Are you searching for the next big wave to ride in the world of digital money? I’m here to dive deep into cryptocurrency market analysis, revealing the gems hidden in tomorrow’s investment terrain. We’ll tackle the current shifts, cutting-edge blockchain breakthroughs, strategic trading maneuvers, and the ever-evolving regulatory landscape. Stay ahead of the curve as we dissect key trends, identify top-performing altcoins, and tailor strategies that work in the high-stakes world of cryptocurrencies. Whether you’re a seasoned investor or a curious newcomer, prepare to unlock the secrets of a market ripe with potential. Join me in charting a course through the dynamic seas of digital currency investment.

Understanding the Current Landscape of Cryptocurrency Markets

Analyzing Key Crypto Market Trends

The world of crypto moves fast. To keep up, we need to spot patterns. Bitcoin trading insights show its price moves often lead the market. Following it helps us see where other coins might go. Ethereum’s market review tells us if investors like tech advances or not. Altcoin performance evaluation is also key. It helps us find hidden gems that could shoot up in value. We look at lots of data: prices, amounts traded, and past trends. This info helps us guess future moves. We also watch the news for changes in rules that affect crypto.

Studying market cap movements can clue us into which coins are gaining or losing steam. We also scan the market for how folks feel about crypto. This is our crypto market sentiment. It’s a mix of fear, excitement, and just going with the flow. These feelings can shake prices up or down. That’s why we keep a close watch on them.

The Latest Blockchain Technology Innovations and Their Financial Impact

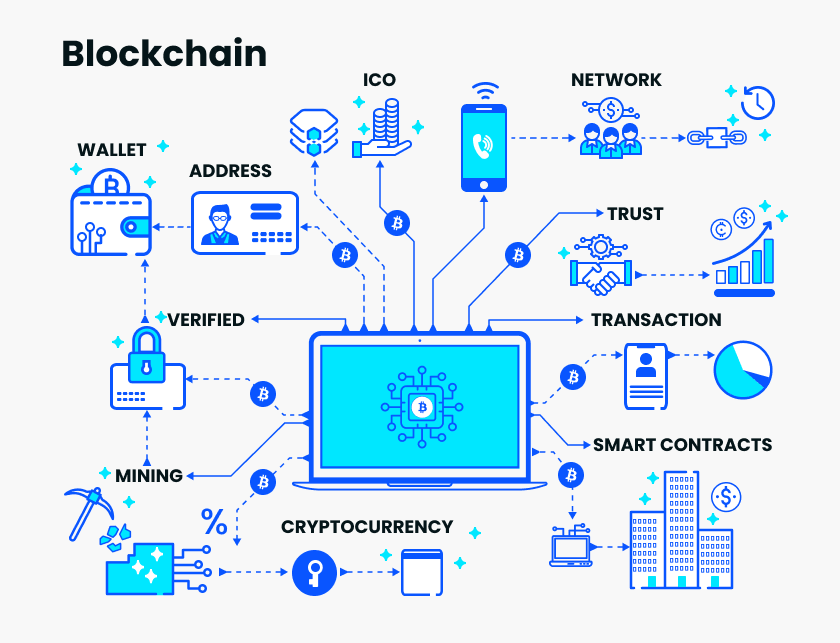

Blockchain tech changes the way our money works. It’s like a digital ledger for all crypto deals. It keeps track a clear way. With every new tech bit that comes out, the crypto market shifts a bit. Some coins get more useful and worth more. Others might not catch up and lose value.

We’re also tracking how “smart contracts” shake up things. They are like regular contracts but run on the blockchain. They do what they’re set to do without extra checking. This makes trading quicker and can change prices.

The big thing everyone’s watching now is “Defi”. It stands for decentralized finance. It’s a new way to do money stuff without a middle man like a bank. It’s growing fast and changes a lot. But with new things, there can be risks too. That’s why we look at it from all sides.

These tech changes keep investors on their toes. We all want to catch the next big wave in crypto. So, we study how blockchain shifts impact our wallets.

Crypto isn’t just about tech though. How easy it is to trade, known as liquidity, can push prices up or down. If a coin is hard to trade, its price might not move much. Coins that are easy to trade can see big price swings.

Crypto’s still a risky game. We do our homework to figure out what’s a smart bet. And we don’t forget about our old pal Bitcoin. Even with new coins coming out, it’s still the boss of market dominance. Keeping an eye on Bitcoin can lead us to smart choices in this wild world of digital money.

Understanding the current market is about looking back and guessing forward. By breaking down the crypto scene today, we can gear up for tomorrow’s chances. It’s never dull in crypto land – that’s for sure!

