The phrase “not your keys, not your coins” might scare you. Let’s face it, the world of cryptocurrency can be a wild ride. That’s where custodial wallet crypto services step in, offering you peace of mind for your digital dollars. But how much control are you trading for security? Dive in as we break down everything from basic functions to hot versus cold storage, ensuring you make savvy choices in safeguarding your online treasure.

Understanding the Fundamentals of Custodial Wallets

The Role of Custodial Cryptocurrency Services

When you keep your digital money safe, think of custodial cryptocurrency services. These services hold and look after your crypto for you. It’s like banking where the bank keeps your money. But here, cryptocurrency wallet providers handle your digital currency.

These providers often run crypto exchange wallets. They let you buy, sell, or store crypto. Your coins are in their care, just like money in a bank.

The thing with managed crypto wallets is that you trust someone else. You trust them with your digital coins. This trust is big. You rely on third-party cryptocurrency storage to keep your assets secure.

Some people ask, “What are the benefits of custodial wallets?” Here’s a quick answer: they are simple to use and can handle many coins. Now, let’s explain more. These wallets make trading easy and quick. They can also connect to other services you might use.

However, not all that shines is gold. So, what are the risks of custodial crypto wallets? The main risk is if the service gets hacked, you could lose your coins.

But don’t worry! Good services work hard to make sure your assets in crypto are safe. They work on improving their security every day.

How Custodial Wallets Work and Their Impact on User Control

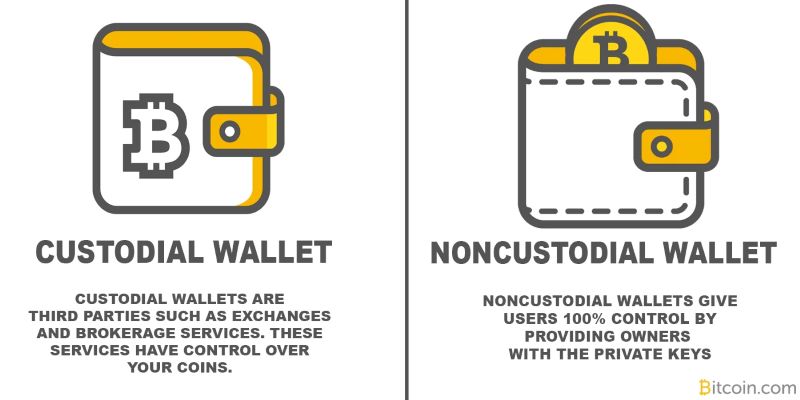

Now let’s figure out how custodial wallets work. When you use one, you are handing over your private keys. The private keys are like password keys for your crypto. This means the service has control over your coins.

They have security features to keep these keys safe. Some use hot wallet versus cold wallet setups. Hot wallets are online and easy to get to. Cold wallets are offline and super safe.

Insurance coverage for crypto assets is another thing to think about. Some providers offer this. It helps cover your coins if bad things happen.

Why should you care about custodial wallet regulations and hosted wallet compliance standards? Think of it like driving. You trust traffic laws to keep you safe on the road. Here, it’s about keeping your crypto safe.

These services also follow rules for know your customer (KYC) and wallets. It helps them know who uses their service.

But what about if something really bad happens? Crypto funds accessibility is important. That’s where things like multi-signature wallets come in. They need more than one person to say ‘okay’ before a big move is made.

Even with all the safety, we can’t ignore the chance of disaster recovery in crypto storage. Providers prepare backup methods to recover your assets if needed. And if your crypto gets lost, there are ways for recovering lost cryptocurrency. No one wants to lose their digital treasure, right?

Lastly, let’s talk about shared control of crypto assets. Some people want to have a say in their crypto moves. So they choose wallets that need approval from more than one person to make a move.

By now, you know how these wallets work and how they affect who has a say in your crypto. Trust in digital wallet providers is key. This trust is built by clear rules, strong safety, and knowing how to get your crypto, even when things go wrong.

Safeguarding Your Wealth: The Security Protocols of Managed Crypto Wallets

Examining the Security Features of Custodial Wallets

When you keep your money in a managed crypto wallet, you trust someone else to protect it. These are called custodial cryptocurrency services. Think of them like a bank. But for your digital money. They have the power to move and safeguard your coins. The good news is, they work hard to keep them safe. And they must follow strict rules, the custodial wallet regulations, to protect your assets.

One key way they do this is by managing private keys for you. A private key is a secret code that lets you access your crypto. Good private keys management means even if you lose your password, you won’t lose your money. Plus, many managed crypto wallets use top-notch tech to stop hackers. This tech includes things like multi-layer security and special checks that make sure it’s really you trying to get in.

Insurance coverage for crypto assets can also be a plus. If something goes wrong, the insurance might help get your money back. That’s a big deal since digital currency storage isn’t always perfect. Remember, picking a wallet with the right security features of custodial wallets is important. It should fit what you need and give you peace of mind.

