Cryptocurrency Security Issues: Navigating the Digital Minefield Safely

Buckling up for an online cash ride? Hang tight. Cryptocurrency security issues can bump your ride. Think digital wallets are bulletproof? Think again. Hackers eye them like candy. Heard of blockchain? It’s robust. But even Fort Knox invites dreamers. Hacking stories fill headlines, and they’re not tall tales. It’s a real threat. And I’m here to guide you. Through my lens, we’ll dive deep, skip the jargon, and you’ll learn to keep your digital treasure locked tight. Let’s start this journey and make sure your crypto voyage doesn’t hit the rocks.

Understanding Cryptocurrency Threats: Blockchain Vulnerabilities

Common Exploits in Smart Contract Code

Smart contracts power the world of crypto. They are like self-run programs that manage money. But they can have faults just like any system. Hackers love to find these smart contract flaws. They use them to steal or mess up digital deals. We call these flaws exploits. Some are small, others huge. All can hurt trust in crypto.

To stop hackers, we look for bugs before contracts go live. This means checking every bit of the contract’s code. Think of it like proofreading an essay. But instead of grammar, we’re fixing security holes. With good checks, we can stop most smart contract issues. It’s a battle of wit against sneaky hackers.

Mitigating Risks of 51% Attacks on Proof of Stake Networks

You may wonder, what’s a 51% attack? It’s when someone gets more than half of a network’s power. In proof of stake networks, this means owning more than half of the coins. If they do, they can control the network. They can stop new transactions or redo old ones. It’s like they become king of the coin.

We avoid this by spreading power wide among many users. No one person should have too much. It’s the idea of strength in numbers. In these networks, to try a 51% attack, you’d need a lot of coins. It makes the attack too costly to even try. The law of crypto is simple: spread power to keep money safe.

In these risks, knowledge is our best shield. The more we learn, the better we can protect our crypto world. We all must do our part, from coders to coin owners, to keep crypto safe and fair.

Protecting Your Crypto Assets: Digital Wallet and Exchange Security

Overcoming Digital Wallet Risks and Hot Wallet Threats

Everywhere you go, hot wallets are like open pockets. Grabby hands can find ways in. So you lock them tight. You stay sharp online, and never share your secret keys. They open your money doors, so you hide them good. Think of hot wallets like your day purse. Only carry what you need. For a big stash, go cold. Cold wallets are like your safe at home. Tough to crack! They make sure your big money stays put. But stay on your toes. Bad folks craft tricks with fake apps. Scary, right?

But we’re smarter. We use our eyes, check every link, and trust no strange emails. They’re just bait. Hackers throw their hooks, named phishing, hoping to catch us. Phishing is when they fake being your pal to steal your money secrets. No clicks on odd stuff. Keep your computer clean, and your crypto cleaner.

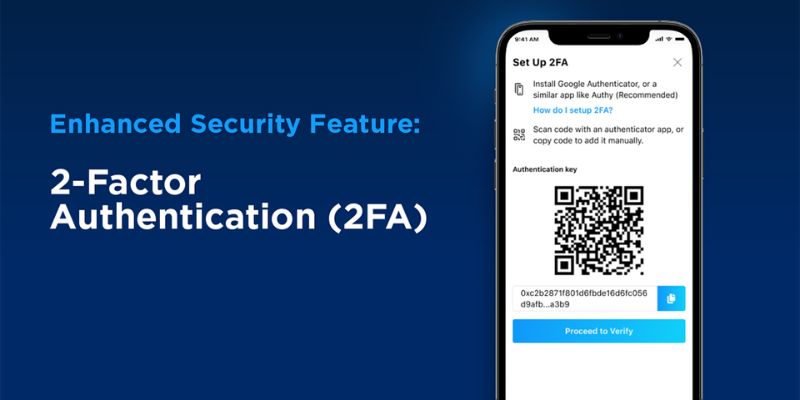

For trades, pick only the best platforms. The ones with armor. They check who comes in, and don’t let just anyone play. You know, the ones with the tight security questions. They’re not nosy; they keep your coins safe. They also do cool handshake tricks. It’s called two-factor authentication, and it’s a secret handshake that only you and the good trading folks know. Use it. It’s another lock on your money door. And keep your eyes open for sneaky scams that whisper sweet lies about quick, big money. They’re just empty promises with a dash of theft.

