Exploring Liquid Staking in Crypto is diving headfirst into DeFi’s untamed waters. Picture locking up your crypto assets only to find you can still trade them. That’s the genius where staking meets liquidity. We’re opening up this playbook, seeing how it changes the game for everyone in DeFi. From what it is, to why it matters, we’re breaking down how liquid staking pumps new life into your assets. Let’s unravel the mystery, boost our returns, and spot what’s coming next on this wild ride. Strap in; we’re just getting started.

Understanding Liquid Staking and Its Impact on DeFi

What is Liquid Staking and How it Differs from Traditional Staking

What sets liquid staking apart? With liquid staking, you stake coins but also get assets that you can use in DeFi. You don’t have to pick between earning rewards and having liquid assets. It’s like having your cake and eating it too.

In traditional staking, you lock up your coins and can’t use them until you unstake. It’s like a savings account you can’t touch. You earn interest, sure, but what if you need cash now? You’re stuck, right?

Liquid staking changes the game. When you stake, you get special tokens you can trade or use as collateral. So your investment is working hard, but you still get to use the value. It’s freedom and earnings together.

The Role of Liquid Staking in Enhancing Cryptocurrency Liquidity

Why does liquidity matter in crypto? Liquidity lets you buy or sell fast without moving the price too much. It’s vital for a healthy market. With more of it, everyone gets a fair price, it’s easy to trade, and the market buzzes.

Liquid staking pumps liquidity into the system. It unlocks the value of staked coins. Usually, staked coins are out of circulation, but not with liquid staking. Those special tokens I mentioned? They keep the market fluid.

It means your staked coins don’t just sit there. They’re actors in the DeFi world. You contribute to the market’s health and still chase those staking rewards. It’s a win-win for you and the market.

So, as you can see, liquid staking is more than a way to earn on your holdings. It’s a bridge. It links the solid, steadying force of staking with the dynamic buzz of DeFi markets. And that’s a game-changer.

The Mechanics Behind Liquid Staking Platforms

How Liquid Staking Works Technologically

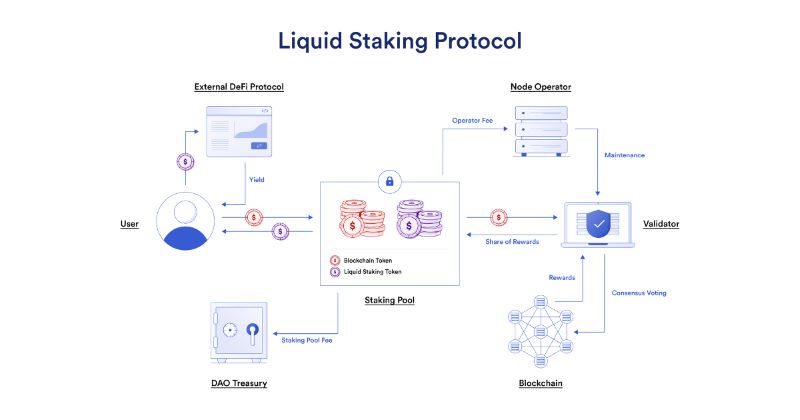

Imagine a magical piggy bank. When you put money in, you can still use it. That’s liquid staking. You stake coins, but get special ones back to use any time. These special coins are proof you staked. They let you trade or use them in DeFi, all while earning rewards. This is how we make money work smarter in crypto.

Liquid staking turns locked coins into useful ones. It uses smart contracts on the blockchain. These contracts are like computer programs that keep your staking safe and running. When you stake, the platform gives you tokens. These tokens represent your staked amount. You can use them to earn in DeFi or swap them when you want. It’s like having your cake and eating it too!

Analyzing the Security of Staking Contracts

Security is a big deal in liquid staking. Think of it as having a strong lock on your money. You must ensure it’s safe. Staking contracts are like security guards for your stake. They lock up your coins safely. A good platform checks their contracts many times. They use audits and guards against hackers.

