Hot wallets vs cold wallets: it’s the ultimate showdown in the cryptocurrency universe. Imagine standing at a crossroads, one path lined with the ease of instant access and the other, a secure vault untouched by the chaos of the online world. Your digital fortune hangs in the balance. As a crypto enthusiast, you know this isn’t just about choosing a storage method—it’s about crafting a strategy to shield your assets from digital bandits while maintaining quick-draw access. Dive deep with me as we untangle the knots of convenience and fortress-like security. Whether you’re making your first trade or your thousandth, understanding the ropes of crypto storage is not just smart; it’s essential. I’m here to guide you through the murky waters of hot and cold wallets, so you can navigate the high seas of digital currency with confidence.

Understanding Hot Wallets: The Basics of On-the-Go Crypto Management

Defining Hot Wallet Accessibility and Convenience

Hot wallets are like a wallet in your pocket. They hold your digital coins so you can use them any time. You can find them as apps on phones or programs on computers. They need the internet to work, which makes them handy. Think fast shopping or trading. It’s as simple as sending a text. But each hot wallet has its setup steps. Make sure to follow them to keep your coins safe.

With hot wallets, moving crypto is quick. They fit right in with our busy lives. You click a few buttons, and off your crypto goes. Hot wallets work with many kinds of devices, from phones to laptops. Many hot wallets are free, making them a good pick for folks new to crypto.

Highlighting Common Hot Wallet Vulnerabilities and Risks

Now, let’s get real about the risks. Hot wallets connect to the internet. That’s what makes them less secure than cold wallets. Hackers are out there, always poking around for a chance to steal. They use tricks like fake websites or nasty software to swipe your crypto.

Theft isn’t the only worry. Sometimes, the places that hold your hot wallets might get hacked. Then, your coins could be gone in a snap. Remember, in the crypto world, once your coins are stolen, getting them back is rare. So, what you do to keep them safe really matters.

Always update your hot wallet when new versions come out. These updates often have fixes for security holes. And if you see any alerts about hackers or scams, pay attention. Keeping your coins safe is about staying sharp and knowing the risks.

Remember, hot wallets are best for small amounts of crypto. Think of them as your daily spending money, not your life savings. For bigger amounts, cold wallets are safer. But we’ll save that talk for another time. For now, know that hot wallet convenience comes with a need to be careful.

Exploring Cold Wallets: The Vault for Your Digital Assets

Cold Storage Setup and the Different Types of Cold Storage Solutions

When you step into the world of cryptocurrencies, knowing how to keep your digital coins safe is key. Think of cold wallets as a safe-deposit box for your digital fortune. These are handy when you’re not planning to spend your crypto soon. They work offline, far from the grasp of online hackers.

First off, what types of cold storage solutions exist? You’ve got paper wallets, hardware wallets, and even USB drives. Paper wallets are just that — your crypto keys printed on paper. They’re easy to store but can be hard to use when you need to move funds. Hardware wallets are like tiny, ultra-secure computers you can connect to your desktop or laptop to manage your crypto. They’re tough to hack since they’re not online when you’re not using them.

USB hardware wallets come next. They’re small, carry your keys, and plug into computers when you need to make a transaction. Some fear losing them, but they are often equipped with ways to recover your assets if that happens. Remember, for any cold storage, writing down your recovery seed phrase is crucial. This is a unique set of words that can bring your wallet back if your device is lost or broken.

The Benefits of Cold Wallet Protection for Long-Term Storage

Now, let’s talk perks of using a cold wallet for the long haul. The main win here is top-notch security. No internet means no access point for digital thieves wanting to swipe your stash. Less day-to-day hassle, too. With cold wallets, you don’t need to worry about software updates or phishing scams.

Another huge plus — control. Your crypto stays in your hands, not with some company that could mess up or get hacked. Peace of mind? You bet. And even though they sound like they should be in the freezer, cold wallets just keep your coins offline and secure. Simple, right?

Also, let’s not forget hardware wallets’ durability. Many can shrug off water and drops. Your mobile phone, not so much. And with cold wallets, things like transferring your assets to heirs get simpler. All they need is the key or that recovery phrase.

