**Navigating the maze of crypto exchanges can seem like cracking a high-tech vault. But don’t stress – mastering how to choose a cryptocurrency exchange is simpler than it sounds. Our wallet-friendly guide dives deep, equipping you with razor-sharp tools to slice through the jargon. You’ll learn how to weigh liquidity and fees, and why security seals the deal. We’ll also help you decide between the hands-on approach of decentralized platforms or the full-service experience of centralized counterparts. Get ready to pair up with a crypto exchange that meshes with your financial flow and stands by your side. Buckle in, because this is where your savvy investor journey takes a strategic leap forward!

Understanding the Landscape of Digital Currency Trading Sites

Assessing Exchange Liquidity and Volume

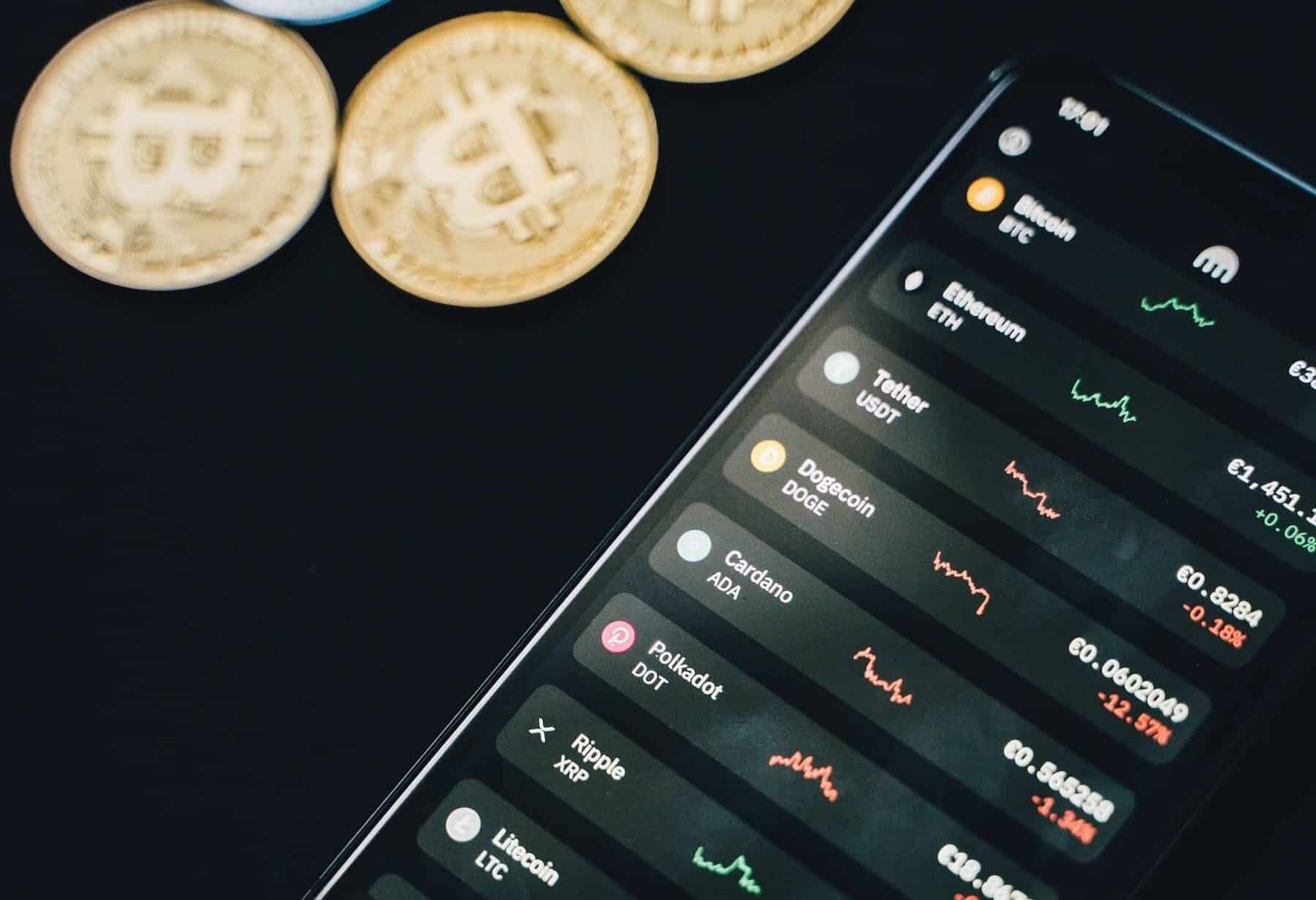

When picking a crypto platform, you must look at the exchange’s liquidity. This means how easily you can buy or sell without affecting the price too much. High liquidity means quick trades and better prices for you. A spot with top-rated liquidity means a lot of people use it, making it a trusted place for your money.

