Diving into the world of digital currency needs the right tools. How to use crypto tools for beginners is your key to unlocking this tech treasure chest. No fluff here — we’ll guide you through setting up your wallet, getting a grip on blockchain, and making smart trades. You’ll learn how to pick a secure digital wallet, grasp the core ideas of blockchain, and cleverly navigate the market. Ready to trade? We’ll walk you through tracking your investments like a pro. Stepping into the exchange ring, we’ll ensure your security game is strong. And for those hungry for more, we dip our toes into the vast ocean of DeFi and NFTs. Grab your digital pickaxe; it’s time to mine some crypto knowledge!

Getting Started with Cryptocurrency: First Steps for Newcomers

Choosing Your First Digital Wallet

Signing up for your first digital wallet is easy. Think of a wallet as your crypto bank account. It holds Bitcoin, Ethereum, or any other coin you buy. A good wallet keeps your coins safe. So, how do you pick the right one?

First, decide between an online wallet or a hardware wallet. Online wallets run on the cloud. You can reach them from any device with web access. But, storing coins online has risks. Hackers can break into online systems. Hardware wallets are different. They store coins on a physical device, like a USB stick. Much safer, but not as quick to access.

Next, check the wallet’s security features. Look for things like two-factor authentication (2FA). This is where you use a second passcode from your phone to get into your wallet. Also, think about the backup options. Can you recover your wallet if your device is lost?

Lastly, make sure your wallet supports the coins you want. Some wallets only hold Bitcoin or a few others. Others let you hold many kinds of coins.