In short, cold wallets are your best bet for secure crypto storage that’s tough, controlled by you, and carefree. Sure, they can be pricier than software or mobile wallets, but isn’t the safety of your digital fortune worth it? Think of it as the ultimate wrapper for your digital candy. For crypto you won’t touch daily, cold wallets are the way to go, hands down.

Comparing Security Protocols: Ensuring Cryptocurrency Wallet Security

Wallet Encryption Methods and Multi-Signature Wallets

We know you care about keeping your crypto safe. You lock your doors, right? So think of wallet encryption methods as high-tech locks for your digital coins. Just using a password might not cut it these days. Hackers are smart, but we can be smarter.

Let’s break it down. Encryption means scrambling your wallet data so only you can read it. Just as you wouldn’t leave your home keys lying around, don’t share your wallet’s private keys or passwords.

Now, ever have more than one key for a lock? That’s what multi-signature wallets are like. You need at least two keys to open up your crypto treasure chest. This means if one key is stolen, your coins stay put. Safe and sound.

Having multiple people hold different keys can also be a wise move. Think about it like a team sport – teamwork makes the dream work. This spreads the responsibility and the risk, making it tougher for thieves to score a goal against you.

Surviving Online Wallet Hacking Incidents: Lessons in Secure Crypto Storage

Now, no one wants their money to vanish into thin air. When it comes to secure crypto storage, we’ve seen some real nightmares. Online wallet hacking incidents make headlines, and they are the boogeyman of the crypto world.

Think of online wallets like your wallet in your back pocket. It’s super easy to use, but what if someone picks your pocket? Hot wallet advantages like quick access and ease of transfers are awesome, but with great power comes great responsibility.

Learn from the misfortunes of others. Use different passwords for different services. Look around – scammers are tricky. Don’t click on shady links or share your screen with strangers. Keep your computer and mobile device up to date with antivirus software.

And don’t forget, chuck some of your coins into cold storage. Like a secret vault in a mountain, it’s offline and super safe. Sure, it’s less convenient when you want to move your crypto quickly, but if you plan to save for a rainy day, cold storage benefits like a fortress for your funds can’t be beaten.

To sum it up, protect your crypto like you would a golden egg. Use smart encryption and multi-signature wallets. Don’t get spooked by the online wallet boogeyman – learn the secure storage dance. And remember, mixing a bit of hot wallet convenience with the solid security of a cold wallet might just give you the best of both worlds. Stay safe, crypto friends!

Best Practices for Managing Your Cryptocurrency Portfolio

Balancing Hot Wallet User Experience with Secure Digital Asset Management

Think of hot wallets like your wallet in your pocket. It’s got cash or cards you use every day. Hot wallets work the same way but with cryptocurrency. They are easy to use and are always online. This is great because you can quickly send and get coins. However, being online all the time can be risky. Hackers are always looking for a way in.

Keeping your digital coins safe means finding a middle ground. You want your hot wallet handy for daily trades or buys. Yet, you also want your stash secure. Start with a reputable hot wallet service. Make sure you use a strong, unique password. Turn on two-factor authentication (2FA) for better security. This adds an extra step but also a strong layer of defense against unwanted guests.

Use your hot wallet for what you might spend or trade soon. Like grabbing a coffee, you only need a little cash on hand. For big amounts, look towards cold wallets for safety.

Implementing Cold Storage Strategies and Creating a Crypto Wallet Backup Plan

Now, let’s talk cold storage, your personal crypto safe. It’s like a bank’s vault for your digital wealth. Cold wallets keep your crypto offline. This means no internet, no hackers, pure peace of mind. It’s meant for saving, not spending. You store what you don’t plan to use right away.

The hardware wallet is a popular type. Picture a USB stick that holds your crypto. You can tuck it away in a physical safe or a secure place at home. Make sure to back up your wallet too. This often means writing down your wallet seed phrases. Keep these safe like a treasure map; they’re the key to your coins if things go wrong.

Another safe type is a paper wallet. It’s simple but secure. It’s just your crypto address and private key on paper. But, if you lose it or it gets damaged, your crypto could be gone for good. That’s why backups are critical.