For example, a big platform like Binance has lots of users and trades. Because of this, you can make big deals fast, and the price won’t jump around. This is good for you. On the other hand, a smaller spot with less action can make trading hard. The prices might swing up or down more.

You can see how much a place trades by looking up its volume. Think of volume like a busy shopping mall. A mall with more people has more shopping, right? Same for exchanges. More volume means more folks are trading, which is good when you’re putting your money in. You can look online to compare different places and see where the most trading happens.

Exploring Fiat to Crypto Exchange Options

Now let’s talk about changing your cash to crypto. You want an exchange that makes this easy. It’s good when a spot lets you use your own money to buy crypto. This is called fiat to crypto option.

Some sites only let you trade crypto for crypto. But others let you use dollars, euros, or other cash to buy Bitcoin and more. This is great for starting out. Not all places do this, so check first. Places like Coinbase are known for letting you use cash to get started in crypto.

To use your money, a place will ask for some info, like your ID. This is part of the rules they follow to keep things safe and legal. It’s called KYC, or Know Your Customer. It might feel like a hassle, but it actually helps keep your money safe.

So when you’re looking at where to trade, always check if you can use cash and what the rules are. Then you’ll know you’re picking the right spot to turn your hard-earned money into digital coins.

Remember, trading crypto is exciting, but know what you’re getting into. Take the time to learn and pick the right place to trade. Look for high volume and easy ways to use your cash. This way, you make smart moves, keep your money safe, and maybe even have some fun as you join the future of money.

Evaluating Cryptocurrency Exchange Criteria

Comparing Crypto Exchange Fees

When selecting a crypto platform, fees are key. Low fees mean more money stays with you. Every digital currency trading site has different fees. Look for a crypto exchange fees comparison online to help. It’s smart to compare a few sites. This way, you find the best deal for your trades. Lower fees are often found at top-rated crypto exchanges.

But fees aren’t just about trading. Some sites charge for deposits or withdrawals. Remember to check these too. They can add up. Choose a place with clear fee info. It saves headaches later.

Examining Security Features of Crypto Exchanges

Security is much more than a good password. It is everything in the crypto world. You need a trusted digital currency exchange that protects your coins like a dragon hoards treasure. Does the site use cold storage? This means they keep most money offline. It’s safer that way, away from hackers. Check if there’s insurance. Just in case something goes wrong, you want to know you’re covered.

But security has other parts, too. Like KYC. Know Your Customer. It’s a sign they follow rules to keep out bad actors. And strong customer support matters. If a problem pops up, good support is your best friend.

User reviews of cryptocurrency exchanges are great for real-life insights. Look for patterns in what people say. If many report issues with security, that’s a red flag. Major exchange hacks history can tell you a lot. If a site’s been hacked before, they should’ve upped their game. If not, better keep looking.

Last thing, always check for updates on the site’s security. Stay in the know. Be safe, not sorry. Your smart moves today protect your coins tomorrow.

Centralized vs. Decentralized Platforms: Choosing What’s Best for You

Benefits and Risks of Decentralized Exchanges

Deciding between a decentralized or centralized exchange is like picking sneakers or dress shoes. Both work, but it depends on your day. Decentralized platforms give you more control. No one holds your assets but you. This feels great, right? But here’s the flip side. You must manage your own security. If you’re new to this, it’s like walking a tightrope without a net.

Let’s say you lost your password or got hacked. On a decentralized exchange, help is limited. You might lose your coins with no way to get them back. Sure, these platforms have fewer hoops to jump through. You can trade directly with others. There’s no need to share personal info, and that’s a win for privacy lovers.

Still, these exchanges can be tricky to use. They may not have the same support you’d find elsewhere. And, they might not offer as many types of coins to trade. So, think hard. Are you okay with these risks? If not, you might lean towards a centralized exchange.

Regulatory Compliance and Insurance in Centralized Exchanges

Centralized platforms are like banks for your digital coins. They keep an eye on your assets. They must follow rules set by governments to stop bad stuff like money laundering. This means doing what’s called KYC, which stands for “Know Your Customer.” You’ll need to prove who you are. It’s another step, but it helps keep things above board.

Another big thing is insurance. Some centralized exchanges offer it. This means if something terrible happens, like a hack or a shutdown, you might not lose all your money. This peace of mind can be worth the extra steps to use these exchanges.

They also have people ready to help you if you run into trouble. Plus, you can trade many different coins. If you want to buy a coin that’s not well-known, these exchanges are your best bet. And if you need to switch your dollars to crypto, they make it easy.

But remember, fees are part of the deal here. Some folks don’t mind, but others want to keep every penny. It’s vital to check out the costs before you jump in. Also, top-rated exchanges might slow down when tons of people are trading at once. Be ready for this, especially if you need to move fast.

Choosing between a decentralized or centralized exchange comes down to what you value most. Do you want full control with more risk? Or would you rather have less control but more safety nets? Weigh your options, check out user reviews, and make the choice that best matches your crypto journey. Remember, smart investors think long-term and choose wisely based on their needs.

