assess your risk tolerance, and commit to only investing an amount you’re comfortable with potentially losing. Additionally, diversify your investments rather than putting all your funds into a single asset, stay informed about market trends, and be prepared to adjust your strategy as you gain more experience. Establishing stop-loss orders can also help manage risk effectively.

Why is it important to diversify my crypto investment portfolio?

Diversification is fundamental to mitigating risk in any investment portfolio, and this is especially true for the highly volatile crypto market. By spreading your investments across different assets, you reduce the impact of a single cryptocurrency’s performance on your overall portfolio. This strategy can help cushion against market downturns and provide exposure to multiple cryptocurrencies that may have different growth potentials.

What security measures are vital for crypto investors to implement?

For crypto investors, implementing robust security measures is crucial to protect investments from theft and unauthorized access. Key practices include using hardware wallets for storing cryptocurrencies offline, activating two-factor authentication, regularly updating passwords, and being cautious of phishing attempts. It’s also important to use trusted and secure internet connections and to be wary of unsolicited investment advice or too-good-to-be-true schemes to avoid fraud and scams.