Understanding the Basics of Blockchain Technology

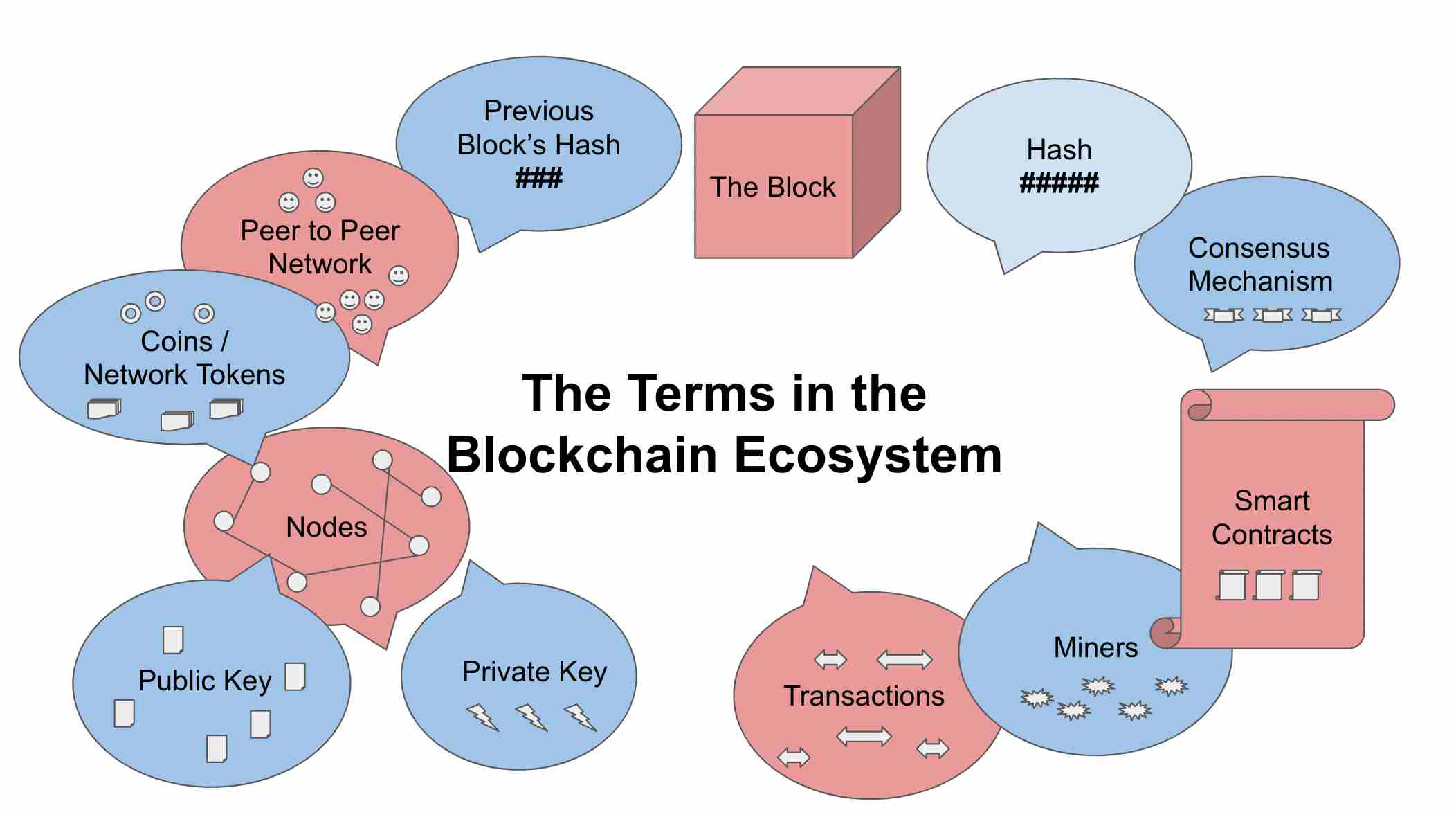

Now, let’s talk about blockchain. Blockchain is like a magic ledger book. Except it’s not just one book. It’s thousands! They all have the same list of crypto dealings. It’s public for anyone to check. This makes cheating hard. If one book is wrong, the others will show it.

Every time a person trades a coin, that deal goes into a “block”. These blocks link to make a “chain”. Hence, “blockchain”. Imagine a tower of toy blocks. Each block is a bunch of trades stuck together.

People called “miners” use big computers to make new blocks. When they add a block, they get new coins as a prize. That’s how new Bitcoins are made. It’s a neat system. Everyone helps to keep the records and gets coins for it.

Blockchain tech lets you send coins directly to others. No need for banks to check everything. This is why some folks like blockchain. It can be fast and cheaper than old bank ways.

To sum up, making your way into the world of crypto starts with these steps. Get a wallet, learn to use it, and understand blockchain. Simple, right? Well, each step has its own little world inside. As you dive in, you’ll learn lots. And it will get easier bit by bit. Remember, everyone starts as a beginner. So take your time, be secure, and soon, you’ll be ready for your next crypto steps!

Navigating the Crypto Market: Analysis and Trading Tools

Exploring Basic Crypto Trading Strategies

Starting in crypto can feel like you’re a tiny fish in a huge pond. The market is big, moves fast, and changes all the time. But don’t sweat it! Here are a few pointers to help you swim with the big fish. First off, know the market. Read up on cryptos. Understanding Bitcoin, altcoins, and how they vary is key. Then, set goals. Ask yourself, “Why am I trading?” Is it for quick profit or long-term growth? Knowing this will shape your trading moves.

Now, let’s talk about risk. Cryptos can be tricky. Their prices can jump or plummet. So, invest only what you can afford to lose. Start small. There’s no need to go all-in from the get-go. And always, keep emotions in check. The crypto market can be a rollercoaster. If you feel too happy or too scared, take a step back. This helps you make smart, not hasty, choices.

How to Track Cryptocurrency Investments Using Price Charts

Watching your crypto investments is important. It’s like checking the weather before you head out. You need to know what to expect. Price charts are your go-to tool for this. Think of them as your crypto GPS. They show you where prices have been and can hint at where they might go next.