When you stake, you enter an agreement. It says how your coins are used and kept safe. A secure contract has ways to stop bad things from happening. It also sets rules on how you get rewards and can take out your stake. These rules help make sure you and your coins stay safe.

Staking contracts must face tough tests. Experts look for any weak spots. They do this before you can stake safely. This is to avoid loss from attacks or mistakes. It’s like checking a ship for leaks before sailing.

Now let’s talk trust. The platform’s history of security matters a lot. It builds your trust in them. Seeing that they keep other’s stakes safe makes you feel good about staking yours. A good security record is a green light for your staking journey.

In summary, liquid staking is super handy. It lets you earn while still using your money in crypto. But always remember: security is key. Pick platforms that show they can protect your stake. That way, you earn rewards without worry. And that’s what smart crypto staking is all about!

Maximizing Returns: Strategies for Effective Liquid Staking

Staking Rewards Calculation and Yield Optimization

Want to get more from your crypto without selling it? That’s where staking rewards come in. You lock up coins and earn more as time goes by. But how much more? To figure it out, you need to know reward rates and staking time. It’s like interest from a bank but often better.

To boost your earnings, you pick coins with high reward rates. Join staking pools to get more steady returns. But there’s a trick. You must balance reward and risk. High-reward coins may not always be safe. I aim to find that sweet spot for you. It’s like using a map to find treasure.

Also, mix it up. Don’t put all your eggs in one basket. Having different coins can help you earn more safely. I love showing people how to spread their bets and win.

Selecting the Right Assets and Platforms for Staking

So, how do you choose where to stake? Look for platforms that are known to be secure and trustworthy. Think of it like picking a bank. You want one that keeps your money safe and offers good services.

Next, choose coins that fit your goals. Some coins are great for short-term earning. Others are better for the long game. I want to help you find your perfect match.

Always read the fine print. Know the rules about when you can get your coins back. Nobody likes surprise lock-up periods. That’s why I stress knowing the terms up front.

And remember, not all platforms are the same. Some offer extras that others don’t. Look for ones with bonuses or extra services. It’s like choosing a hotel. Some have free breakfast, others have a pool. Pick what matters to you.

Staking should work for you, not be a hassle. My goal is to help you stake smart and earn big. I get excited thinking about the extra cash you can make. I’m here to guide you to do just that – pocket more coins with a solid plan.

The Future of Staking: Trends and Challenges in DeFi

Advancements in Proof of Stake and Staking on Ethereum 2.0

Proof of Stake (PoS) is a big deal in the crypto world. It’s how new coins are made and how the system stays safe. Ethereum is moving to PoS in its 2.0 upgrade, a huge step for the network. This means instead of using lots of power to mine coins, you can now earn rewards by holding and staking your Ethereum. But how does it change things for you and me? Well, it’s like earning interest in a bank, but on the blockchain.

This shift to PoS also means big things for us who like passive income. With Ethereum 2.0, we get to be part of the action by staking our coins. We’re helping to keep the network secure and getting paid for it. It’s a sweet deal.

But, there are risks, like if something goes wrong with the network, our staked Ethereum could be at risk. Still, many of us are betting on this new change. We believe it’s the future of how we’ll earn with our crypto assets.

Governance and Incentives in Liquid Staking Protocols

Liquid staking is a new star in DeFi. It lets us earn staking rewards without locking up our coins. What’s even cooler is how it works. When you stake your coins with liquid staking platforms, they give you a token in return. This token represents your staked asset, but you can trade it, sell it, or use it in other DeFi stuff. You’re making money and still free to move.

Why are liquid staking protocols taking off so fast? Because they solve a big problem: accessibility. Traditional staking often meant your coins were tied up – sometimes for months. With liquid staking, your assets stay liquid, meaning you can get to them if you need to.

In liquid staking, governance is key. The people behind these protocols decide how things run. The rules they make – staking agreement terms, incentive structures, all that – that’s what gets people like us to join in or not. If the rules are fair, and the rewards are good, they’ll see a lot of us coming.

