Stepping into the world of cryptocurrencies might have you excited and a bit nervous. Let’s cut through the noise and focus on essential tips for making your first cryptocurrency purchase. I’ll guide you from researching what blockchain really means, to choosing an exchange you can trust. This isn’t just about buying your first digital coin; it’s about starting your journey right with a sturdy grip on your digital wallet. Get ready to turn that curiosity into confident action as we dive into the smart way to join the crypto community.

Preparing Your Entry into the Cryptocurrency World

Understanding the Basics of Blockchain and Cryptocurrencies

Jumping into the world of crypto can be thrilling! But hold on, let’s start simple. You might ask, “What’s blockchain?” It’s like a digital record-keeping system. Imagine a book where every page lists all deals. Once written, no one can change it. That’s blockchain.

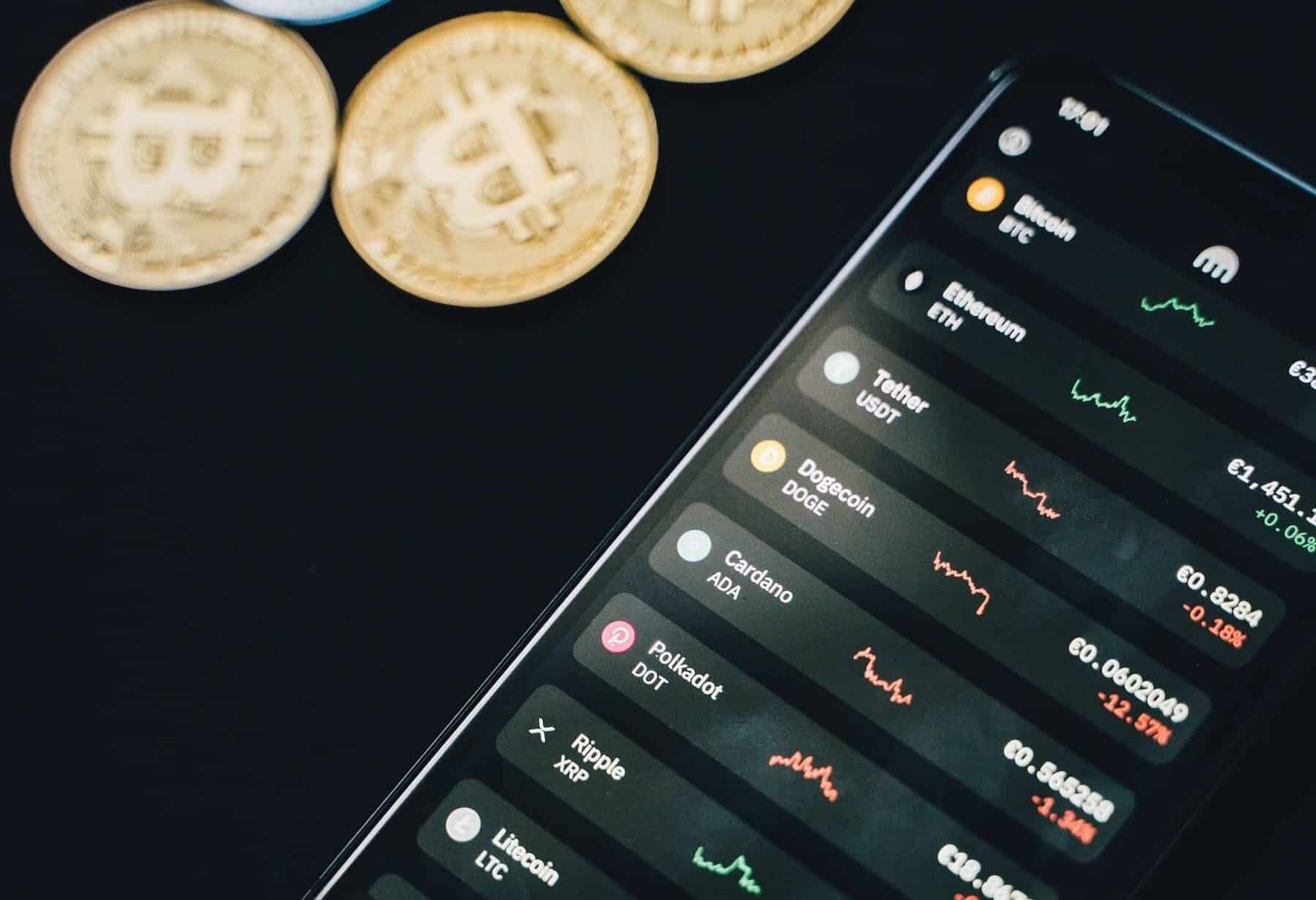

It’s the tech behind Bitcoin and friends, often called cryptocurrencies. They are like virtual coins you can use to buy online or hold hoping their value goes up.

