Welcome to the deep dive into the truth about on-chain analysis. Everywhere you look, experts tout its benefits for crypto investment strategies. But what’s often glossed over is the question: disadvantages of on-chain analysis are what? This post sheds light on the hidden snags that could trip up investors. I’m not just talking about common hiccups—I mean the real cost of misunderstanding or over-relying on blockchain data that might lead you astray. Stick around to discover how even the most sophisticated tools can paint a skewed picture of the crypto market.

Understanding the Limitations of On-Chain Analysis

The Challenge of Blockchain Analytics

Let’s talk about on-chain analysis downsides. One big headache is privacy concerns. Many believe blockchains offer full privacy. But that’s not true. Blockchains record each transaction. So, someone’s buying habits could be exposed. People don’t always want their spends tracked. So, privacy issues are real. Blockchains aim to balance privacy while still being open.

The Hurdle of Complete Clarity

But problems don’t stop there. Blockchain transparency isn’t perfect. Sometimes the data on blockchains isn’t clear. It can show something’s happening. But it can’t always say who’s doing it. People use codes, not real names. This makes it hard to know who’s who.

Staying Ahead of the Bad Guys

Another issue? Tracking bad activities. It’s a tough job. Criminals change their methods fast. Technology tries to keep up. But there’s a gap. Illegal acts slip through.

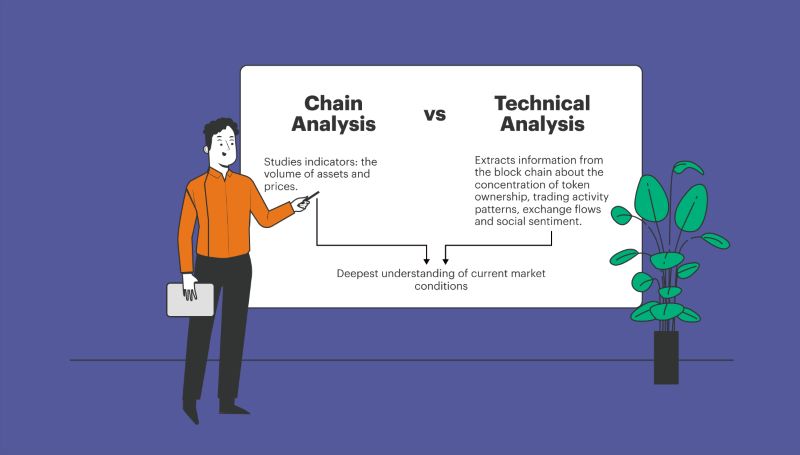

Predictive Shortcomings in Cryptocurrency Forensics

Now, let’s hit on predicting with on-chain data. Analysts try to see patterns. They hope to guess future moves. But it doesn’t always work. User behavior is tricky. It’s hard to guess what someone will do next.

Reading Between the Lines

Blockchain transaction complexity adds to the mix. Transactions can mix and match in many ways. It leads to wrong guesses. False positives in crypto monitoring happen. They show something might be wrong. But it could be a false alarm.

Tackling the Scalability Mountain

There’s also talk of scalability of on-chain data analysis. Simply put, as more people use blockchain, the harder the analysis gets. The data pile gets too big. And then there are smart contract analysis shortcomings. These smart rules on a blockchain should make things smooth. But when they get complex, it’s another headache.

Computers versus Humans

And, of course, we can’t forget reliance on heuristic methods. This is when computers guess based on past events. It’s like a detective following his hunch. But what if the hunch is wrong? This leads to cryptocurrency forensics limitations. Sometimes the clues don’t add up.

Diving into blockchain investigation challenges, we spot lots of hurdles. From privacy and anonymity to predicting bad guys’ next moves. It’s a mix of tech troubles and sneaky tactics. We need to be on our toes. The goal? Use on-chain clues to make sense of the digital money world while respecting privacy and staying accurate. It’s a tough balance, but one worth striving for.

Privacy Versus Transparency in Blockchain

The Balancing Act: Anonymity and Surveillance

Blockchain stands on two legs: privacy and openness. Yet, these two often clash. Sure, we want safety from prying eyes, but too much cover leads to dark dealings and crime. What folks must ask is, “Can on-chain analysis protect without stripping away privacy rights?” Well, let’s dig in.

