Dive into the world of digital currency with user-friendly crypto tools for beginners. It’s like unlocking a secret level in a game, but the rewards are real. Picture yourself trading with ease with the right toolkit. I’ll show you how to pick a digital wallet without breaking a sweat. Plus, we’ll tackle the blockchain beast together so you can talk shop with pros. Get ready to become the savvy investor your friends envy, all at a fifth-grader’s reading level. No fluff, just the nuts and bolts you need to start your crypto journey. Buckle up!

Getting Started with Cryptocurrency: A Beginner’s Toolkit

Choosing Your First Digital Wallet

When starting with digital money, think of a wallet as your first tool. Pick one that is easy and safe. A good wallet keeps your coins safe, much like your real wallet does with cash. But, instead of leather or fabric, it’s an app or a program.

First, know that wallets come in many sorts: online, mobile, desktop, and hardware. Online wallets are on the web and easy to use, but not as safe as others. Mobile wallets, an app on your phone, let you use coins in stores. A desktop wallet lives on your computer and offers more control. The safest is a hardware wallet, a device you plug into your computer.

So, how do you decide? Think about what you want to do. Do you want to buy stuff in stores with your coins? Get an app. If safety is what you want most, pick a hardware wallet. Remember, these devices cost money, unlike apps and software. Don’t forget, when you set up any wallet, write down your private key. Hide this key well. If someone finds it, they can take your coins. If you lose it, you can’t get to your money.