Preventing Crypto Exchange Hacking Incidents and Trade Platform Vulnerabilities

Exchanges are like big money parties, and hackers wanna crash them. They look for windows to sneak in, or dress up like guests with SIM swaps. That’s when they act like you and try to grab your invite. And sometimes they bust in with malware. It’s their nasty software that mucks up the party for everyone. And stealing happens.

When you pick a place to trade, think of a fortress. It should have thick walls. Look for platforms that talk big about fighting hackers. They’ll brag about stuff like bug bounties, where they pay folks who find cracks in their walls. And when you sign up, they’ll make sure you’re you. It’s called KYC, or “Know Your Customer.” It’s like them giving you a once-over to check you’re not a party crasher.

Your job is to keep the keys to your castle safe. Your private keys need a good hiding spot. Same with your seed phrase, a magic spell that gets your wallet back if lost. Write it down, lock it up, and never say it out loud. And keep an eye on what’s going on. If your crypto starts walking away without you, act fast. Tell the exchange, and they’ll help stop the getaway. Remember, you play the hero in your own money story. So wear that cape with pride, stay sharp, and keep your coins out of the bad guys’ hands.

The User’s Shield: Best Practices for Personal Crypto Security

Two-Factor Authentication and Multisignature Wallets

Keeping your crypto safe starts with you. Always use two-factor authentication. It’s like a two-lock system on your crypto account. You need two keys to get in. It could be something you know, plus something you have. For example, a password and a code from your phone. This secures your account more than a password alone.

Two-factor authentication can stop hackers in their tracks. Even if they steal your password, they can’t get into your account. Because they don’t have the second key. This is one of the simplest, most powerful tools in your personal crypto security kit.

But what about storing large sums of crypto? For this, multisignature wallets are key. Think of this as a safe that needs multiple keys to open. No single person can unlock it alone. This spreads the risk. If one key gets lost or stolen, your assets stay safe. You need a few trusted people to agree to open the safe. Multisignature wallets are great for teams or for your own high-security storage.

The Importance of Seed Phrase Protection and Private Key Management

Your seed phrase is a master key. It’s a set of words that can unlock your crypto wealth. So, you must keep it safe at all costs. Write it down on paper. Keep it somewhere only you know. Don’t share it online or with strangers. This is crucial to prevent unauthorized access to your funds.

Think of the seed phrase as the heart of your wallet’s security. If someone gets your seed phrase, they can take everything. It’s that serious. Make sure you guard it with care.

Private keys are the individual locks on your blockchain assets. You own the key, you own the asset. Simple as that. But if you lose the key, you lose the asset. It’s like dropping your house key in the ocean. Goodbye house. That’s why you have to manage private keys with extreme caution. Use secure cryptography practices. Store them in a safe place, like a locked drawer or a personal safe.

If it’s too much to handle, get help. Learn from trusted resources. Use trusted hardware devices like hardware wallets. They can keep your keys offline and safe from online threats.

To sum it up, your digital coins depend on your actions. Turn on two-factor authentication. Consider multisignature wallets for big amounts. Protect your seed phrase like a secret treasure. Manage your private keys with care. Take these steps, and you’ll put up a strong shield against many crypto dangers.

Evolving Threats: From Social Engineering to Quantum Computing

Addressing the Rise of Phishing Attacks and Social Engineering Scams

Phishing attacks trick you into giving up key info. They steal your crypto that way. Hackers love to use emails, fake websites, and messages that look real. They ask for your private keys or login info. Never share these. If you do, thieves can grab your funds fast.

To stay safe, check emails and websites carefully. Look for odd links or mistakes in spelling. Use two-factor authentication for an extra safety layer. This means even if crooks get your password, they can’t get into your account without another code. Usually, this code comes to your phone or an app.

Now, let’s talk about a scary scam called SIM swapping. This is when someone tricks your phone company, takes over your phone number, and gets your two-factor codes. To beat this, use an authenticator app, not texts, for two-factor codes. That way, your codes stay safe even if your phone number is stolen.