User Experience and Support: Finding a Reliable Trading Partner

Ease of Use and Customer Support Quality

When you’re picking a crypto platform, think of it like finding a new friend. It should be easy to talk to, always available, and super helpful. Let’s not forget, a friend that makes things hard isn’t much of a friend, right? The same applies when selecting a cryptocurrency platform.

The ease of use is key. You want a site that’s simple to navigate. This means clear menus, easy access to your wallet, and no headaches when buying or selling your digital dollars. If you’re tripped up on the first step, chances are it’s not going to get easier.

Now, about customer support. Imagine hitting a snag at 2 AM. You’d want someone to help you out right away. Look for exchanges that have 24/7 support. Live chat, phone help, or even quick email responses can save your skin when you most need it. Check user reviews to see if the support team really stands by you, or leaves you out in the cold.

Trading Pair Availability and Navigation of Geographic Restrictions

Ever been to a store with just a few things on the shelf? It’s the same with digital currency trading sites. You want a place that offers a variety of trading pairs. More options mean you can switch, trade, and invest as you like. Think of it as a crypto candy store – the more choices, the better!

But don’t forget the rules. Some places say a big “no” to certain coins or exchanges. It can be a real bummer if you sign up and then find out you can’t trade because of where you live. Avoid the hassle. Check up front if the exchange works in your country and offers the coins you’re after.

Geographic restrictions can be tricky, but the right site makes it a piece of cake. They tell you straight up what’s allowed and what’s not. No guesswork means no nasty surprises later on.

Here’s the bottom line: a trusted digital currency exchange gives you a smooth ride and a helping hand when you need it. So, take the time, compare those crypto exchanges, and find your perfect trading partner. It’s like choosing a good buddy – with the right one, you’re set for some great times ahead!

In this post, we’ve walked through the essentials of digital currency trading sites. You now know to check an exchange’s liquidity, volume, and whether it supports swapping your cash for crypto. Costs matter too; always compare fees before you dive in. Don’t overlook security—your money’s safety is key.

Centralized platforms offer some peace of mind with regulations and insurance, while decentralized exchanges give you more freedom but come with risks. Think about what fits you best.

And let’s not forget, trading should be hassle-free. Pick a partner that’s easy to use and has your back with solid customer support. It’s also smart to ensure the site works where you are and offers pairs you want to trade.

Remember, you call the shots. Choose an exchange that matches your need for safety, cost, and comfort. This choice will shape your trading journey. Choose wisely and trade confidently!

Q&A :

What factors should be considered when selecting a cryptocurrency exchange?

When choosing a cryptocurrency exchange, it’s important to consider various factors that align with your needs and priorities. Security is paramount, so look for exchanges with strong track records of safeguarding user funds and personal data. Check the exchange’s liquidity to ensure you can buy and sell assets with minimal slippage. Additionally, consider the exchange’s fee structure, supported cryptocurrencies, user interface, and customer support quality. Regulatory compliance and the geographical restrictions of the exchange should also be taken into account, as these can affect your ability to trade.

How important is security in a cryptocurrency exchange?

Security should be a top priority when selecting a cryptocurrency exchange. Ensure the platform implements robust security measures such as two-factor authentication (2FA), encryption technology, cold storage options, and mandatory identity verification processes for users. Investigate the exchange’s history of security breaches and how they have handled past incidents. Trustworthy exchanges will be transparent about their security protocols and actively work to protect user assets against hacks and other threats.

Are fees a major consideration in choosing a cryptocurrency exchange?

Yes, fees are a significant consideration. They can vary widely between exchanges and impact the overall cost of trading. Look closely at the fee structure, which can include trading fees, withdrawal fees, and any other service charges. Some exchanges offer lower fees for high-volume traders or users who hold a certain amount of the exchange’s native currency. Understanding the fee structure can help you manage costs effectively and maximize your returns.

Does the usability and interface of a cryptocurrency exchange matter?

The usability and interface of a cryptocurrency exchange are critical, especially for beginners. A well-designed, intuitive interface helps users to navigate the platform efficiently, execute trades, and access essential features without confusion. It’s also beneficial for the exchange to have a mobile app or a responsive website for trading on the go. For advanced traders, the availability of sophisticated trading tools and charting options is necessary. Try demo versions or explore tutorials if available to get a feel for the platform’s usability before committing.

How do I find out if a cryptocurrency exchange is reputable?

Researching the reputation of a cryptocurrency exchange involves reading reviews from other users, exploring community feedback on forums like Reddit, and checking if the exchange has been subject to regulatory actions. Look at the exchange’s history, how long it has been operating, and its track record during market volatility. News articles and press releases can provide insight into the company’s stability and how it manages operational issues. Moreover, a reputable exchange should offer transparency in its business practices and maintain open lines of communication with its user base.