Your backup plan should also include checking on your cold storage now and then. Make sure it’s still safe and works as it should. Encryption is your friend here. Encrypt your wallet with a strong passphrase. Remember, no one but you should know this passphrase.

For super safety, think about multi-signature wallets. These need more than one key to open. This is like a safety deposit box that needs two keys at the same time.

Alright, keeping crypto safe is all about balance. Use hot wallets for ease and quick access. Save the bulk of your fortune in cold wallets. Oh, and always back up, encrypt, and stay smart with your digital dough. It’s a wild web out there, but your crypto doesn’t have to be at risk.

Alright, here we go. In this article, we checked out hot wallets and their ease of use. We also looked at the risks. You learned about cold wallets too – they’re like secure vaults for your digital cash. I explained the tough security steps you need to keep your crypto safe. Plus, we talked about how to keep a cool head if hackers strike.

We compared wallet security and shared best practices for managing your crypto stash. Remember, mix hot wallet access with cold wallet safety. Get a backup plan, and stay sharp. Smart crypto handling is about balance – quick use and solid security. Stick with these tips, and you’re set to manage your digital dollars like a pro. Keep your crypto safe and be wise with your wallet choices. That’s it – go out there and make your crypto work for you!

Q&A :

What is the essential difference between hot wallets and cold wallets?

Hot wallets are digital cryptocurrency wallets that require an internet connection to operate, making them more convenient but also more vulnerable to online attacks. In contrast, cold wallets are offline storage solutions for cryptocurrencies, such as hardware wallets or paper wallets, which provide enhanced security since they are not connected to the internet.

How do hot wallets and cold wallets compare in terms of security?

When it comes to security, cold wallets are generally considered more secure than hot wallets. This is because cold wallets are not connected to the internet, thus reducing the risk of being compromised through online hacking attempts. Hot wallets, while easier to use for daily transactions, are more susceptible to cyber threats like phishing, malware, and remote unauthorized access.

Can I use both hot wallets and cold wallets for my cryptocurrency?

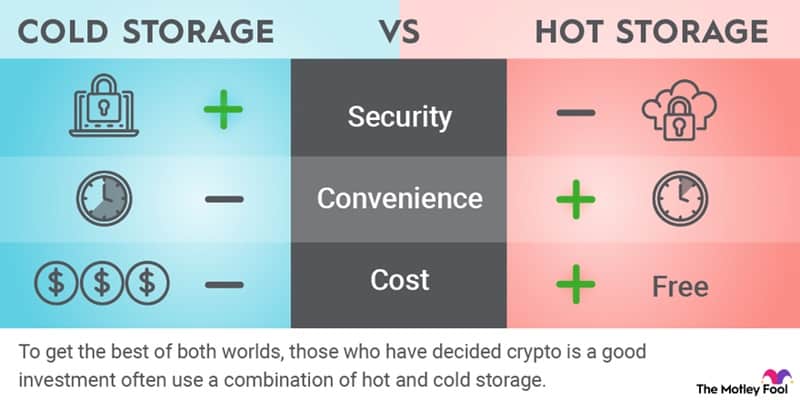

Yes, many cryptocurrency users utilize both hot and cold wallets to manage their assets. A common strategy is to keep a limited amount of cryptocurrency in a hot wallet for regular use or trading, while storing the bulk of one’s assets in a cold wallet for long-term holding and added security. This way, users benefit from both the convenience of a hot wallet and the robust security of a cold wallet.

Which type of wallet should I choose if I’m new to cryptocurrency?

If you’re new to cryptocurrency, starting with a hot wallet might be more user-friendly as they are often easier to set up and use. Hot wallets can be a good option for small amounts of cryptocurrency that you might want to trade or spend. However, as you become more invested or if you’re handling significant funds, it’s recommended to familiarize yourself with cold wallets to better secure your assets.

Are cold wallets completely immune to attacks?

While cold wallets are significantly more secure than hot wallets due to their offline nature, they are not entirely immune to risks. Physical theft, damage, or loss are potential threats to cold wallets. Additionally, users must be careful during the setup process and when transferring funds between wallets to ensure that they do not inadvertently expose sensitive information. It’s crucial to follow best practices for backup and recovery irrespective of the wallet type.