So, getting started with price charts is not just smart, it’s essential. Here’s how you do it. Go to any crypto exchange or market site. Find your crypto and boom, there’s the chart. It looks complex, but it’s not. The line going up and down? That’s the price over time. Green means prices went up, red means they went down. Then, look for patterns. Do prices dip at certain times? Do they spike after big news? Spotting these hints can guide your trading decisions.

And remember, slow and steady wins the race. Don’t rush. Spend time with the charts. The more you look, the more you learn. And soon you’ll see the patterns like a pro. Just like learning a new game, it takes time to get good. But once you do, those charts will help you make moves that can turn your pennies into dollars.

In crypto, the info you have is your superpower. Use these tools, learn the ropes, and soon, you’ll be the one showing newbies how it’s done. Every giant was once a beginner. And every expert trader started with one coin, one chart, and one big dream. So start this journey with your eyes open and your mind sharp. Welcome to the crypto world, it’s your turn to make a splash!

Making Your First Crypto Transactions: Exchanges and Security

Selecting a Reliable Cryptocurrency Exchange

When starting out with crypto, picking a good exchange is key. What is a cryptocurrency exchange? It’s like a stock market for crypto, where you buy and sell digital coins. Here’s how you choose one:

- Look for a well-known exchange with lots of users.

- Check it’s been around for a while, which adds trust.

- Make sure it has many types of coins, not just Bitcoin.

- It should have good help for users, especially new ones.

A good exchange will keep your money safe. Be sure to read what others say about it online.

Implementing Crypto Security Practices for Safe Trading

Next, let’s talk about keeping your crypto safe. Why does this matter? In the crypto world, there’s no bank to call if things go wrong. So, you must be your own guard. Here are some great tips:

- Use a strong password that’s hard to guess.

- Always enable two-factor authentication (2FA). This adds a step to logging in but keeps out hackers.

- Never share your private keys. Think of them like the key to your home.

- Update your software often to keep things secure.

- Consider using a hardware wallet. This is like a safe for your crypto.

Good security stops thieves from stealing your crypto. Before making transactions, learn these steps well. Remember, better safe than sorry!

Expanding Your Crypto Knowledge: DeFi, NFTs, and Beyond

Introduction to Decentralized Finance (DeFi) and Smart Contracts

What is DeFi? It’s finance but built on blockchain tech, with no banks involved. With DeFi, you can do things like lend or borrow money, earn interest in savings-like accounts, trade coins, insure against risks, and more—all done without a middleman. This is possible thanks to things called smart contracts.

Smart contracts are like normal contracts but they run by themselves. They are bits of code that live on the blockchain. They work automatically when certain conditions are met. Think of them as self-working programs that do what they’re supposed to without anyone telling them to do it again.

DeFi is fast, open all the time, and available to anyone with an internet connection. You don’t need permission to use it. But it’s also new and can come with risks, like bugs in smart contracts or sudden price drops.

Now, what should you do first to get started with DeFi? I’d say learn about these contracts and how they work. Then, try out a DeFi platform by lending a little bit of your crypto. You’ll see how you can earn money on it. Always start small to keep risk low.

Discovering Non-Fungible Tokens (NFTs) and Their Significance

What are NFTs? They are a type of digital item you can buy, sell, or trade, like art, music, or games. Each NFT is unique and can’t be swapped like-for-like, which is different from regular cryptocurrencies. This is why they’re called “non-fungible” tokens.

Why are NFTs important? They let artists and creators sell their work in a digital format and keep more of the profit. They also give buyers something called “digital ownership” of the work.

To start with NFTs, think about what you like. If you’re into art, look for digital art NFTs. If you love music, there are music NFTs, too. Remember, you’re buying these because they mean something to you, not just to make money. That’s important.

When you buy an NFT, you usually do it with cryptocurrency, so you’ll need some of that first. Also, most of the time, you’ll store your NFT in a digital wallet—yes, the same kind you use for your other crypto stuff.