Understanding Blockchain Basics

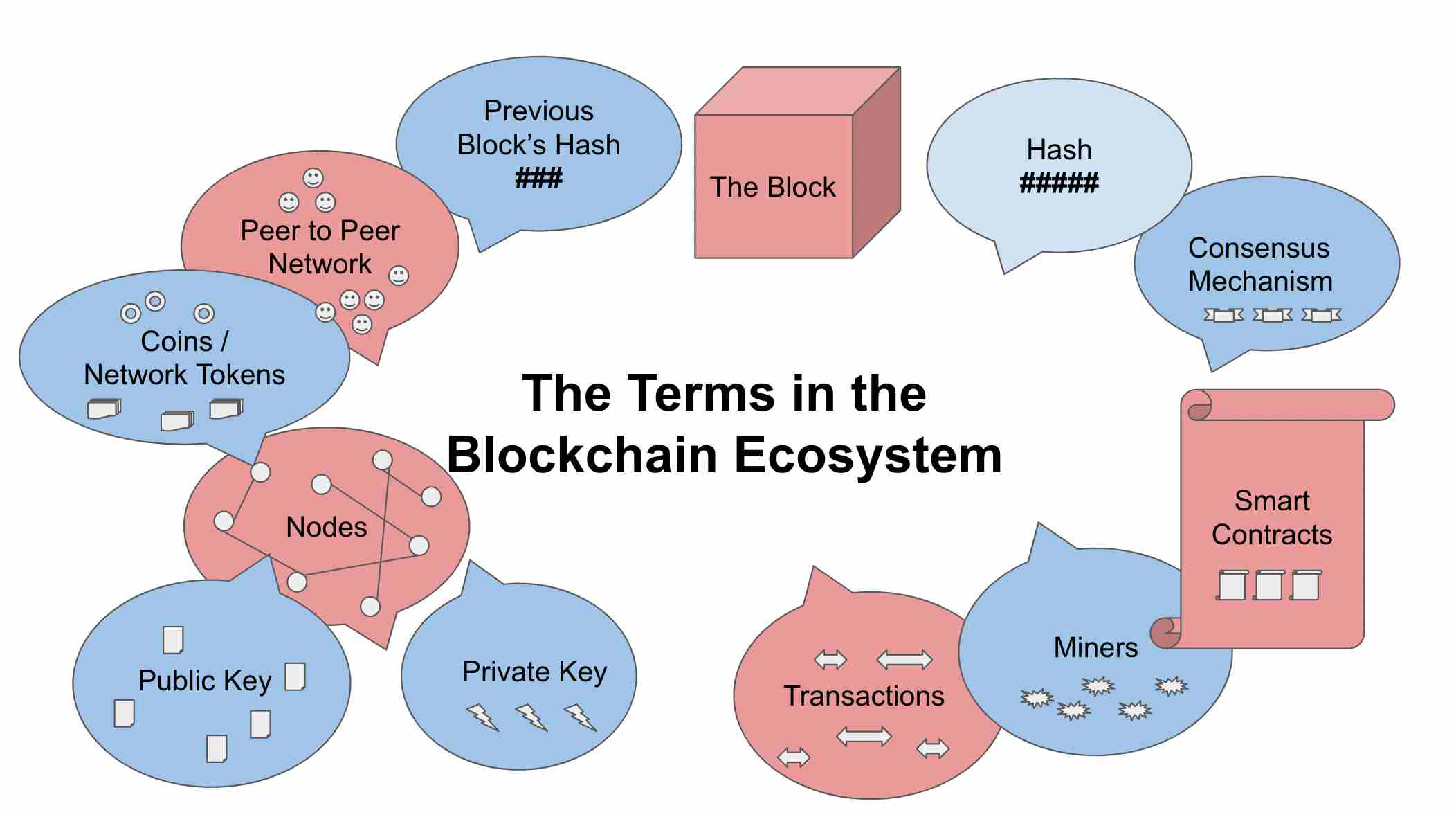

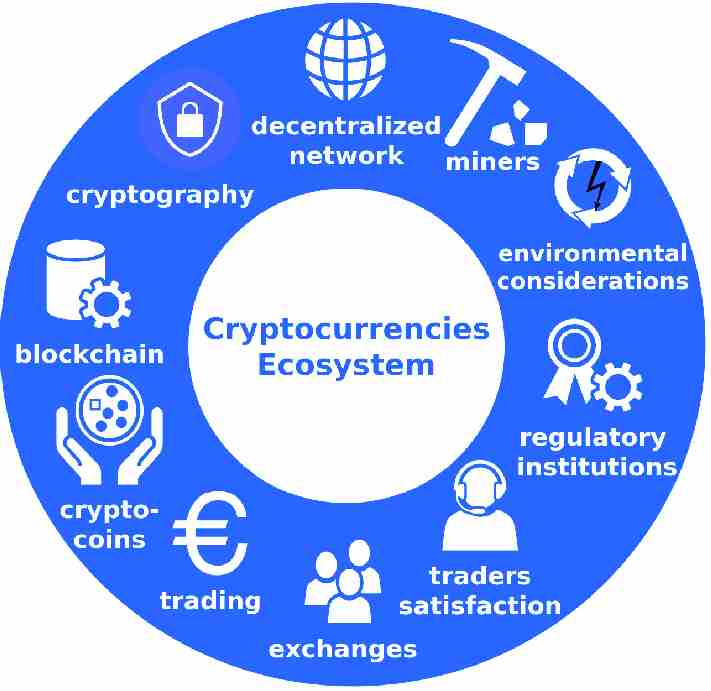

Blockchain sounds complex, but let’s break it down. Imagine a book where you write down every dollar you spend or get. Everyone has this book and can see every line. But, no one can change a line once it’s written. That’s the core of blockchain.

It’s a list of all deals made with a crypto, like Bitcoin. Each deal is a block. These blocks link together in a chain. Every deal is out in the open for truth and trust. Once a block is full, a new one starts, always linked to the one before.

But wait, can anyone add blocks? Not so fast. People called miners check deals by solving hard puzzles. If the puzzle is right, the deal goes through, miners get new coins, and the chain grows.

The great part? Once a block is done, no one can change it. This means you can trust that your deals will stay as they are. Just know, learning about blockchain is key to using crypto right. It helps you get why your coins are safe, and why sometimes it takes time for deals to finish.

Now you have the basics! You learned about picking wallets and blockchain. Remember, a wallet is like a key to your coins. Keep it safe. And blockchain is like a book that everyone writes in, but no one can erase. It’s open for everyone to trust what’s in it. With these tools, you’re ready to step into the world of crypto. Don’t hurry and always ask questions. There’s a lot to learn, but you’ve got this!

Making Your First Crypto Investment

Navigating Simple Crypto Exchanges

When you’re new, picking a simple exchange is key. With easy-to-use crypto exchanges, you start trading fast. Look for exchanges that help beginners. They must be clear and not too complex. What makes an exchange good for new folks? It should guide you well, have a clean layout, and give direct steps to buy your first coin.

What’s the first step? Set up an account! Use your email and make a strong password. Then, you’ll verify your identity. It’s for safety; don’t skip this step. Once in, you’ll add money. You can use a bank transfer or a card. Now, what to buy? Bitcoin is many folks’ first choice. Why? It’s well-known and widely accepted.