A good system also depends on good security. With these platforms, the stakes are high—our money’s on the line. So, they work hard to make sure contracts are solid and our assets are safe. Still, it’s on us to do our homework too. We need to know who we’re trusting with our crypto.

And that’s where I come in. I look deep into how these contracts work. I try to pick apart the mechanics and make sure everything’s tight. When I stake, I want to make sure my investment’s as safe as it can be, and that I’m getting a good deal.

From where I stand, liquid staking is a game-changer. By making assets work harder and stay accessible, it opens new doors for earning in crypto. It drills into the essence of DeFi – making finance democratic and available to all, without the old locks and barriers. It’s about giving you and me a better shot at growing our digital wallets. And that, my friends, is worth the dive.

We’ve covered a lot about liquid staking. It’s a new way to earn with crypto, different from the old style. It helps make your coins work for you without locking them up. We looked at how this tech works and why it’s secure.

To make the most money, we learned to pick the best coins and platforms. Keep an eye on how staking is changing things, especially with Ethereum 2.0. And don’t forget, the rules and perks in staking keep evolving.

Thinking ahead, liquid staking could really shake up DeFi. It’s smart to stay informed and ready to adapt. Thanks for reading, and here’s to making good choices in your staking journey!

Q&A :

What is liquid staking in cryptocurrency?

Liquid staking is a process within the cryptocurrency ecosystem that allows token holders to stake their assets to secure a blockchain network while maintaining liquidity. Unlike traditional staking, where assets are locked up and inaccessible, liquid staking platforms issue derivative tokens in exchange for the staked assets. These derivative tokens can then be traded, used in DeFi protocols, or utilized in other ways without forfeiting staking rewards or the security contributions of the original assets.

How does liquid staking differ from traditional staking in crypto?

Liquid staking differs from traditional staking primarily in terms of liquidity. In traditional staking, users lock their tokens in a staking contract to support the network’s consensus mechanism and earn rewards. However, these tokens cannot be used for other purposes while they are staked. With liquid staking, users receive a representative token in exchange for their staked cryptocurrency that they can use elsewhere, providing them with liquidity and freedom to participate in other activities within the crypto space without losing their staking benefits.

What are the benefits of liquid staking in DeFi?

The benefits of liquid staking in DeFi (Decentralized Finance) are numerous:

- Liquidity: Users maintain access to their funds for other investments or for trade.

- Yield Optimization: It enables users to earn staking rewards while simultaneously participating in other yield-generating activities.

- Reduced Opportunity Cost: By being able to use staked funds in other DeFi protocols, users do not have to choose between staking and other investment opportunities.

- Enhanced Capital Efficiency: Liquid staking improves the capital efficiency for users by unlocking the value of staked assets.

- Risk Diversification: Users can spread their exposure across various DeFi products, reducing the impact of single-platform risks.

Are there risks involved with liquid staking?

While liquid staking offers several attractive benefits, there are also risks to consider:

- Smart Contract Risk: As with any DeFi protocol, there is a risk of bugs or vulnerabilities in the smart contracts.

- Liquidity Provider Risk: There may be a risk associated with the liquidity of the derivative tokens received in exchange for staking.

- Market Risk: The value of the derivative tokens can fluctuate independently of the original staked assets.

- Regulatory Risk: The regulatory landscape for DeFi and staking derivatives is uncertain and may affect the legality or functionality of liquid staking services.

What tokens can be used for liquid staking?

Many cryptocurrencies that utilize a Proof of Stake (PoS) or a Delegated Proof of Stake (DPoS) consensus mechanism are eligible for liquid staking. Popular cryptocurrencies that often support liquid staking include Ethereum (after its transition to PoS), Polkadot (DOT), Cosmos (ATOM), and Tezos (XTZ), among others. The availability of liquid staking for a particular token depends on the platforms and services that support that token, and it’s always best to research and ensure that the service is reputable and secure before participating.