The Hot Wallet Versus Cold Wallet Debate

Now, let’s talk about where to keep your digital coins. Some folks like hot wallets. These are online and easy to use for quick trades. They’re part of what’s called “crypto exchange wallets”. That means they live on the internet and let you do crypto trading with custodial wallets smoothly. But because they are online, they can be at risk for cyber-attacks. This is why asset security in crypto is a hot topic, pun intended!

Cold wallets, on the other hand, are like secret vaults. They’re offline and super safe. They can’t be hacked remotely because they’re not connected to the net. Think of them as a safe in your house. You can’t use them as fast as hot wallets, but your money is a lot safer.

So, which one is the best for you? It depends on how you use your crypto. If you trade a lot, a hot wallet might be handy. You might enjoy the liquidity advantage in custodial services that hot wallets offer. But if you have a big amount of crypto and want to keep it safe for a long time, a cold wallet might be better for you. It’s the tougher one.

Understanding custodial blockchain wallets, whether hot or cold, means knowing their pros and cons. It’s about finding a balance between security and convenience. But no matter what, make sure there’s trust in digital wallet providers you pick. Read up on them, check their history, and make sure they follow the hosted wallet compliance standards. This way, you can rest easy, knowing your digital treasure is in good hands.

Navigating the Risks and Rewards: The Dual Faces of Custodial Crypto Wallets

Benefits of Custodial Wallets for User Liquidity and Accessibility

Custodial cryptocurrency services make life easy for users. With them, buying and using crypto is a breeze. The main perk is liquid access. This means getting to your money fast when you need it. You can trade crypto on the fly, pay for goods, or swap for other currencies. This advantage is huge for folks who move their funds a lot.

We choose custodial wallets for their ease too. These wallets are run by companies that keep our digital cash safe. Think of them like banks for your Bitcoin. When you keep your money with them, you don’t stress about losing your keys. They look after them, so you can relax and focus on making smart trades or shopping with your coins.

These wallets also offer quick sign-ups. Most only need your basic info to get started. This means hopping into trading is quicker than saying “cryptocurrency wallet providers”. This gets you buying and selling while the prices are right. Plus, if trouble hits, good to know that some wallets even promise to give back your deposits if they mess up.

Understanding and Mitifying the Risks of Custodial Crypto Wallets

Alright, let’s chat about the risks of custodial crypto wallets. It’s not all sunshine in the world of managed crypto wallets. The key risk is trust. Sure, it’s tempting to let someone else deal with your keys and security. But remember, you’re putting your trust in someone else’s hands. If they go under or get hacked, your coins could vanish into thin air.

Another issue is control. With these wallets, someone else calls the shots with your money. If they decide to lock down your account, there’s little you can do. It’s like they have the key to your car, and you’re just asking nicely to get a drive.

Security is a big must for any crypto holder. Third-party cryptocurrency storage means you lean on their security smarts. But you gotta do your homework. Make sure they’ve got tough defenses against hackers and their systems are solid. It’s your dough on the line, after all.

Insurance is a lifesaver. Before you choose a wallet, ask, “Do they have insurance coverage for crypto assets?” If they say no, think twice. If yes, dig into what they cover. Will they have your back if things go south? You want insurance that steps up to plate if your coins get lost or stolen.

Lastly, always check up on their rules. Custodial wallet regulations and hosted wallet compliance standards are your friends. They tell you if a wallet is playing by the rules and keeping your assets legal and safe. Nobody wants a call from the law about their crypto.

So while there’s ease and speed with custodial wallets, stay sharp. Understand their policies, pump them for info on safety, and keep an eye on how they handle your keys. It’s like riding a bike with a helmet – better safe than sorry.

Compliance and Control: Ensuring the Integrity of Crypto Assets

The Importance of KYC Procedures and Regulatory Adherence

Do you know who you’re trading with? In crypto, this question matters a lot. Know Your Customer, or KYC, means crypto wallet providers check who their users are. They do this to keep out the bad guys and follow the law. By doing KYC checks, they make sure people using the service are who they say they are. This helps stop money laundering and other sneaky business. Think of KYC like the security guard at the door. They won’t let you in unless they know you’re not there to cause trouble.

Why do we care so much about KYC? Well, we all want a safe place to keep our coins, right? Rules like KYC help us build trust in custodial cryptocurrency services. If everyone gets checked, it’s like knowing everyone in town. You feel safer, and so does everyone else.

But let’s be real. No one likes filling out forms or sharing ID. I get that. Still, it helps keep everyone’s money safe. It’s like putting on a bike helmet. You might not like how it looks, but it’s there to protect you if you fall. Crypto exchanges do the same for your digital cash.

Private Keys Management and Multi-Signature Wallet Strategies

Let’s talk about keys. Not the ones jingling in your pocket, but private keys. These keys unlock your crypto money box. Think of them as secret codes for your online treasure. Lose them, and say bye-bye to your digital gold.

So, how do we keep these keys safe? Some people like to have one super-strong key. Others go for something called multi-signature wallets, or multi-sig for short. Multi-sig means you need more than one key to open your wallet. It’s like having a safe that needs two keys to unlock. You keep one, and someone you trust keeps the other.