Investing in Cryptocurrencies: Opportunistic Strategies for Traders

Identifying Profitable Altcoin Performance Patterns

In the wild world of crypto, altcoins can light up like a star. They can grow fast! To spot these, I look at their past wins and losses. I ask, “What shot them up before?” Digital currency market trends help me here. I find patterns, like how they react to big news. Good tech updates can send prices flying. But bad news or bugs? Down they go.

To get it right, I delve into each coin’s details. I study their technology and goals. I see if they have a strong team. Do they solve real problems? This way, I look for those about to make it big. If done right, this can really pay off.

Devising Investment Strategies Suited for Crypto’s Volatility

Crypto dances up and down. Price swings are its tune. We need a plan that swings along. Watch the Bitcoin dance, it leads the way. When Bitcoin jumps, others may follow. But if Bitcoin drops, panic can spread.

Bitcoin trading insights are gold here. We watch its every move. When the king coin sneezes, altcoins may catch a cold. Ethereum market review helps too. It’s the smart contract champ. Its steps affect many altcoin prices.

To dance to the crypto beat, know the risks. Don’t put all eggs in one basket. Spread out. Pick coins with solid tech and real-world use. Look to decentralized finance, DeFi. It’s where finance meets blockchain magic. Growth here means a brighter future for your picks.

We watch the ICO stage. New coins pop up. What’s their new trick? Does it shine? We dig through the tokenomics. Is their plan sound? A good tokenomics means growth potential.

And don’t forget, markets talk. Listen to crypto market sentiment. Hope and fear show up in the charts. Too much hope? A warning it may turn. Fear on the streets? Might be a chance to buy.

We must also eye liquidity in crypto markets. Money flowing smooth keeps the market healthy. If it’s stuck, prices may not show the full picture. Watch trading volumes for the truth behind price moves.

To sail this sea smoothly, use trading indicators. They’re like a compass for storms. Indicators can hint when to buy or sail away. We mix these with bitcoin’s heavy hand in the market. Market dominance means power. If Bitcoin rules, altcoins may wait to shine.

Now, let’s keep our eyes on the map. A look back can guide us ahead. Historical performance of crypto lights the way. From it, we make our future bets in digital currency. And remember, aim smart, move with care, and watch the stars for tomorrow’s treasures.

The Influence of Regulatory Changes and Market Sentiment

Navigating Through Recent Crypto Regulatory Updates

In crypto, rules matter a lot. When new laws come out, prices can swing. We’ve seen it happen many times. These changes keep us on our toes. They can push the market up or down in a snap.

But here’s the deal: not all changes kill the market. Some can even help it grow. They can build trust and bring more people in. I keep an eye on the news. So should you. It’s key to stay ahead in the crypto game. Knowing what’s going on with laws can guide our next moves.

Take for example when a big country says, “Let’s make crypto safer.” This can lead to a price jump for Bitcoin or Ethereum. Why? Because it shows that crypto is getting more accepted. And when folks trust crypto more, they put more money into it.

Other times, countries might say, “Hold on, we need to check this crypto thing out.” That can scare people. They might sell their coins. Then, prices can drop. Still, this doesn’t always mean it’s bad news. It could just mean that the market is cleaning up its act.

The main point? Stay sharp. Watch the news. It’s how you dodge the bad and catch the good.

Assessing the Effects of Market Sentiment on Cryptocurrency Valuations

Now, let’s talk feelings. Yes, feelings! In crypto, how people feel can change prices. We call this market sentiment. It’s like a big mood swing that can make the prices dance.

When folks feel good about crypto, prices tend to rise. They talk it up to friends, online, everywhere. Positive vibes spread fast. More buyers come in. It’s like a party where everyone wants in.

But the reverse is true too. If people start worrying, watch out! Panic can spread. Prices can fall quick as a result. It’s not just talk. There’s data behind this. Let me explain.

By looking at trends, we can spot these mood shifts. We check things like how much people talk about crypto online. Or how much they’re buying and selling. This info hints at where things might head next.

But remember, just like weather, moods can change fast in crypto land. One day it’s sunny; the next, it’s not. That’s why part of my job is to feel the market pulse. I check out how folks are reacting to news, to prices, to anything really.

Staying tuned in to these vibes is a big deal for trading. It can tell us if it’s time to buy, hold, or maybe let go. Think of it as the heartbeat of the market. You listen to it to stay alive in the trade game.

So, to wrap up this part: keep an eye on the rules and the emotional buzz. They can lead us to some bold moves and smart choices.