On-chain analysis aims to root out foul play with smart tech but hits a wall with privacy. Every move in the crypto world leaves a mark. These marks are clues, but not foolproof. Scouring the blockchain for dirty money begs big questions about snooping into lives too much.

Each transaction is a jumble of codes that hide who’s behind them. Yet, if experts pierce that veil too far, we end up on shaky ground. The risk of privacy invasion stands tall. Someone must watch the watchers to make sure they don’t cross lines.

GDPR Compliance and On-Chain Data Implications

Now, Europe’s GDPR looms large over the blockchain world. It yells for personal data security, which seems fine until it butts heads with transparency. See, GDPR grants the right to be forgotten, but the blockchain never forgets. This clash creates a real head-scratcher for on-chain sleuths.

When you look too hard, blockchain’s crystal-clear waters get muddy. The ripples of our tech push against the shores of private life. We’re in a tight spot, balancing act on a wire tied between two cliffs – privacy on one side, clear sight of crimes on the other. Make one wrong move and down goes trust along with all the good blockchain brings.

Tools and tricks exist to ease this tension, but they’re not perfect. They shape a foggy mirror. This mirror shows us shapes and shadows, but not clear faces. The danger is folks might think they see a crime where there’s none or miss where there really is one. What’s clear is that no tool yet cracks this nut completely.

Even with top gear, false alarms ring and real mischief slips through. Blind faith in these tools might lead investors into troubled waters. They trust the system to keep fairness. If that trust breaks, the whole house cards might tumble down.

So now you know. On-chain analysis walks a thin line. It must respect privacy and still keep the wolves at bay. Every step must be careful – too hard or too soft, and the balance tips. Watch, but with respect – that’s the motto for the wise on-chain detective.

The Risks of Misinterpreting On-Chain Data

Addressing Data Misinterpretation and False Positives

On-chain analysis often hits roadblocks. One big hiccup is false positives. This means some data could fool you into thinking there’s shady business when there’s not. Think of it like mistaking a shadow for a monster.

Trouble begins when numbers jump out, but they don’t show the full story. We see cash moving and might guess it’s for bad reasons. But sometimes, it’s just a person moving their own money. This kind of goof can tag good folks as wrong, which isn’t fair.

Market players rely on what the blockchain tells us. But when they read into things wrong, it can sway decisions. This can lead to poor investment moves. Worse, it can scare folks about safety and security.

Overcoming the Inherent Complexity of Blockchain Transactions

Now, dive into the tangle of blockchain transactions. These records are like knots – complex and tough to unwind. Each trade, each gift, each buy – they all shape a web. You need sharp eyes to see if they’re legit or not.

This web gets trickier in bigger chains with more deals. The size of the chain can stretch the limits of our tools. It’s like using a net to catch fish but the holes are too big.

Some folks think smart contracts might fix these snags. Yet, even they fall short. They’re hard to read and predict right. Plus, bad guys are witty. They twist these contracts to hide their trails.

We also juggle keeping folks’ info safe with hunting for clues. Laws like GDPR throw in another loop. They say people’s data is theirs to keep to themselves. So, we must balance this with keeping an eye on the blockchain.

In short, the blockchain’s maze can lead even pros astray. False leads and dense data can mean missed marks or wrongly accused users. It takes keen know-how to sift through the noise. But, with the game ever changing, we must stay swift on our feet to keep pace.

Navigating the Cost and Complexity of Blockchain Analysis

Scalability Challenges in On-Chain Data Analysis

On-chain analysis downsides are no joke. As we dive deeper into the blockchain, we hit some big roadblocks. The first? Scalability of on-chain data analysis. Picture this: blockchain is a fast-growing library with billions of books. Each transaction is a new book. But there’s a catch. Our library’s getting too full, too fast.

Some blockchains, like Bitcoin, can handle only a few transactions per second. Now, think about all the transactions worldwide. We can’t check them fast enough. It’s like we need more librarians, but there’s just not enough space. We’re trying to solve this. But it’s tough. Everyone on the team is scratching their heads.

Bitcoin transactions are tiny pieces in a massive puzzle. We can spot patterns, kinda like how you see shapes in clouds. But our crypto monitoring tools can get overwhelmed when the sky’s full of clouds.

Practicality and Reliability of Heuristic Methods in Crypto Monitoring

Now, let’s talk about heuristic methods. Big word for a simple idea: guesses based on patterns. We use this a lot in crypto monitoring. It’s like playing detective. We look for clues, like who’s sending crypto to whom. We use these clues to guess what’s happening. Smart, right?