Also, watch out for fake crypto offers and pump and dump schemes. If someone promises huge, quick profits, it’s likely a scam. These cons pump up a coin’s price, then sell their share, and the price drops. So you lose money. Always research offers and don’t rush into investing.

Preparing for the Implications of Quantum Computing on Cryptocurrency Security

Now, quantum computing is a future risk for crypto. It’s a new tech that can solve complex problems super fast. And that includes cracking codes that keep your crypto safe. But don’t worry, it’s not a problem yet. Scientists are still working on making these computers practical.

What can you do? Keep learning about secure cryptography practices. Blockchain and crypto folks are also getting ready. They’re working on new, quantum-resistant encryption. So, the key is to stay updated on tech news and changes in the crypto world.

Remember to use cold storage for your crypto. This means keeping it offline, away from hackers. Think of it like a safe in your home. No one can reach your funds without physical access. Cold storage devices, like hardware wallets, are a smart choice to lock down your crypto.

Last, keep your software updated. Whether it’s your digital wallet or trading platforms, updates often patch up security holes. By staying up-to-date, you help keep your crypto out of reach from new threats.

So, watching out for phishing, using tough security like two-factor, avoiding scams, and keeping an eye on quantum tech can keep your crypto safe. Remember, this digital world is always changing, so stay sharp and informed.

In this article, we’ve explored how to stay safe in the crypto world. We looked at blockchain flaws, like smart contract bugs and ways to stop 51% attacks. We also covered how to protect your digital money, focusing on wallet and exchange security to block hackers.

We dived into your own defenses, stressing how vital two-factor authentication and private key care are. And we eyed the future, preparing for threats like scams and quantum computers.

Always remember: your crypto safety rests in your hands. Keep sharp, use what you’ve learned, and secure your digital wealth. Stay safe out there!

Q&A :

What are the most common security threats in cryptocurrency?

The digital landscape of cryptocurrencies faces several security threats, including phishing attacks, where scammers trick users into revealing sensitive information, and hacking of exchanges or wallets, leading to direct theft of funds. Another prevalent risk is the presence of malware designed specifically to steal cryptocurrencies, and the potential for 51% attacks, where a miner or group of miners gain control of more than 50% of a network’s computing power, allowing them to manipulate transactions.

How can individual investors protect their cryptocurrency investments from potential security breaches?

Individual investors can bolster their defenses against security breaches by employing robust measures, such as using hardware wallets for storing cryptocurrencies, which are less susceptible to online hacking. Activating two-factor authentication (2FA) wherever possible provides an additional layer of security. Investors should also regularly update their software, use strong, unique passwords, and be vigilant against phishing attempts by double-checking URLs and not clicking on suspicious links.

What impact do security flaws have on the overall cryptocurrency market?

Security flaws can significantly impact the overall cryptocurrency market by undermining trust in digital assets, leading to reduced investor confidence and potential market volatility. High-profile security breaches or thefts can prompt fear, uncertainty, and doubt (FUD) among investors, which may result in sell-offs and price drops. Furthermore, regulatory bodies might impose stricter regulations in response to such incidents, affecting market dynamics.

Is there a difference between the security of various cryptocurrencies?

Yes, there can be significant differences in the security measures and protocols of various cryptocurrencies. For instance, cryptocurrencies like Bitcoin, which utilize proof-of-work (PoW) consensus mechanisms, are typically more secure due to the significant computational power needed to compromise the network. Alternatively, newer and less established cryptocurrencies might be more vulnerable if they lack sufficient network size or robust security protocols. Moreover, the code base and development practices of the respective cryptocurrency teams can also impact security standards.

How does blockchain technology address cryptocurrency security issues?

Blockchain technology enhances cryptocurrency security through its decentralized structure and cryptographic principles. Each transaction is recorded on a block and linked to the previous one, creating an immutable and transparent transaction ledger. The decentralized nature of blockchain means there is no central point of failure, making it harder for malicious parties to manipulate the system. Furthermore, consensus algorithms (such as PoW or proof-of-stake) require the validation of transactions by multiple network participants, reducing the risk of fraudulent activity. However, blockchain does not inherently protect against user error or security threats at the point of user interaction, such as phishing or compromised private keys.