Remember, there are many types of cryptocurrencies. Bitcoin was the first and is still the big boss. But others called altcoins, like Ether or Ripple, are also popular. Each coin has a job to do. Some are for fast payments, while others let programs run right in the blockchain.

Comprehensive Research Before Your First Purchase

Alright, so you want to buy some crypto. Begin with homework. It’s like picking a new car. You wouldn’t buy one without knowing about its fuel, would you? Just like that, learn about different cryptos. What sets them apart? What can you do with them? This will help you pick ones that fit your needs.

Check out their whitepapers too. These are their birth certificates. They tell you why they exist and how they work. Visit websites to compare cryptocurrency fees and read up on which coins might suit you.

Word of caution: be picky about where you buy from. There are many places, or exchanges, to choose from. Look for ones with good reviews and not too expensive fees. Also, make sure they keep your info and money safe.

You’ll also need a wallet – no, not for cash, but a digital one for your coins. Think of it like a super-secured USB stick. Only it holds your crypto. Setting up a crypto wallet should be done with care. Look for one that has strong safety features to keep hackers away.

Now let’s talk coins. Should you invest in Bitcoin or altcoins? Good question! Many like to start with Bitcoin since it’s well-known. Yet, don’t throw all your money into one basket. Spread it out. This is called diversifying, and it’s smart.

Before you buy, you’ll need to do a bit of paperwork. It’s called KYC, short for “Know Your Customer.” It’s a must-do to make sure all is legal and safe. Plus, it keeps troublemakers out.

Take a breath and set a budget for your crypto adventure. Don’t spend all your savings. Start slow and see how things go.

Finally, be on the lookout for scams. Sadly, they’re out there. Always double-check info and never share your key or password with strangers.

Investing in crypto can be a bumpy ride. Prices go up and down a lot, and that can be scary for new folks. But don’t let that spook you. With the right research and a solid plan, you’re ready to make a splash in the world of digital currency!

Choosing the Right Exchange and Wallet

Comparing Exchange Fees and Security Features

When picking a crypto exchange, focus on fees and safety. Low fees keep costs down. But cheap doesn’t mean best. Safety is key. Look for an exchange with strong security. This means two-factor authentication, insurance, and user reviews that praise its security. Compare fees online and pick an exchange that balances cost and safety.

Setting Up a Secure Crypto Wallet for Your Assets

After choosing an exchange, you need a crypto wallet. This is where you keep your digital coins. There are two types: hot wallets (online) and cold wallets (offline). A hot wallet is easy to use, but less secure. A cold wallet, like a USB drive, is safer. Always back up your wallet and keep private keys to yourself. Never share them.

Buying crypto can be exciting, but go slow. Take time to learn and make smart choices to keep your money safe.

Making Your First Cryptocurrency Purchase

Executing Secure Cryptocurrency Transactions

Buying crypto? Start by picking a secure platform. Use one with strong security and good reviews. Always set up two-factor authentication for extra safety. Never share your private keys or password.

For a secure buy, transfer funds from your bank. Avoid public Wi-Fi when making transactions. Use a personal device you trust. Double-check the recipient’s wallet address before sending funds.

Recognizing the Best Time to Buy and Types of Cryptocurrencies

What’s the best time to buy crypto? It’s smart to watch the market trends first. Buy when prices are low if you can. Remember, the crypto market can be unpredictable.

Wondering which crypto to buy? Start with Bitcoin or popular altcoins. These have a more proven track record. But, be aware of their price swings. Small investments are best when starting.

Research helps avoid beginner’s mistakes. Know the potential and risks of any coin. Learn about its use, team, and technology. Look for solid projects with real-world applications.

Ready to invest? Budget how much you want to put in. Stick to this budget to avoid overspending. Keep in mind the impact of volatility on your funds.

Doing your homework is key. A good start is reading crypto whitepapers. It gives you insights into the crypto’s purpose and tech. Ask more experienced investors or join online crypto communities for tips.

Diversifying is smart for your crypto portfolio. Don’t put all your eggs in one basket. Spread your investment across different assets. This can help reduce risk in the long run.

Monitoring crypto prices becomes part of your routine. Use apps or websites to keep an eye on the market. Setting alerts can help you catch good buying opportunities.

Paying taxes on crypto gains is important. Understand how crypto taxes work in your area. Record all your trades to make tax time easier. Don’t skip on this, it’s the law.

Buying at regular intervals is called dollar cost averaging. This can be a useful strategy. It smooths out purchase prices over time. It’s handy if buying in a volatile market.

Finally, steer clear of scams. If it looks too good to be true, it probably is. Always conduct due diligence before making a move. Protect yourself and your hard-earned money.