But here’s the rub. These guesses? Sometimes they miss the mark. Why? Because blockchains are tricky. They’re also private. And people use them in wild ways we can’t always predict. This can trip us up, leading us to false positives in crypto monitoring. Think of it like finding a needle in a haystack. Except it turns out the needle looks a lot like the straws.

So, our tools are looking everywhere. They get excited. “Found it!” they yell. But sometimes… it’s just another straw. This means we can accuse the wrong person of doing something they didn’t. Or miss someone who’s up to no good. It’s a real head-scratcher.

We’re working on getting better. We need faster computers, smarter tools, and clearer rules. But it’s a race. A race between improving our tech and the bad guys getting craftier. And as we run this race, we’re juggling lots of balls. Privacy concerns, blockchain transparency issues, and keeping everyone safe.

Remember, on-chain analysis is still in its kid shoes. It’s learning to walk and run. Sometimes it falls. But it’s getting up. And it’s getting stronger. We’ve got a top-notch team on it, making sure we stay on the right track.

In the end, we’re all about keeping your crypto safe. And making sure the blockchain plays nice. It’s a big job. But hey, we love a good challenge. And we’re sticking to it. So next time you send some crypto, remember, we’re behind the scenes, keeping an eagle eye on things. And we’re cracking this puzzle, one piece at a time.

In this post, we’ve dived deep into the tricky world of on-chain analysis. We’ve seen how tough it can be to make sense of blockchain data and why we can’t always rely on it to tell the future of crypto prices. We’ve also weighed the pros and cons of privacy against the need for clear data. Plus, we talked about the tightrope walk of following rules while keeping user info safe.

We explored how easy it is to get the wrong idea from on-chain data, and we shared tips on how to steer clear of these traps. And let’s not forget the resources and time it takes to really understand what’s happening in blockchain transactions.

So, what’s the bottom line? On-chain analysis is super helpful, but it has its limits. Remember, it’s a tool—not a crystal ball. It needs smart use and a keen eye for details. If we keep our heads on straight and use it right, we can unlock a ton of insight about the wild world of crypto. Stay sharp out there!

Q&A :

What are the main drawbacks of on-chain analysis in cryptocurrency?

On-chain analysis, while providing significant insights into blockchain transactions and trends, comes with some inherent disadvantages. One major drawback is the lack of privacy for users, as their transactions are permanently recorded and publicly accessible on the blockchain. This can lead to potential security risks if personal data is correlated with wallet addresses. Moreover, on-chain analysis might be unable to provide real-time data due to the time required for transactions to be verified and added to the blockchain.

Does on-chain analysis impact cryptocurrency volatility?

On-chain analysis can potentially affect cryptocurrency volatility. When on-chain data indicates certain trends, such as a high number of coins moving to exchanges (which can signal potential sell-offs), investors might react quickly, leading to rapid price changes. Conversely, on-chain metrics showing increased accumulation by long-term holders might foster stability or a gradual price increase. It’s crucial to understand that on-chain analysis is just one of many tools investors use, and not the sole driver of market movements.

Can on-chain analysis provide a complete financial picture of blockchain assets?

On-chain analysis is limited in scope, as it only accounts for transactions and activities recorded on the blockchain. Off-chain events, such as private deals, OTC (over-the-counter) trades, or sidechain activities, are not captured in on-chain data. This means on-chain analysis cannot provide a comprehensive financial picture, as it misses a portion of the market dynamics occurring outside the public ledger.

To what extent can privacy coins challenge on-chain analysis methods?

Privacy coins are designed to obfuscate the details of blockchain transactions, which poses a challenge to on-chain analysis techniques. Features such as stealth addresses, ring signatures, and zero-knowledge proofs can conceal transaction amounts, origins, and destinations. This undermines the effectiveness of on-chain analysis for surveillance and tracking purposes, giving rise to concerns regarding the use of privacy coins for illicit activities.

How might the future development of blockchain technology affect on-chain analysis?

The evolution of blockchain technology has direct implications for on-chain analysis. The emergence of new consensus mechanisms, privacy-enhancing features, or scaling solutions like sharding may alter the granularity and type of data available on-chain. This could either enhance the capabilities of on-chain analysis by providing more detailed information or further complicate analysis by introducing additional layers of privacy and complexity. Analysts and tools will continuously need to adapt to these changes to remain effective.