Why is this cool? It stops one person from having all the power. If you need two or three people to agree to spend, it’s harder for thieves to take your treasure. It’s teamwork for your wallet!

But wait, what if someone loses a key? Or what if you and your key buddies get into a fight? Make sure you have a backup plan. Think about who can help if things go wrong. It’s like knowing who has the spare keys to your car.

Understanding custodial blockchain wallets means knowing that someone else helps manage your keys. They’re looking out for your crypto coins. It’s their job to make sure no one sneaks in and takes them. They use all the best locks and alarms, digital style.

So, when you pick a place to store your crypto money, ask questions. How do they keep your keys safe? What’s their plan if something goes wrong? Trust in digital wallet providers comes from knowing they’ve got your back. Your money’s worth that extra homework, don’t you think?

In this post, we dove into custodial wallets and their role in handling crypto. We looked at how these wallets work and their effects on user control. Keeping your digital wealth safe is key, so we explored the security of managed crypto wallets, including hot and cold storage.

We also balanced the scales by showing the good and bad of custodial wallets. You now know how they make access to funds easy but come with risks, too. Lastly, we talked about staying within the law and keeping your crypto assets safe.

To wrap it up, custodial wallets offer a mix of ease and challenges. They are more than just storage; they’re a gateway to managing your crypto with peace of mind, as long as you stay aware and careful. It’s all about knowing the system and using it to your benefit. Stay sharp out there!

Q&A :

What is a custodial wallet in cryptocurrency?

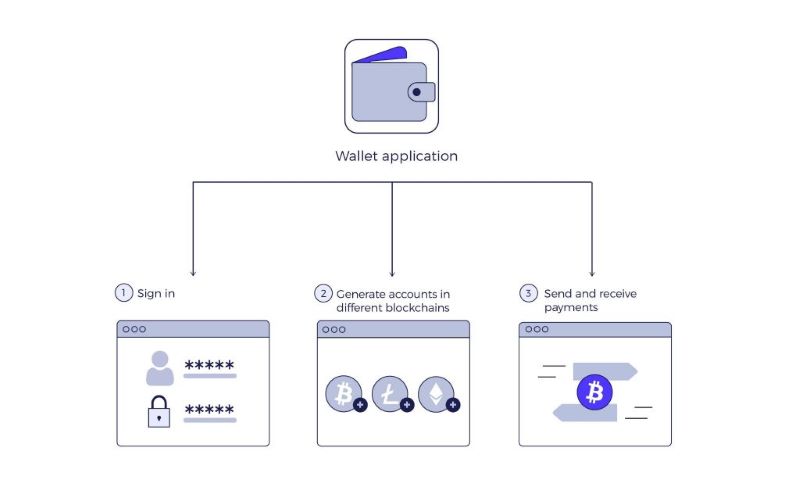

A custodial wallet in cryptocurrency is a type of digital wallet where the private keys—the critical data used to authorize transactions—are managed by a third party, such as a cryptocurrency exchange or wallet service. In contrast to non-custodial wallets, where the user holds and controls their own private keys, a custodial wallet entrusts the security and management of these keys to the wallet provider. This setup can offer convenience for users, as the provider can offer easy recovery options for lost passwords and streamlined transactions, but it also means users must trust the provider to secure their assets.

How does a custodial wallet differ from a non-custodial wallet?

The primary difference between a custodial and non-custodial wallet is who holds control over the private keys required to access and manage the cryptocurrency. With a custodial wallet, the service provider retains control of the private keys, effectively taking custody of the user’s funds. This can provide added features like user-friendly interfaces, easy password recovery, and access to customer support. On the other hand, non-custodial wallets give full control to the user, who must responsibly manage and backup their private keys. This offers greater independence and security from third-party risks, at the cost of being solely responsible for the safety of their funds.

What are the risks of using a custodial crypto wallet?

Using a custodial crypto wallet introduces several risks, including the potential of the service provider being hacked, going out of business, or engaging in fraudulent activities. Since the provider has control over the private keys, users are also vulnerable to their wallet being frozen or accessed due to legal or regulatory actions against the provider. Additionally, while convenient, the centralized nature of custodial wallets goes against the decentralized ethos of cryptocurrency and can be seen as a single point of failure.

Can you still own your cryptocurrency if you use a custodial wallet?

Yes, you still own your cryptocurrency when you use a custodial wallet, but you are entrusting the security and access of your funds to the wallet service provider. This means that while the cryptocurrency is yours by right, and you can make transactions as you wish, the actual custody and control over the private keys needed to transact and access your crypto assets are in the hands of the provider.

What are the benefits of using a custodial wallet for crypto?

Custodial wallets offer several benefits which make them a popular choice, particularly for beginners or those looking for convenience. These benefits include the ability to recover accounts easily if you forget your password, the potential integration with services that require KYC (Know Your Customer), access to customer support, and often a simple and user-friendly interface. They can also offer increased liquidity and faster transactions since the provider can facilitate trades on their internal systems without the need for blockchain confirmations.