Remember, your first purchase is a big step. Take your time to learn and go at your own pace. Welcome to the world of crypto investing!

Developing a Sustainable Investment Strategy

Diversifying Your Cryptocurrency Portfolio

When you start, you’ll hear one tip a lot: don’t put all your eggs in one basket. This means split your money across different coins. This way, if one goes down, you won’t lose it all. Kind of like mixing up your veggies to stay healthy.

To start, learn about different coins. Bitcoin and Ethereum are like the Coke and Pepsi of crypto. But there are more, like Binance Coin or Cardano. Each one works a bit different. Think about what they’re for and the tech behind them. Invest in a mix to spread your risk around. Check the history and who’s backing them. Go for ones that have a clear purpose and strong support.

When we talk buying crypto, it’s key to compare fees. Each place that sells crypto charges you for the trade. Some charge more, some less. Always look this up so you don’t pay too much. You want more coin, not less money.

Choosing where to buy is big, too. Go for spots that are known for being safe and honest. Read up, ask around. A good platform protects your money and info. It’ll also guide you as you start.

Understanding Long-Term vs. Short-Term Investment Approaches

Now, let’s talk time—long-term versus short-term. Short-term is like a sprint. It’s quick, you’re in and out. Buying low, selling high, grabbing wins fast. But, it’s risky; the market can be wild. You have to watch the prices a lot. It’s not for everyone. Plus, you might have to pay more taxes on what you make.

Long-term is more like a hike. It’s slow and steady. You pick coins you trust for years, like saving up for a car or college. It’s safer than the quick game but needs patience. Prices go up and down, but you wait for the big prize down the road.

Using fiat to buy crypto, like dollars or euros, is where you start. After that, set a budget. Decide how much you can put in without stress. Never use money you need for rent or food. Only risk what you can afford to lose, just in case.

Top tip? Learn about dollar-cost averaging. This is when you put in a little money regularly. This can cut the pain of price swings. It’s like buying groceries over time instead of in one go.

Stay sharp on tax rules, too. Each place has laws on money made from buying and selling. Know them and save yourself from stress later.

Also, watch out for tricks and scams. If an offer looks too good, it might be a trick. Stay away from those. Stick to what you know is true and proven.

Remember, everybody starts somewhere. Even the pros were new once. Learn from them. They’ve walked the path and can help you avoid slips.

So, before you jump in, take your time. Know the risks, plan your steps. And always keep learning. It’s a big world full of chance. Make it count!

In this guide, we walked through the essential steps for getting started with cryptocurrencies. From the core ideas of blockchain and digital coins to digging deep before buying, we covered what you need to know. Choosing a solid exchange and a safe wallet sets the base right. We also looked at making your first buy without risks and when to do it. Plus, we tackled how to mix up your coins and think about your investment time frame.

Now, you’re ready to step into the crypto scene with confidence. Remember, the crypto market shifts fast. Stay informed and always think about safety first. Keep learning, and your smart moves will pay off. Remember, each choice is a building block to your future in the digital money world!

Q&A :

What should I know before buying cryptocurrency for the first time?

Understanding the cryptocurrency market is key before making your initial purchase. Educate yourself about the basics of blockchain technology, different types of cryptocurrencies, and how digital wallets work. It’s also important to research the volatility of the market, the security of different trading platforms, and how to manage the risks associated with cryptocurrency investments.

How do I choose a cryptocurrency to invest in as a beginner?

As a beginner, it’s crucial to start with well-known cryptocurrencies like Bitcoin or Ethereum, which have more established markets and infrastructure. Evaluate market trends, read through whitepapers, and consider community and developer support. It’s advisable to keep an eye on the project’s use case to ensure it has the potential for future growth and adoption.

What are the best practices for securing cryptocurrency purchases?

After purchasing your first cryptocurrency, prioritize security. Opt for hardware wallets for the best security as they store your assets offline. Always use strong, unique passwords and two-factor authentication (2FA) for your accounts. Never share your private keys with anyone, and consider using multi-signature wallets if you are handling larger amounts.

Can I buy a small amount of cryptocurrency or do I need to invest a lot?

Absolutely, you can start by purchasing small amounts of cryptocurrency. Many platforms allow you to buy fractional shares of cryptocurrencies, which is a great way to get started without a significant investment. This method also helps in spreading risk and learning the market dynamics without overexposing yourself financially.

Is it necessary to use a special exchange for my first cryptocurrency purchase?

While you don’t need a special exchange, it’s important to choose a reputable and user-friendly platform for your first purchase. Look for exchanges with a good track record, customer support, and reasonable fees. Many such platforms also offer resources and tools to help beginners understand and navigate the process of buying and holding cryptocurrencies.