Preparing for the Future of Digital Currencies

Projecting Future Market Movements and Their Implications

Knowing what lies ahead for digital money is key. How do we guess future trends? We study patterns in prices and trading. We see how events change the market.

What moves Bitcoin’s price? News, supply, and big investors’ choices do. These can push prices up or down fast. It’s the same for Ethereum and other altcoins. New tech and rules can change the game too. We keep our eyes open to stay ahead.

So, why should you care about these trends? Because they make chances to earn money. When prices move, smart choices can lead to big wins. But always remember, risks are part of this deal too.

The market can flip from good to bad quickly. That’s why knowing the signs is so important. It’s like the weather. When you know a storm is brewing, you can get ready.

Risk Management: Safeguarding Your Crypto Portfolio

Now, let’s talk staying safe with your crypto coins. First rule: Don’t put all your eggs in one basket. Spread your bet across different coins. This can help if one coin takes a hit.

What should you watch? Check how much money flows in the market. Fewer trades can mean a bigger risk for quick price drops. You want to be in markets where money moves like water.

How do you handle big price jumps? Set limits. Decide when to get out before you even jump in. This can keep you from big losses when things go wild.

Also, keep an eye on news and new rules. They can shake the market. If you know what’s coming, you can act smart. This means more wins and fewer surprises.

And remember, crypto isn’t the only way to go. Other options exist, like normal money markets. Sometimes it’s smart to play in both fields.

In short, caring for your crypto means being smart, safe, and always ready.

We dove deep into the crypto world in this post. We looked at market trends and tech breakthroughs that shape finance. We shared tips for smart crypto investing, even when the market jumps around. Regulatory shifts and public mood swings – we covered how they switch up crypto values. And we thought about what’s next for digital money, showing you how to protect your crypto stash.

I believe knowing the crypto scene’s ups and downs is key. Keep sharp about new tech and laws. Look at how folks feel about crypto—it really matters. When you trade, stay calm and have a clear plan. Always think ahead and play it safe with your investment. Stay smart, stay alert, and you’ll be set for the future of digital cash. Keep these points in your back pocket, and you’ll do great!

Q&A :

What factors should I consider in a cryptocurrency market analysis?

When conducting a cryptocurrency market analysis, it’s crucial to look at a variety of factors to get a comprehensive understanding of the market. These include the historical price trends, trading volumes, market capitalization, and news/events that could influence market sentiment. Analyzing these factors helps identify patterns and forecast future movements. Remember to also consider technological advancements, regulatory changes, and the overall sentiment in the crypto community.

How can I use technical analysis for predicting cryptocurrency price movements?

Technical analysis involves examining past market data, primarily price and volume, to forecast price movements. To use technical analysis in cryptocurrencies, one should familiarize themselves with various technical indicators like Moving Averages, RSI (Relative Strength Index), and Fibonacci retracement levels. Chart patterns, such as head and shoulders, triangles, or candlestick formations, are also key. It’s important to note that while technical analysis can provide insights, it’s not always entirely predictive due to the volatile nature of the crypto market.

What’s the difference between fundamental and technical analysis in cryptocurrency market analysis?

Fundamental analysis assesses a cryptocurrency’s intrinsic value by examining related economic, financial, and other qualitative and quantitative factors. This might include the project’s whitepaper, use case, team behind the project, community involvement, and technological innovations. On the other hand, technical analysis looks purely at the statistical data from the market, such as price movements and volume, using charts and other tools to identify trends and patterns. While technical analysis is more about timing the market, fundamental analysis tries to determine the crypto asset’s value.

Can sentiment analysis be helpful in cryptocurrency market analysis?

Definitely, sentiment analysis can be a crucial tool when analyzing the cryptocurrency market. It involves gauging the emotional tone of the market, often sourced from social media, news headlines, and other public forums to understand the feelings of investors about a particular cryptocurrency. Positive sentiment can indicate growing interest and potential price increases, while negative sentiment may signal decreases. Sentiment analysis has to be used cautiously and in conjunction with other analysis methods due to the fast-paced and speculative nature of the crypto markets.

Are there reliable sources for cryptocurrency market analysis?

There are numerous sources for cryptocurrency market analysis, including crypto-analytics platforms, financial news websites, expert commentary, and community forums. Reliable sources for up-to-date and accurate information include CoinMarketCap, CoinGecko, and Blockchain.info for market data. For in-depth analysis, websites like CryptoSlate, CoinDesk, and Cointelegraph offer expert opinions and insights. Always ensure you’re getting information from credible sources and cross-reference to avoid misinformation.