Both DeFi and NFTs make up the new world of crypto that’s beyond just Bitcoin and Ethereum. It’s filled with chances but also has its own language and rules. Start by learning these, just a little at a time, and you’ll be on your way to being a savvy crypto user. Just remember to stay safe, learn as you go, and don’t rush. The crypto world is always growing, and there’s always something new to pick up!

To wrap up, we’ve covered a lot in this guide. We started with choosing a digital wallet and understanding blockchain, which is vital for any crypto user. We then dived into the market, checking out trading strategies and how to read price charts to track your crypto.

Next, we tackled exchanges and how to keep your trades safe. Finally, we explored the exciting worlds of DeFi and NFTs. Our trip doesn’t end here. The crypto landscape keeps changing, and there’s always more to learn. Stay curious, stay secure, and happy trading!

Q&A :

What are the basic crypto tools that beginners should know about?

When starting out in the world of cryptocurrency, it’s essential to familiarize yourself with some fundamental tools:

- Cryptocurrency Wallets:

Beginners must understand that a wallet, which can be hardware-based or digital, is used to store the keys to their cryptocurrency holdings securely. - Exchange Platforms:

These are the websites or services where you can buy, sell, or trade cryptocurrencies. - Portfolio Trackers:

These tools help beginners keep track of the value of their investments in real-time.

- Price Alert Systems:

Price alert systems notify the user when a cryptocurrency reaches a predetermined price, which can be crucial for timely investment decisions. - Security Tools:

Security should never be overlooked. Beginners should invest time in learning about the tools that help in keeping their accounts and funds secure, such as two-factor authentication (2FA) and VPNs.

How do beginners use crypto exchange platforms safely and effectively?

For beginners, the use of crypto exchange platforms safely involves several critical steps:

- Research: Learn about different platforms to understand their fees, security measures, and user-friendliness.

- Verification: Always go through the necessary verification process to ensure account security.

- Security: Employ strong passwords, enable 2FA, and never share your private keys or passwords.

- Transactions: Begin with small transactions to get a feel for the platform before committing to larger trades.

- Education: Take advantage of educational resources or demo accounts offered by many platforms to learn without real investment.

Are there any particular strategies for managing a cryptocurrency portfolio for beginners?

Yes, beginners can adopt several strategies to manage their cryptocurrency portfolios effectively:

- Diversification: Don’t put all your eggs in one basket—spread your investments across different cryptocurrencies to mitigate risk.

- Regular Assessments: Regularly review and adjust your portfolio based on performance and market developments.

- Risk Assessment: Understand your risk tolerance and invest accordingly, setting clear goals and limits.

- Stay Informed: Follow market news and trends to anticipate changes and adapt your strategy.

- Avoid Emotional Decisions: Make decisions based on data and research rather than emotions or impulses.

What is the importance of learning about blockchain when using crypto tools?

Understanding blockchain technology is crucial because:

- It enables crypto users to appreciate the fundamentals of their transactions, enhancing trust in the system.

- Knowledge of blockchain informs users of the security features which protect their assets.

- It helps users to better grasp the development and value proposition of different cryptocurrencies.

- Blockchain knowledge can aid in the discernment of promising projects and phony schemes, aiding investment choices.

Can beginners also use crypto analysis tools, and if so, which ones are recommended?

Absolutely, crypto analysis tools can be beneficial for beginners who are looking to make informed decisions. Some recommended tools include:

- Charting Platforms: Tools like TradingView, Coinigy, or CryptoCompare provide real-time charts and technical analysis.

- Market Aggregators: Use services like CoinMarketCap or CoinGecko to track prices, market capitalizations, and to access a broad range of market data.

- Social Sentiment Trackers: Tools like LunarCRUSH help gauge the community sentiment surrounding various cryptocurrencies.

- Educational Platforms: Utilize platforms like Coinbase Learn or Binance Academy to improve understanding of both the market and analysis techniques.

By using these tools, beginners can get a better insight into market trends and make more educated investment decisions.