Next comes trading — not as hard as it seems. These platforms will show clear buy and sell buttons. Simple charts can track prices over time. You’ll see, buying or selling is just a few clicks. And that’s it, you’ve made your first trade!

Grasping Crypto Trading Fundamentals

Imagine crypto trading as a game. You aim to buy low and sell high. How to start? Learn the basics. This means understanding supply and demand. It also means getting why prices change. News, supply changes, and trader mood all move prices.

For new traders, starting with a plan is best. Decide when to buy and sell before you begin. And don’t react quickly to price jumps or drops. Instead, think long term. Look for tools that teach you while you use them. They should explain terms and give simple tips. Smart tools also show realistic scenarios. This practice makes you a sharper trader.

Security is a big part of trading too. Pick exchanges that focus on keeping your coins safe. They should have features like two-factor authentication. Wondering about two-factor? It’s that extra step after you log in, like a code sent to your phone. It stops others from getting into your account.

And remember, always start small. It’s easy to get excited and go big. But practice with less, learn the ropes, then grow your investment. Crypto can seem like a lot to take in. But with a good start, clear tools, and a solid plan, you’re set to succeed.

Enhancing Your Crypto Knowledge and Security

Utilizing Beginner-Friendly Crypto Educational Apps

Ready to dive into crypto? It can be a blast but you gotta learn first. Funny enough, there are apps that can turn this complex stuff into child’s play. Take newbie-friendly apps Coinbase and Binance Academy. They have cool features. These help starters like you explore and learn. With them, even blockchain, which sounds like a brick wall to your brain, makes sense.

These apps have courses just for new folks. “What’s Bitcoin?” They got you covered. “How does trading work?” They’ll guide you step-by-step. And they’re free! Better yet, they use simple words, short videos, and have quick quizzes. Makes learning a breeze. You’ll know crypto terms and can start investing after a few taps on your phone.

Now let’s talk safety. When you use these apps, they guide you. You learn to keep your digital cash safe. Keep watching for tips on security. Because who likes getting hacked? Nobody.

But, always stay awake out there. Look up more stuff. Ask friends who trade. Because the more you know, the better you trade.

Implementing Security Best Practices for New Investors

Heads up on staying safe in crypto land. First, let’s go for the basics. You need a strong password. Like, really tough. Have a mix of letters, numbers, and symbols. And please, no “1234”. Also, think about two-factor authentication (2FA). It’s like double-locking your digital door.

But it gets trickier. Heard of phishing? No, not the one with a rod. It’s when scammers try to steal your login info. They can be sneaky. They send emails or texts that look real. Always double-check where those links go. And if a deal sounds too good, walk away. Most times, it’s a trap.

And backups. Let’s say it together: back it up. Keep your wallet info safe but have a copy somewhere. Think of it as your crypto life jacket.

Alright, looking good. You’re learning fast. And staying safe. Remember, slow and steady wins the crypto race. Keep those digital coins snug in your wallet, and you’re set for an epic adventure.

Taking the Next Steps in Crypto Trading and Management

Diversifying with Altcoins and ICOs

Let’s talk coins, but not the kind you stash in a piggy bank. I mean altcoins, and if you’re new to this, they’re like the colorful cousins of Bitcoin. Think of Bitcoin as the first kid on the block, and altcoins as the cool new kids.

“What’s an altcoin?” you might ask. Simply put, it’s any cryptocurrency that isn’t Bitcoin. There are thousands out there. Some are super useful; others, not so much. Just like any family gathering, it’s a mixed bag.

Now, ICOs are like a baby’s first steps in the altcoin world. ICO stands for Initial Coin Offering. It’s a way for new coins to say “Hello, world!” It’s also a chance for you to get in on the ground floor—kind of like finding a band before they hit it big.

But here’s the deal: you’ve got to be choosy. I’ve seen folks dive headfirst into ICOs, only to realize the pool was empty. So start slow. Learn about the altcoin. What’s it for? Who made it? If it feels right, and you’ve done your homework, maybe take that step.

Remember, every altcoin is its own adventure. You’ve got your privacy coins that keep your money business just that—private. Then you’ve got coins that are all about speed. Others are about making apps run smoother.

So why not pick one? Maybe a couple. Spread out your chances. We call it diversifying, and it’s a smart move.

Managing Your Crypto Portfolio Effectively

Now, onto managing your crypto stack. If “portfolio” sounds like something only fancy folks in suits have, don’t sweat it. Think of it as your crypto collection. Just like how some people collect stamps, you collect digital coins.

You’ll want a crypto wallet. Not a leather one, but a digital wallet. This is where your crypto lives. It’s like your pocket for digital money. “How do I choose one?” Well, look for simple crypto wallets. They need to be easy to use. And secure, can’t forget that.

Look, I know numbers can be a snooze, but keeping track of them is key. That means knowing what you’ve got, and what it’s worth. Use beginner-friendly crypto apps to stay on top of it. They’re like your personal crypto assistant, minus the coffee runs.

Getting into mobile crypto trading? Sure, why not! It means you can manage your crypto on-the-go. Buy a little, sell a little—all from your phone. But take it easy, watch for those app fees, they can sneak up on you.

Balancing your trades, investments, and wallet contents… This is your portfolio management. Just like not eating candy for every meal, you’ve got to balance it right. Trade some, hold some, and always, always do your research.

Remember, you’re learning. And asking questions is how you get smarter. Explore crypto payment gateways, lending platforms, and maybe DeFi—a way to do finance without the middleman.

You’re not just buying and selling here. You’re taking steps in a whole new world. And hey, it’s pretty exciting. Welcome to the next level of your crypto journey!

In this post, we walked through the basics of starting with cryptocurrency. From picking your wallet to making your first investment, we’ve got you covered. We also looked at ways to learn more and stay safe. With tips on how to branch out and handle your assets well, you’re set to thrive in the crypto world.

Always remember, the key is to learn and grow. Use the tools and advice shared here to build a strong start. Keep your investments safe and your knowledge sharp. That’s how you win at crypto trading. Stay curious and always double-check your steps. Good luck on your crypto journey!

Q&A :

What are the best user-friendly crypto tools for beginners?

When starting out in the cryptocurrency space, beginners should look for tools that are intuitive and offer educational resources. Some of the most user-friendly crypto tools for beginners include user-friendly wallets like Exodus or Trust Wallet, which offer simple interfaces and support multiple currencies. For exchanges, platforms like Coinbase and Binance have a simple buy/sell process that is straightforward for novices. CoinMarketCap and CoinGecko offer user-friendly ways to track price movements and provide valuable crypto data. Additionally, resources like CryptoCompare can help analyze and compare different digital assets.

How do I choose a crypto wallet that is suitable for a beginner?

Beginners should look for a crypto wallet that balances simplicity with security. A good beginner-friendly wallet should have an intuitive interface, provide basic security features like two-factor authentication, and offer customer support. Software wallets like Exodus or hardware wallets like Ledger Nano S are often recommended due to their ease of use and strong security measures. It’s also beneficial to choose a wallet that supports multiple currencies if you plan on diversifying your portfolio.

What are the simplest cryptocurrency exchanges for first-time users?

The simplest cryptocurrency exchanges for first-time users typically have an intuitive interface, a straightforward sign-up process, and a dedicated beginner’s guide or tutorial. Coinbase is often cited as one of the easiest exchanges for first-time users due to its simple design and educational content. Other exchanges like eToro and Robinhood also offer a very user-friendly experience for beginners. It’s important to also consider the level of customer support and the range of available cryptocurrencies before choosing an exchange.

Are there any user-friendly apps to track cryptocurrency investments for beginners?

Yes, several user-friendly apps can help beginners track their cryptocurrency investments. Blockfolio and Delta are popular options that offer a straightforward approach to portfolio tracking, with user-friendly interfaces and real-time price updates. These apps often include features like price alerts, market overviews, and a summary of your holdings across various wallets and exchanges. CoinStats is another app that’s great for beginners, allowing users to track and manage their crypto investments in one place.

Can beginners use technical analysis tools for cryptocurrency trading?

Beginners can certainly start learning how to use technical analysis tools for cryptocurrency trading; however, they should approach these tools with caution as the learning curve can be steep. Many user-friendly platforms provide simple charting tools with basic indicators like moving averages and RSI that can introduce the concepts of technical analysis. It is advisable for beginners to start with educational resources or use platforms like TradingView, which offers a freemium model with plenty of tutorials and community support to help ease the learning process.